Sometimes, you have expect the unexpected. The Daily Breakdown looks at how surprise news can impact stock prices and investor sentiment.

Thursday’s TLDR

- Surprise news can be good or bad

- An impressive 2024 for Costco stock

- Tesla stock rallies on earnings

What’s happening?

On Monday, we talked about Starbucks stock recently gaining some bullish momentum. On Tuesday afternoon, that momentum appeared to go out the window when the company pre-announced its preliminary Q4 results, doing so about a week earlier than expected.

Shares initially fell in after-hours trading and opened lower on Wednesday by about 3%. But by the close, shares were positive on the day, ending higher by almost 1%. That’s despite a bad day in the markets for the S&P 500, Nasdaq 100, and Bitcoin.

On the same evening, McDonald’s shares tumbled close to 10% after reports of E. coli surfaced, sparking fear among investors. That stock fell more than 5% on the day — not great by any means, but it finished well off the initial lows.

Keep in mind, McDonald’s stock hit a record high earlier this week and Starbucks shares are up 28% over the last three months. In other words, these stocks had not been low-quality duds.

So where am I going with all this?

My point here is to expect the unexpected. While it’s impossible to know about something like an E. coli outbreak or a pre-announced earnings result, expect that it can happen.

Maybe that means using smaller position sizes with individual stocks. Perhaps it just means being mentally prepared that something like this can happen. Those who were in a better position were less likely to panic on the initial news release.

And remember, good news can be unexpected too. You just never really know — and that’s the point. Unexpected surprises happen all the time in this game and as individual investors, we can only control so much.

Want to receive these insights straight to your inbox?

The setup — Costco

Costco shares have been on fire, rising more than 36% so far in 2024 and more than 66% over the past 12 months. Investors may struggle with the stock’s premium valuation, but there’s no denying how well it has performed.

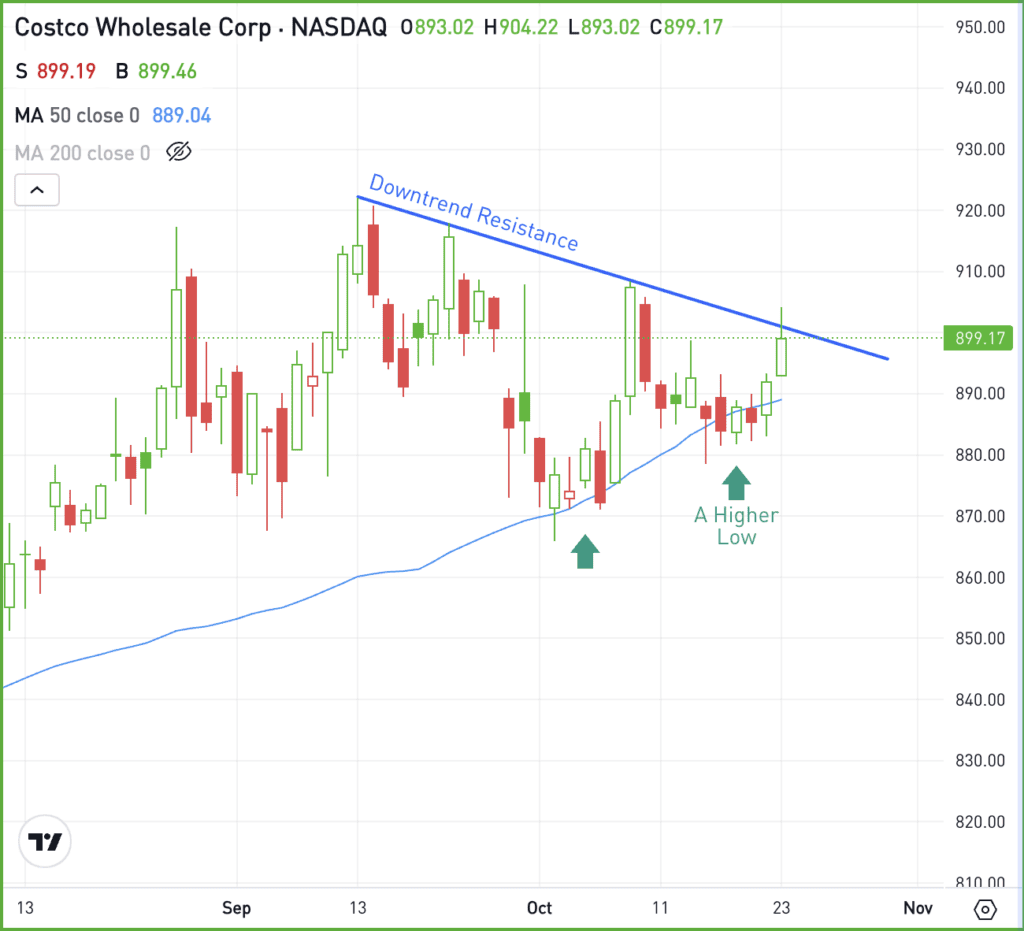

Shares hit an all-time high in mid-September and have been consolidating since:

The stock recently put in a higher low around $880 and is now trying to clear downtrend resistance. If shares can clear $900, then Costco stock could gain more bullish momentum, potentially putting the recent highs back in play.

If the recent lows near $880 fail to act as support on a dip, then more selling pressure could ensue and Costco may need more time consolidating.

Options

One downside to COST is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TSLA – Tesla stock jumped higher in after-hours trading after reporting its Q3 results. Earnings of 72 cents a share beat expectations of 60 cents a share, while revenue of $25.2 billion grew 7.8% year over year, but missed consensus estimates of $25.7 billion. CEO Elon Musk spoke positively about future production, both for Q4 and in 2025.

IBM – Shares of IBM rallied in after-hours trading on Wednesday. Like Tesla, the firm delivered better-than-expected earnings results but missed on revenue expectations. Through Wednesday’s close, IBM stock is up 21.1% in 2024 and 33.9% over the past 12 months. Check out the chart now.

BA – Boeing stock shook off a top- and bottom-line miss on Wednesday, falling just 1.8% on the day despite the quarterly miss. However, shares are under pressure this morning after “workers rejected a proposed deal to end their ongoing strike, and the company faced another setback with the explosion of its satellite in space,” according to StockTwits.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.