The Daily Breakdown looks at Ethereum as it sits on a key support level. It will be a busy week as consumer spending news comes out.

Monday’s TLDR

- The Dow has rallied 8 days in a row.

- Retail earnings start this week.

- A technical look at Ethereum.

What’s happening?

We expected a quiet week last week…and we got one! A lack of events helped US stocks drift higher last week, as bad news dissipated and bulls regained momentum.

The S&P 500 is now down less than 1% from its all-time high, while the Dow has climbed in an astounding eight straight trading sessions — its longest streak since rallying for nine in a row in December.

This week, we turn our attention to two key economic reports — the CPI and retail sales reports — both of which will be released at 8:30 a.m. ET on Wednesday morning.

The CPI report will provide the latest update on inflation, while the retail sales report will give investors a glimpse into the health of the consumer. Remember, roughly 70% of the US economy is driven by consumer spending, so it’s a key measure to keep track of it.

As for consumer trends, earnings season will pivot toward retailers this week, starting with Home Depot on Tuesday and Walmart on Thursday.

Other notable earnings reports include Alibaba (Tuesday), Cisco (Wednesday), and JD.com, John Deere, and Applied Materials (Thursday).

Want to receive these insights straight to your inbox?

The setup — ETH

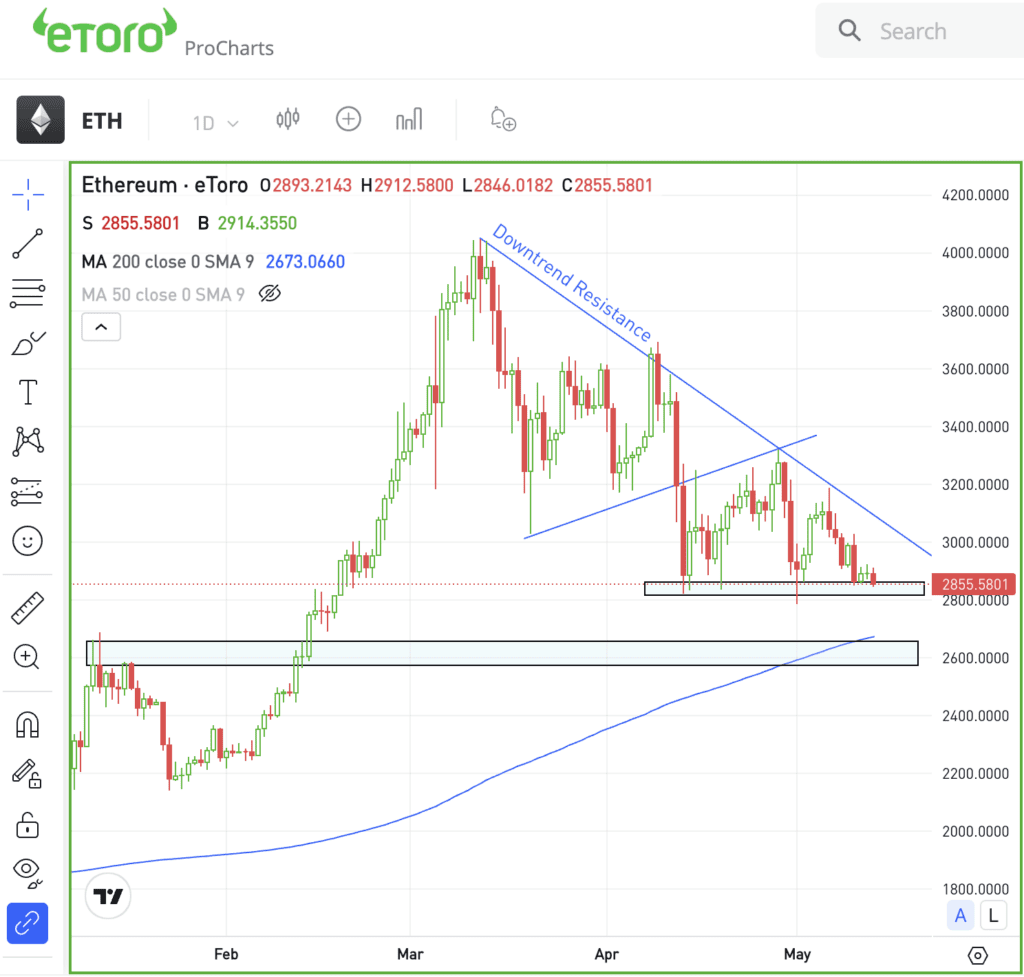

On May 1, I wrote about Ethereum and how notable the $2,800 to $2,900 zone had become. Well, ETH is leaning into this level once again with bulls hoping that support materializes.

Ethereum remains trapped below a downtrend resistance line (marked on the chart), which continues to suppress the rallies.

As I look at Ethereum leaning into current support, I can’t help but let my eyes drift down to the same spot we talked about two weeks ago — the $2,600 area.

When we look down toward that zone, it was a clear level of resistance in January before a big breakout in February. The rising 200-day moving average, a key long-term measure of the asset’s trend, is also near this level.

Let’s see if current support holds first. If not, this zone will be in focus. On the upside, bulls will be looking to see if Ethereum can regain $3,000. Above that and the current downtrend resistance will be on watch.

What Wall Street is watching

BTC — Bitcoin prices continue to stabilize above the $60,000 level. While some bulls may be disappointed by the sluggish action, one could argue that it’s healthy consolidation after the halving event last month. Investors are likely keeping a close eye on $60K — followed by this month’s low near $56,500.

TSM — Taiwan Semiconductor’s April sales surged nearly 60% to $7.3 billion, fueled by robust demand for AI chips. That news helped fuel a 4.5% rally on Friday, boosted by large orders from its largest companies — like Apple and Nvidia.

SOUN — SoundHound AI shares rose more than 7% on Friday as its Q1 revenue results beat expectations and grew 73% year over year. Management also raised its full-year sales outlook. Demand for SoundHound’s voice AI products in customer service is driving its growth.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.