The Daily Breakdown looks at the week ahead as we near the end of February, and examines Ethereum as it hits new 52-week highs.

Monday’s TLDR

- The PCE report is this week’s big focus.

- Ethereum hits 52-week highs.

- Walmart 3-for-1 stock split goes into effect.

What’s happening?

Markets continued to push higher last week, largely thanks to Nvidia’s powerful post-earnings rally.

The S&P 500, Dow, and Nasdaq have now gained in 15 of the last 17 weeks, as we’ve seen a staggering run in the indices.

February is set to come to an end this week, with Thursday’s leap day being the final day of the month. That’s also when we’ll get the PCE report. Remember, that’s the Fed’s preferred inflation gauge.

There are some other notable economic events this week — like housing data and consumer confidence — but investors’ main focus will be on the PCE results.

With estimates for the first Fed rate cut in constant limbo so far this year, investors are looking for and craving some certainty around this event. If the number comes in hot, it adds to the likelihood of a delayed rate cut. If it’s less than expected, odds for a rate cut in May could increase.

Want to receive these insights straight to your inbox?

The setup — ETH

As the largest cryptocurrency, Bitcoin has gotten a bulk of the attention lately. That’s particularly true with the SEC’s ETFs approval and the upcoming halving event in April.

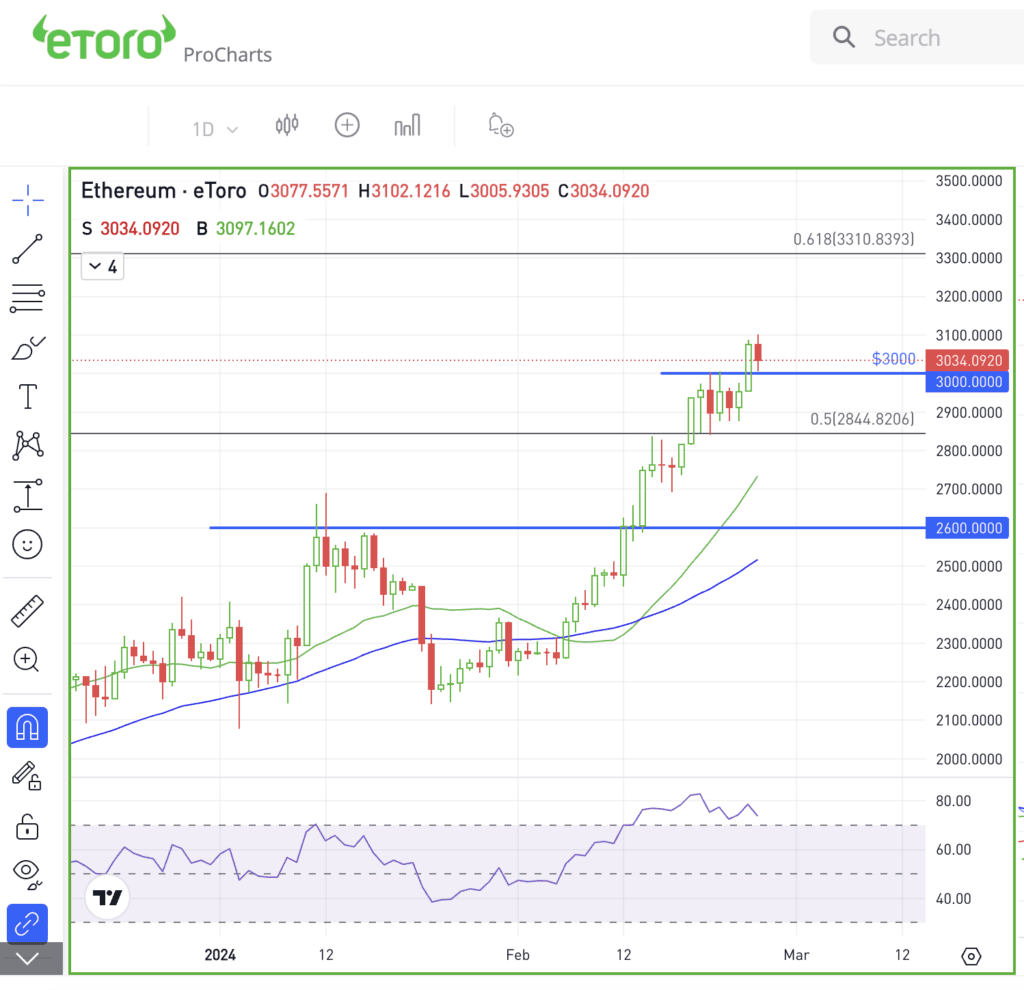

Quietly though, Ethereum is hitting new 52-week highs. Ethereum is up 35% over the past month — Bitcoin is up about 22% — and has recently pushed above $3,000.

The breakout over the $2,500 to $2,600 zone was strong, helping set the stage for a rally up to $3,000, which Ethereum rallied above this weekend.

If it can stay above the $3,000 mark, attention may quickly shift up to the $3,300 to $3,500 area. For what it’s worth, the 61.8% retracement (as measured from the bear market low to the all-time high) comes into play near $3,300.

If Ethereum can’t hold up above $3,000, investors will likely look for potential support from $2,850 — which acted as recent support — followed by the $2,500 to $2,600 zone, which was that key breakout level we mentioned earlier.

What Wall Street is watching

WMT: Walmart stock may look like it got a big haircut this morning, but it’s just a facade. The stock underwent a 3-for-1 stock split on Friday after the close, so Monday will be the first day that it goes into effect. For more info on stock splits, check out this guide.

BRK.B: Berkshire Hathaway’s cash reserves soared to an all-time high of $167.6 billion in the last quarter, while Warren Buffett lamented the lack of deals to fuel “eye-popping performance” in his annual letter. The company’s operational earnings surged to $8.5 billion, buoyed by upticks in insurance underwriting and investment returns.

AMZN: Amazon is set to join the Dow this week, replacing Walgreens in the process. This adjustment reflects the shift in the American economy, enhancing retail and other sectors’ representation in the Dow. Amazon will rank 17th in the Dow, (with Walmart falling to 26th due to its stock split). Remember, the Dow is a price-weighted index, so weightings go by stock price, not market cap.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.