The Daily Breakdown looks at Ethereum as it continues to trade sideways and consolidate its big year-to-date gains.

Friday’s TLDR

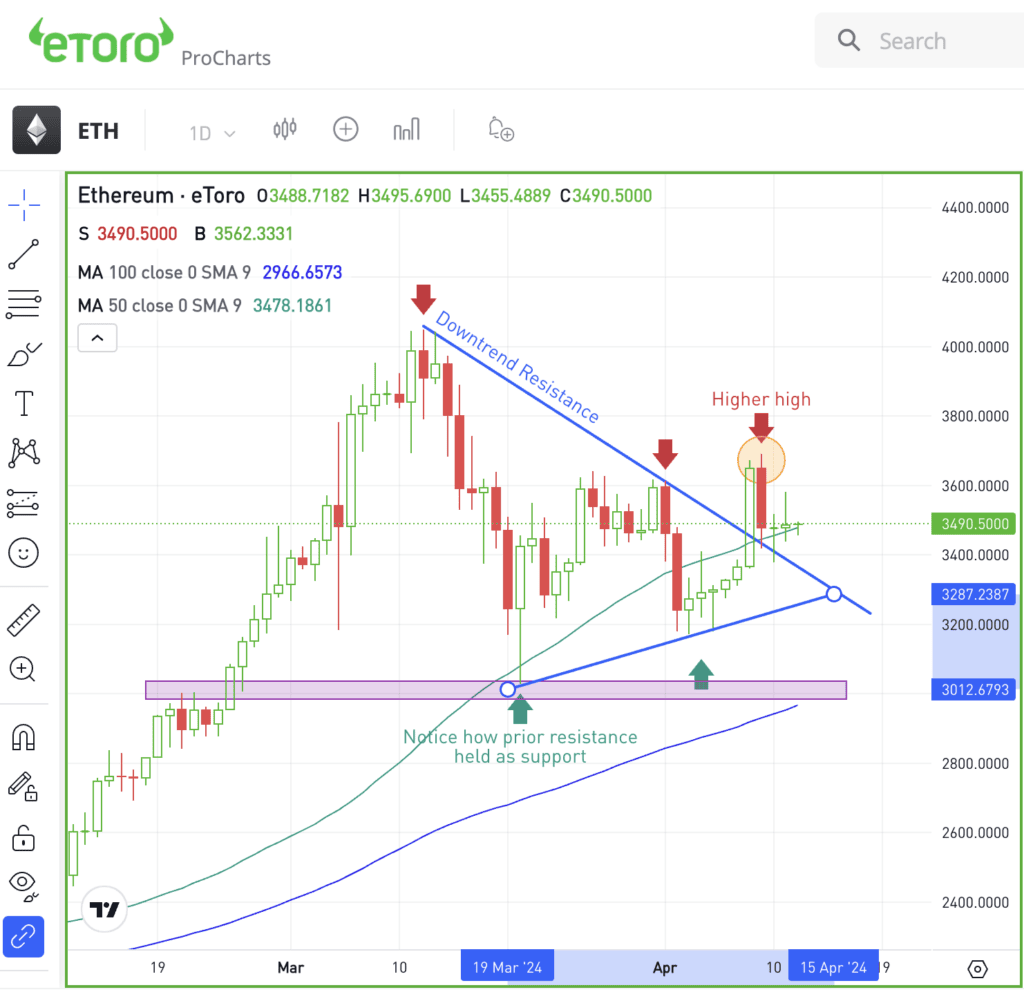

- Ethereum just cleared downtrend resistance.

- Apple has its best day in 2024.

- Amazon hits all-time highs.

What’s happening?

It’s Friday. Let’s get into a combined Daily Breakdown and a Bottom Line.

Earlier this week, we noted the significance of two levels in the S&P 500: The 5,260s on the upside and roughly 5,150 on the downside.

Even though we got disappointing inflation data earlier this week — more on those implications in a second — support near 5,150 ended up holding. For passive or inactive investors, these levels don’t mean all that much. These investors have a long-term plan and they’re sticking to it. Good!

However, for active investors, losing this level as support would have been a potential opportunity to change gears. For some, that would mean lightening up on their long positions. For others, it may mean they were getting short or possibly building a list of stocks they want to buy on a bigger dip.

Bulls aren’t necessarily out of the woods, yet. After all, the 5,260 resistance area is still in play. But this week has been noteworthy when it comes to focusing on single events.

Remember, the market doesn’t live or die based on a single data point.

It ebbs and flows in a constant state of motion, digesting and juggling thousands of data points, scenarios, and outcomes at once. It does all this while being forward looking, meaning market participants are generally looking forward by 6 to 12 months at a time — they’re not necessarily fixated on where the market will go today or tomorrow.

Hear me out.

The takeaway from the higher-than-expected CPI print on Wednesday is that rate cuts in June are now far less likely than they were a few weeks ago. If rate cuts were the only factor for the stock market, it would still be selling off. Instead, the S&P 500 is down just 0.1% so far this week.

Now consider this.

Coming into 2024, investors were pricing in upwards of six rate cuts, with the first starting in March. Now estimates are 50-50 on whether we get just one or two cuts this year, with the first one now expected in September.

Yet what has the market done? It’s up 9% year-to-date and is down just 1% from its all-time closing high.

My point is, rate cuts matter — they just aren’t the only thing that matters.

Other headwinds still exist, like higher bond yields and a rising US dollar. However, other tailwinds exist too — like earnings and improving economic measures.

If this week serves as nothing else, let it serve as a reminder that the market is always adapting, always looking ahead, and always interpreting numerous data points of significance; it’s not just listening to the Fed and guessing on interest rates.

Want to receive these insights straight to your inbox?

The setup — Ethereum

When I look at the charts, I see major cryptocurrencies — like Bitcoin and Ethereum — consolidating after a major run to the upside.

Ethereum is up more than 50% year to date and 85% over the past year. Now, it’s trying to break out from its recent consolidation pattern.

Ethereum recently ran to $4,000. However, it has since pulled back into this nice consolidation pattern marked by higher highs and higher lows.

But look at that last pop. See the third red arrow and how it took out the high from the prior rally near $3,600? That also came after Ethereum broke out over downtrend resistance, which at least for right now, is acting as support.

Now this isn’t a slam dunk for the bulls — not by any means.

Ethereum could easily roll back over and keep chopping around in the low-$3,000s. However, now that it’s broken out over its downtrend line, bulls are looking for continuation to the upside. That argument will gain steam if ETH takes out its recent high near $3,730.

What Wall Street is watching

AAPL — Shares of Apple ripped higher by more than 4%, its best one-day gain so far this year and its best one-day gain since May 5, 2023. The rally came after reports surfaced that Apple is working on its next chip — the M4 — which will have a focus on AI capabilities in an effort to boost Mac sales.

AMZN — Amazon stock rallied for a fifth straight daily gain — which is no small feat given the recent volatility. However, the stock isn’t making headlines for its win streak. Instead, it comes after the tech giant finally made a new all-time high, taking out its prior high that was set in November 2021.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.