The Daily Breakdown looks at Ethereum after its latest Dencun upgrade, as well as the recent strength in energy stocks.

Thursday’s TLDR

- Ethereum’s Dencun upgrade is complete.

- Bitcoin hits all-time highs.

- Energy stocks quietly enjoy nice gains.

What’s happening?

Ethereum is in focus after its Dencun upgrade successfully took place. It’s the latest major development in the crypto space, which has been storming higher this year.

eToro Web3 analyst Anna Stone weighed in with her thoughts, which includes:

“The Dencun update was expected to increase efficiency on the Ethereum network, leading to increased scale. Analysts will be monitoring to see what happens with transaction costs, as they remained high the morning of the Dencun upgrade, but started to drop throughout the afternoon. A marked decrease in transaction costs on Ethereum and increased usage of L2s will indicate the upgrade had the desired effect.”

Overall, crypto has been trading quite well.

Bitcoin has hit a new all-time high each day this week, while Ethereum is working on its seventh straight weekly rally and is up more than 80% from its January low.

The total market cap for the crypto space has grown to $2.7 trillion, as it nears its all-time high near $3 trillion from November 2021.

If we exclude Bitcoin and Ethereum, crypto’s total market has grown to $760 billion. While it still has quite a bit of room to go before hitting the 2021 peak near $1.1 trillion, this figure is up almost 140% over the last six months.

Want to receive these insights straight to your inbox?

The setup — VLO

When I look at FinTwit and other investment sites, many investors seem focused on the usual suspects, like big tech stocks and semiconductors. However, not many investors seem focused on energy.

Admittedly, I’m not the biggest energy investor either. However, it’s hard to deny the moves we’re seeing in this space right now.

One such stock that caught my eye? Valero Energy.

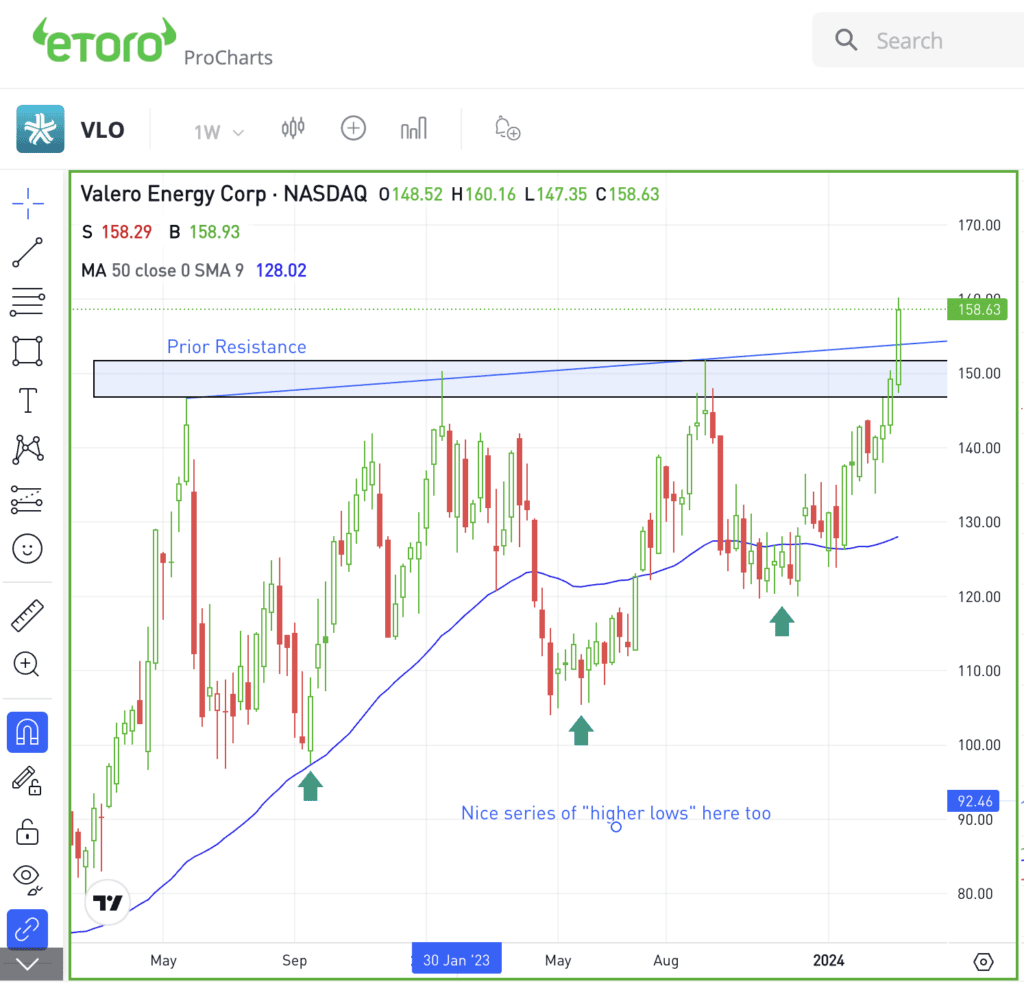

On Wednesday, Valero cleared long-time resistance and broke out to all-time highs.

The weekly chart above highlights how $150 had been resistance for almost two years leading up to this week’s breakout. Also notice the series of higher lows along the way. That’s a bullish technical development that helped fuel this recent rally.

Now up through $150, bulls will want to see the stock stay above this level. If it can do so, the stock could maintain momentum and potentially see even higher prices.

However, if VLO rolls back over, then this could turn into a failed breakout and Valero shares could lose steam.

With energy stocks performing well and with Valero’s breakout this week, this is a stock to watch.

What Wall Street is watching

TSLA — Tesla stock made new 52-week lows on Wednesday, falling more than 4% in the session. The stock has struggled immensely so far this year, down 31% so far in 2024. Further, shares remain almost 60% below the all-time high, as bulls wonder when Tesla will find its footing.

USO — Morgan Stanley’s Martijn Rats warns of a potential summer oil price spike, surprising investors amid rising prices and fears of supply disruptions. “Not a super cycle, but expect strength,” Rats said on CNBC. The USO ETF has done well so far in 2024, up more than 12.5% year to date.

FSR — Fisker shares are tanking in pre-market trading, down more than 40% as the EV maker continues to struggle. The company reportedly hired an outside firm to help with a bankruptcy filing. The decline is the latest nail in the coffin for the stock, which as of Wednesday’s close is down about 95% from the Q4 high.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.