Ethereum is erupting on hopes that the SEC will approve the first spot Ethereum ETF. Here’s what The Daily Breakdown is watching for next.

Tuesday’s TLDR

- Hopes for an Ethereum ETF spur huge rally.

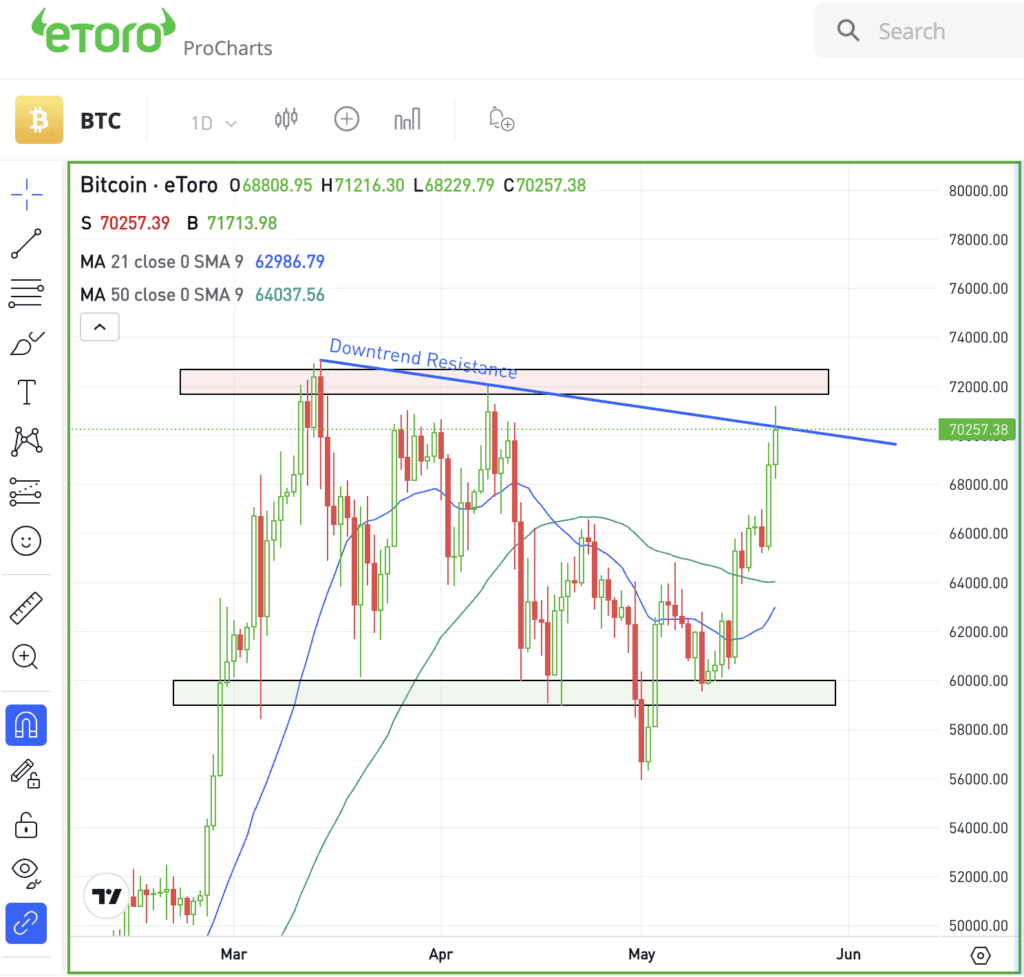

- Bitcoin rips back above $70,000 into key technical level.

- JPMorgan stock sinks as CEO comments sour mood.

What’s happening?

The S&P 500 came within a whisker of all-time highs, while the Nasdaq 100 set a new record. But it wasn’t stocks that investors were focused on — it was crypto.

Ethereum prices erupted on Monday, climbing 19.2% and hitting its highest level since early April. The rally came on hopes that an Ethereum ETF may be approved by the SEC after all.

One reason why Ethereum had been lagging Bitcoin — suffering a peak-to-trough decline of 31.3% vs. a 23.4% decline for Bitcoin — was due to pessimism surrounding the SEC’s likely ruling. Investors came to expect that the SEC would not approve a spot Ethereum ETF, so the market began to price in that outcome.

Now though, hopes are rapidly improving.

A decision from the SEC is due this week (on May 23) for at least one of the Ethereum ETF applications, but others are waiting as well. On Monday, Eric Balchunas and James Seyffart, two Bloomberg Intelligence ETF analysts, raised their approval odds for a spot Ethereum ETF from 25% to 75%.

For now, bulls are riding a new wave of momentum, but remember that there’s still the potential that it doesn’t go through.

Ethereum’s breakout over key resistance helps, but now investors will need to see the good news continue and that likely rests with the SEC.

Want to receive these insights straight to your inbox?

The setup — BTC

Crypto bulls may have been growing antsy waiting for something to happen with Bitcoin and Ethereum. These names rallied into Bitcoin’s halving event last month, but have been trading sideways to lower since.

Monday delivered with some robust gains, but could more be on the way?

Along with US stocks, Bitcoin ripped higher last week after a tame inflation report brought about hopes of rate cuts later this year from the Fed. Now extending from that rally, Bitcoin faces two key areas on the chart.

The first is downtrend resistance, which comes into play around the $70,000 to $71,000 area. If it can clear this level, then the $73,000 to $74,000 area — which includes the all-time high — is the next focus.

Bulls are looking for more upside and it’s clear why as the charts could really open up if Bitcoin clears resistance. But do use some caution. Ethereum still awaits an answer from the SEC and Bitcoin faces a big test with these technical levels.

What Wall Street is watching

PANW — Shares of Palo Alto Networks slumped in after-hours trading despite the firm’s top- and bottom-line beat for its Q3 results. Guidance was roughly in-line with expectations, but management’s billings outlook for the year was slightly below consensus expectations.

ZM — Zoom Video was a growth favorite amid the pandemic, but the stock has had trouble finding its groove since. While the company beat on earnings and revenue expectations, the roughly in-line revenue outlook — which translates to revenue growth of roughly 2% — did little to excite investors in after-hours trading.

JPM — Shares of JPMorgan tumbled lower after longtime CEO Jamie Dimon talked about succession plans at the bank’s Investor Day. It didn’t help that Dimon also said the company’s stock buybacks would slow considerably because current prices are too high.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.