The Daily Breakdown looks at the recent dip in Ethereum, as the cryptocurrency finds support at a key level.

Monday’s TLDR

- Earnings unofficially start this week with the banks.

- The monthly inflation report is on Thursday.

- Ethereum keeps testing a key support level.

What’s happening?

Investors enter Monday following weekend volatility in Bitcoin and Ethereum, and a stock market that’s riding high as the S&P 500 gained almost 2% last week.

After a few holiday-shortened trading weeks, we finally have a solid stretch of uninterrupted trading in US equity markets. But just because there are five full trading sessions this week doesn’t mean it’s set to be a quiet one.

This week starts slow and ends with a bang.

Monday, Tuesday, and Wednesday have a small trickle of earnings, with a few minor economic reports.

The biggest event in this three-day stretch may be Fed Chair Powell’s two-day testimony with the Joint Economic Committee in Washington DC. There’s also a 10-year bond auction on Wednesday.

However, Thursday marks a turning point. The monthly CPI report will give investors the latest update on inflation, while PepsiCo and Delta Air Lines will report earnings.

Friday is the unofficial start to earnings season as the big banks kick things off. JPMorgan, Wells Fargo, Citigroup, and Bank of New York Mellon report earnings.

Want to receive these insights straight to your inbox?

The setup — ETH

Not long ago, Ethereum was ripping higher on the surprisingly positive prospects of the SEC allowing Ethereum ETFs. However, it has lost its recent momentum — as has the entire crypto space.

For now, the positive underlying fundamentals remain in play for cryptocurrencies, although the recent price action has been a bit disappointing. One could argue that this is healthy digestion of a big rally, with Bitcoin and Ethereum still up 34% and 33.5% so far this year, respectively.

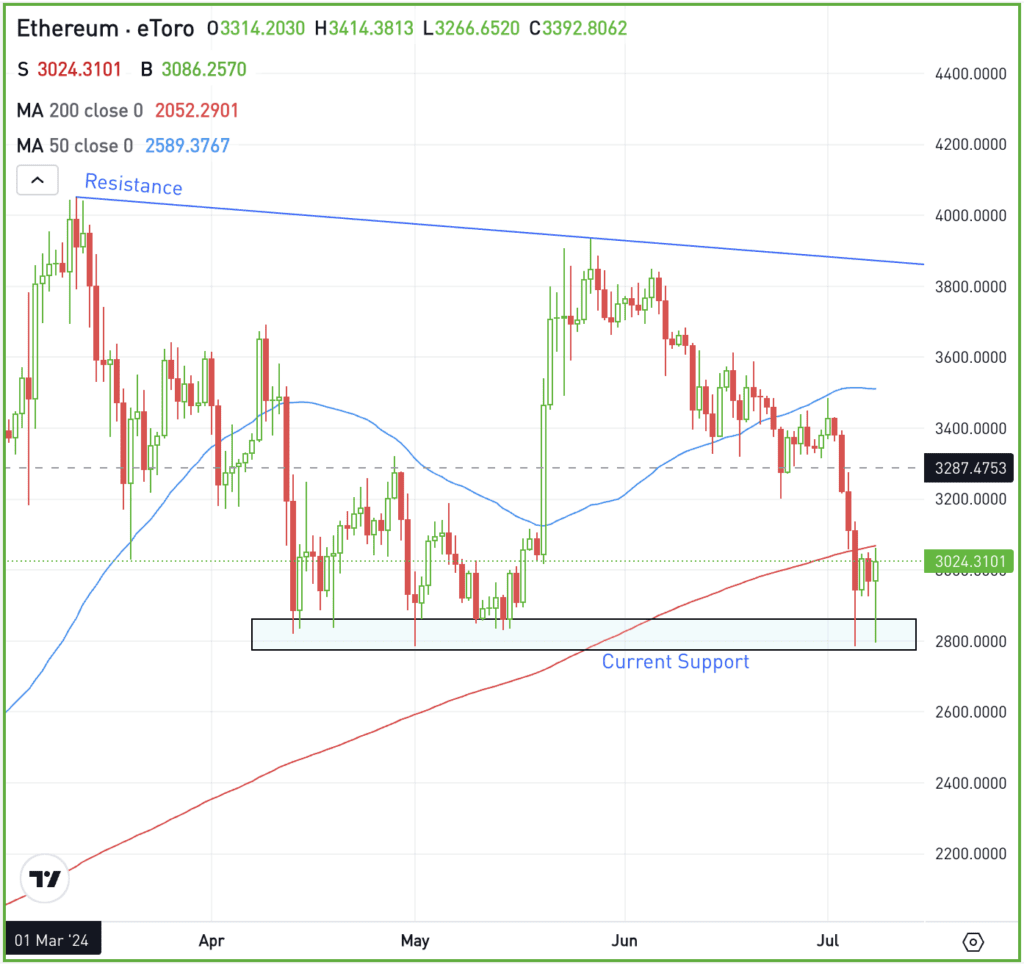

Ethereum recently dipped to multi-month lows, although support continues to hold around $2,800.

Short-term, active investors should keep an eye on this area. If it breaks and Ethereum can’t get back above it, then it may continue to move lower in the days or weeks ahead.

On the upside, bulls want to see Ethereum regain the $3,000 mark and the 200-day moving average — a long-term trend that helps determine the overall health of an asset. If Ethereum can regain these marks, a larger rebound could be in store.

What Wall Street is watching

BA — Boeing will plead guilty to a criminal fraud charge related to the 737 Max crashes. The deal includes a $243.6 million fine and installing an independent compliance monitor. This agreement helps Boeing avoid a trial as it navigates its ongoing safety and manufacturing challenges.

TSLA — Tesla stock surged 27.1% last week and is now up more than 41% over the past month. The recent rally has erased its year-to-date losses and makes it the best-performing Magnificent Seven holding over the past three months.

SLV — Physical silver prices gained more than 7% last week, surging past $31 — its highest level since late May. On Friday, the SLV ETF gained 2.3% following a weak US jobs report that raised expectations for a Fed rate cut.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.