The Daily Breakdown looks at energy stocks as the sector continues to surge higher. Plus, Bitcoin reclaims the $70,000 level.

Tuesday’s TLDR

- Trading volume dries up amid a slow week.

- Bitcoin bounces back above $70,000.

- Energy sector hits 52-week high.

What’s happening?

The SPY ETF tracks the S&P 500 and gives investors a great way to follow the markets — whether that’s a small position size with fractional shares or a massive position for institutional investors.

SPY is the largest ETF in the US stock market in terms of assets under management (AUM) and is one of the most-traded ETFs on any given day.

On Monday, the SPY generated trading volume of just 48.5 million shares. While that may seem like a lot, yesterday’s tally was more than 30% below SPY’s 30-day average trading volume of about 70.4 million shares.

It was the SPY’s lowest one-day trading volume since November 24th — the holiday-shortened trading session on the Friday after Thanksgiving.

It’s clear that investors are traveling instead of trading, as spring break is in effect.

If we shift our attention to the crypto market, Bitcoin and Ethereum jumped on Monday, each climbing about 4% on reports that the London Stock Exchange would create a marketplace for Bitcoin and Ethereum exchange-traded notes (ETNs).

Will it be enough to send Bitcoin to new highs?

Want to receive these insights straight to your inbox?

The setup — XLE

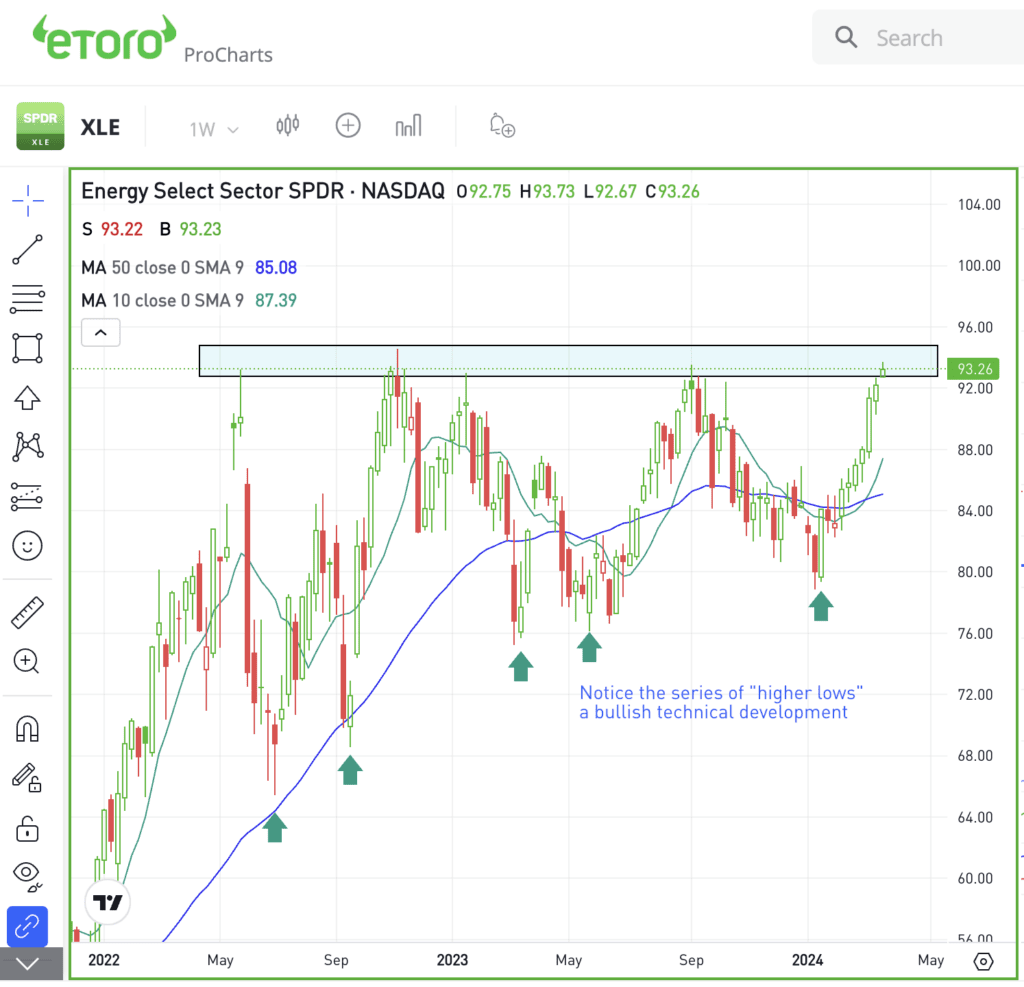

Energy stocks continue to climb higher and it’s now one of the top sectors in the S&P 500 so far this year, up 10.2% year to date.

Valero and ConocoPhillips are just two stocks we’ve focused on lately that have been riding this bullish wave. The XLE ETF has already rallied in six straight weeks, but now it’s running into a critical area on the charts.

On the one hand, momentum has been very strong, with the ETF up 18% from the January low. On the other hand, this area has been stiff resistance for almost two years now.

There are basically three outcomes. Either resistance holds and XLE falls, the sector breaks out over resistance, or it pulls back in a potential buy-the-dip scenario.

In all three of those situations, investors can approach the energy space in a limited-risk manner with options. Buying puts or put spreads is speculation that resistance holds and energy stocks fall, while buying calls or call spreads speculates on a move higher — whether that’s a breakout over resistance or a potential buy-the-dip setup.

And don’t forget, eToro’s options trading contest* runs through March 29th — and has $4,000 in prizes up for grabs.

*Terms and conditions apply. You must be approved for an options account in order to participate.

What Wall Street is watching

Cocoa — Cocoa prices continue to soar, exceeding $10,000 per ton for the first time ever. The increase comes amid a supply shortage, impacting chocolate production. Cocoa futures trading in New York rose after funding issues in Ghana, a major cocoa producer, exacerbated the crunch.

BTC — Bitcoin began the week on strong footing, surging back above $70,000, signaling a potential recovery from its recent correction. The surge propelled other cryptocurrencies and related stocks and ETFs, with notable gains across the sector.

BA — Boeing’s leadership shake-up continues as CEO David Calhoun — in office since the aftermath of 2019’s controversies — announces his departure amid new challenges and concerns about how the company will navigate a new set of headwinds. Shares rallied slightly on the news.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.