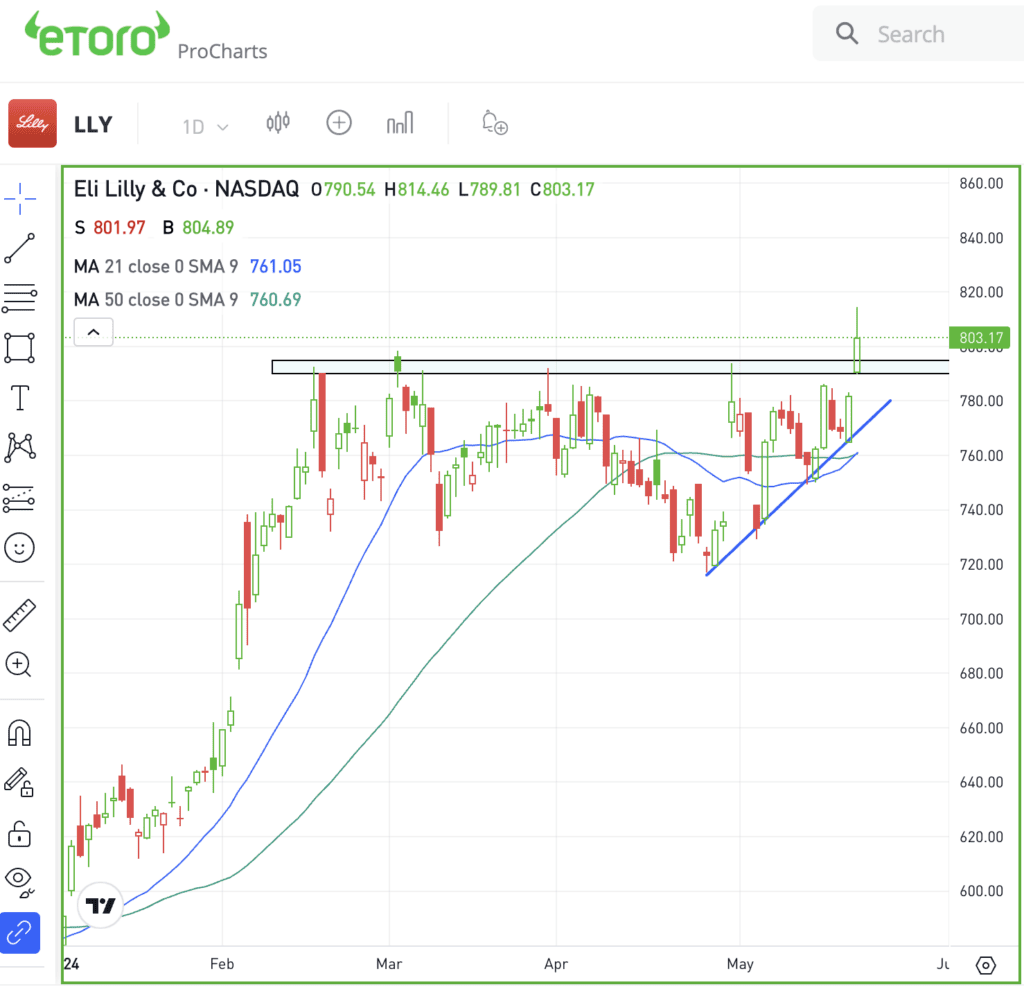

The Daily Breakdown takes a closer look at Eli Lilly, which broke out to new record highs after several months of consolidation.

Wednesday’s TLDR

- The VIX sits at multi-year lows.

- Nvidia’s earnings are in focus.

- Eli Lilly stock hits a new record high.

What’s happening?

The S&P 500 closed at a record high on Tuesday, as the index has now declined in only two of the past 14 sessions.

Consider this.

There have been 11 trading sessions since May 7th. Eight of those sessions have seen a daily change of 0.25% or less (and four of those sessions clocked a move of 0.1% or less).

All of this is to underscore the low volatility environment we’re in right now. Despite the pullback in April, bulls have stormed back in force. As a result, the VIX — AKA Wall Street’s “fear gauge” — closed at 11.85, its lowest closing level since 2019.

Will Nvidia’s earnings report shake things up tonight?

The options market is currently pricing in a move of 7% to 8% — equating to roughly $160 to $180 billion in market cap. While it may not be a “life or death” report for the overall market, it will be a key focus for investors on Wednesday evening and likely through the week.

Not only has Nvidia become a major weighting in US indices — it’s the third-largest holding in the S&P 500 and Nasdaq 100 — it’s become a critical stock when it comes to investor sentiment. Further, it’s the leader of the semiconductor/AI theme.

However, more important than the report itself will be the stock’s reaction to Nvidia’s results.

Want to receive these insights straight to your inbox?

The setup — LLY

The focus may be on Nvidia, but did anyone happen to notice the breakout in Eli Lilly on Tuesday?

The healthcare giant erupted over the critical $790 to $795 zone, hitting new all-time highs in the process.

While shares did fade a bit off session highs, investors are hoping the stock will hold up above prior resistance. If it can do so, the stock can maintain bullish momentum.

If the stock does break back below prior resistance, it doesn’t necessarily mean the long trade is ruined. However, it would weigh on momentum if that were to happen.

Options

One downside to Eli Lilly — and Nvidia for that matter — is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

LULU — Shares of Lululemon Athletica added to its recent losses, falling in after-hours trading after Chief Product Officer Sun Choe resigned. Before the fall, shares had fallen 7.5% amid a five-day losing streak and were down 32.5% since reporting earnings back in March.

TSLA — Shares rallied almost 7% on Tuesday, Tesla’s best one-day gain in almost a month as shares hit a two-week high. The rally came after Tesla was at the Advanced Clean Technology Expo in Las Vegas, a rare conference appearance for the automaker. Some positive commentary surrounding the Tesla Semi helped spark the move.

ETH — Ethereum added to its recent gains, climbing 3.5% on Tuesday. The rally added to Monday’s gain of more than 19%, as investors await an ETF ruling from the SEC by May 23. For the week, Ethereum is currently up 21%, while Bitcoin is up 5.6%.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.