The week starts off with a heated US election and if followed by a Federal Reserve meeting on Thursday. The Daily Breakdown dives in.

Monday’s TLDR

- Election on Tuesday, Fed on Thursday

- Intel gets booted from the Dow

- Berkshire’s record cash pile

Weekly Outlook

From a seasonality perspective, November and December are two of the best months for US stocks. However, it’s hard to focus on how we’ll do this month when this week is littered with major events.

We’ll have earnings from Palantir and Wynn Resorts on Monday, followed by SuperMicro Computers on Tuesday.

On Wednesday, Celsius Holdings, Novo Nordisk, CVS Health, Arm, Qualcomm and AMC Entertainment will report earnings. But earnings aren’t the main focus this week.

That’s as investors — like hundreds of millions of others — are focused on the outcome of Tuesday’s election. The hope is that by Wednesday we’ll know who the next president will be and the market can begin pricing in various expectations for the administration.

If the outcome is unknown and dragged out, the markets may not like that scenario. But for now, let’s press ahead with the hope that we’ll know this week. And if you thought an election and some earnings were enough, think again.

We’ll also have the Fed’s next interest rate decision and press conference with Chair Powell on Thursday afternoon. The expectation is that the Fed cuts rates by 25 basis points, but an update from Powell will give more clarity to the Fed’s outlook.

Want to receive these insights straight to your inbox?

The setup — Intel

Intel was added to the Dow in 1999, but will be replaced by Nvidia. We’ve seen Nvidia’s market cap swell beyond $3 trillion this year, while Intel is down 53.8% year to date (despite Friday’s near-8%) rally.

That performance isn’t cherry-picked either. Shares are down 38% over the past year, 53.2% over the past three years, 59% over the past five years, and 32.4% over the past decade.

While Intel’s returns were better when including the dividend, the reality is that this stock should have gotten the boot a long time ago.

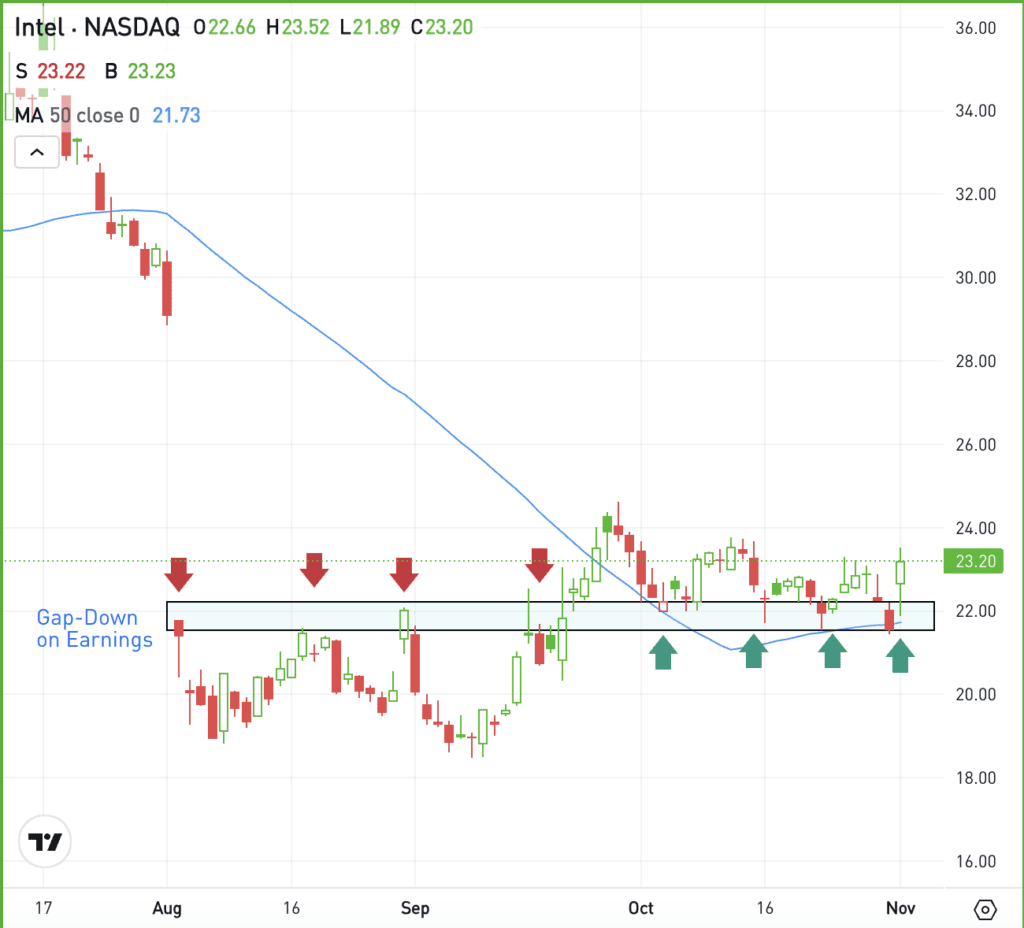

Despite all the negativity around this name, the chart is actually starting to shape up. The firm reported earnings last week and reacted well to the news. In August and September, the $21 level was stiff resistance. But it has been support in October and November, along with the 50-day moving average.

As long as shares can stay above these levels — $21 and the 50-day — bullish traders could make a supportive argument about the technicals. However, if the stock breaks below these levels, bearish momentum could accelerate.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

BRK.B – As it usually does, Berkshire Hathaway reported earnings over the weekend. The firm, run by Warren Buffett, reported that its cash position had climbed to $325.2 billion in the most recent quarter, as Berkshire continued to reduce its stake in Apple. Buffett’s cash position continues to build despite the market’s strong rally this year.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.