Earnings season is upon us as the big banks begin to report their quarterly results. The Daily Breakdown looks at what you need to know now.

Friday’s TLDR

- Banks kick off earnings today.

- Analysts expect an earnings acceleration.

- Looking at the S&P 500 after CPI-fueled dip.

The Bottom Line + Daily Breakdown

Second-quarter earnings will officially be underway this morning when the big banks begin reporting their quarterly results.

JPMorgan, Wells Fargo, Citigroup, and Bank of New York Mellon will report their Q2 results this morning and more banks will follow in the days ahead.

While Delta Air Lines and PepsiCo both reported their results on Thursday morning, big bank earnings are generally considered the start of earnings season. (Fun fact: Years ago, the earnings kickoff task previously belonged to Alcoa).

So what can we expect this quarter?

Estimates are strong

Last quarter, S&P 500 earnings grew roughly 6% year over year. That was the best quarterly growth in two years, since Q1 2022. Now though, earnings are expected to accelerate.

According to Bloomberg, analysts expect S&P 500 earnings to grow roughly 8% in Q2 and again in Q3. From there, estimates call for another acceleration, this time to double-digit growth for the next four quarters (Q4 2024 through Q3 2025).

If that ends up being the case, it could be an enormous tailwind for US equities — particularly if the economy can hold up and as the Fed is all but certain to cut interest rates in the second half of 2024.

Earnings are the driving force being equity prices. And remember, estimates are just that — estimates — and are subject to fluctuate over time. But if these estimates come to fruition over the next six quarters, it should bode well for stocks even if there’s volatility sprinkled in.

What to expect in the weeks ahead

Big banks will kick off earnings today, but they are not the only ones to watch in the days and weeks ahead.

While more banks will report next week — like Goldman Sachs, Morgan Stanley, and Bank of America to name a few — we’ll also hear from companies like Johnson & Johnson, Netflix, and United Airlines.

The pace of earnings will really pick up in the following two weeks (from July 22 through August 2). That’s when a bulk of mega-cap tech companies will likely report earnings, including Tesla, Apple, and Meta.

Alphabet, Amazon, and Microsoft have yet to confirm their earnings dates, but these six firms generally report around the same time. The one notable absentee is Nvidia, which reports later in the cycle.

So buckle up and get ready, because earnings season is no longer around the corner…it’s here right now!

Want to receive these insights straight to your inbox?

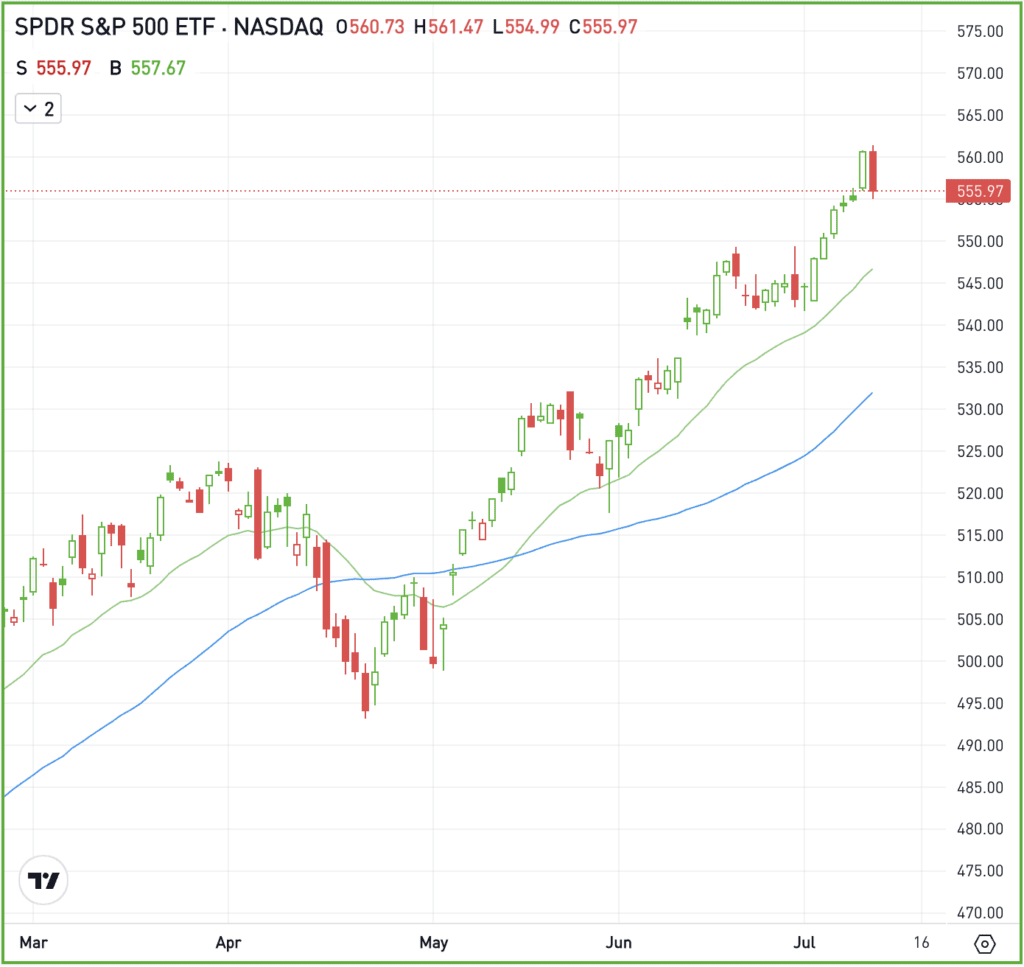

The setup — SPY

Thursday’s CPI report came in lower than expected and even though the odds of a Fed rate cut went higher, the S&P 500 went lower.

Not many would have expected that, although a “sell the news” reaction isn’t all that surprising after the recent rally we’ve seen.

Yet seven of the 11 S&P 500 sectors finished higher on the day, while roughly 84% of NYSE-listed securities finished higher, too. This is called rotation, as investors took profit in mega-cap tech and rotated into more rate-sensitive assets — like the utilities and real estate sectors, small caps, and bonds.

The thing is, we don’t know how far the S&P 500 may pull back. It might be a quick one- to two-day dip or it may be more meaningful — something like one to two weeks or even one to two months.

Stocks have been on a tear this year, with the S&P 500 up over 17%.

Despite the clear positives driving markets higher — like the momentum in the AI theme, an acceleration in earnings, and expectations for lower rates — we have to acknowledge that the markets have run a long way in a short period of time. Further, stocks have averaged three pullbacks of 5% or more per year going back to 1974.

That doesn’t mean we’ll get a 5% correction, but we have to remember that stocks don’t only go up — even when we get the news we want. For now, the long-term trend remains intact and that’s constructive for the bulls, even if there are some dips along the way.

Options

For some traders, options might be a consideration. Call spreads allow bulls to speculate on a bounce, while put spreads allow investors to speculate on further downside and/or protect their portfolio in the event of a deeper pullback.

Spreads allow traders to take options trades with a much lower premium than buying the options outright. In these cases, the maximum risk is still the premium paid.

Options aren’t for everyone, but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.