Earnings season officially begins and The Daily Breakdown looks at which companies kick off the action, as well as this week’s key economic reports.

Monday’s TLDR

- PepsiCo, JPMorgan, Delta report earnings

- Palo Alto Networks tries to break out

- China’s stock markets reopen

Weekly Outlook

Friday’s job number was incredibly strong, with the 254,000 jobs added coming in well ahead of estimates calling for just 150,000 jobs. The prior month was revised higher and the unemployment rate came in at 4.1% vs. estimates of 4.2%.

It was a strong reading and one that investors cheered as the S&P 500 gained 0.9% and the Nasdaq 100 climbed 1.2%. Can stocks continue their momentum this week as earnings start?

PepsiCo will report earnings on Tuesday morning, while several Fed members will speak throughout the first three days of this week. It will be interesting to hear their thoughts on rate cuts after such a strong jobs report.

The action picks up later in the week. That’s with the latest inflation results coming out on Thursday when the CPI report is released. Delta Air Lines and Domino’s will also report on Thursday.

Friday is what many investors consider the start of earnings season as banks like JPMorgan, Wells Fargo, and Bank of New York Mellon issue their quarterly results.

Want to receive these insights straight to your inbox?

The setup — PANW

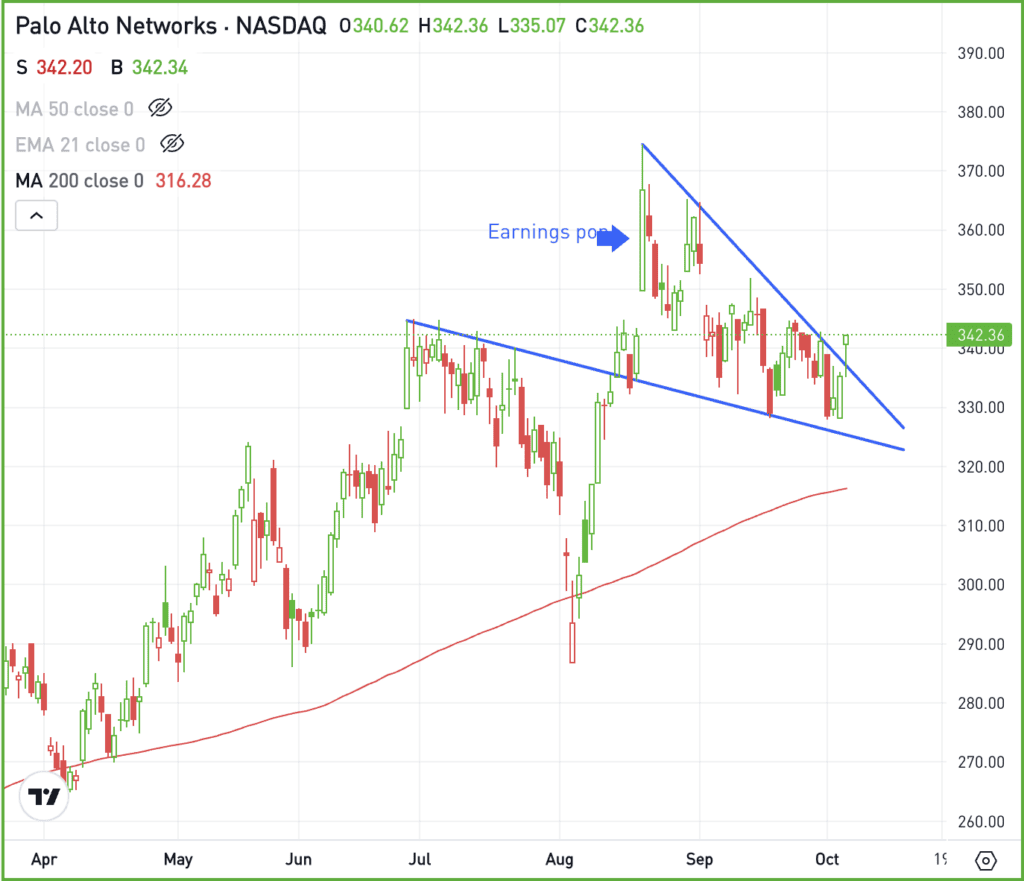

Palo Alto Networks is a leading cybersecurity firm, although it’s had a volatile year so far. Shares have been up as much as 29% in 2024 and down as much as 13%.

Currently, the stock is up about 16% as it tries to work higher out of a recent consolidation phase.

Shares of PANW popped to multi-month highs in August after a strong earnings report, but the stock drifted sideways to lower for weeks now. Can it regain its momentum?

If shares can stay above the $325 level, bulls can look for a potential rally to continue higher. However, if the stock breaks below the $325 level, more selling pressure could ensue, potentially pushing PANW down to the 200-day moving average.

Fundamentally, analysts expect 13.7% sales growth this year and 10.4% earnings growth, while Palo Alto is a profit leader in cybersecurity.

Options

One downside to PANW is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

FXI – China’s stock markets are expected to keep rising as they reopen following Golden Week. Analysts attribute the recent stock surge to stimulus measures from the Chinese government, but warn of potential reversals in 2025 if the economic impact falls short of expectations. Volatility remains likely amid mixed sentiment.

BTC – Friday’s strong jobs report showed unexpected job gains, reducing the likelihood of aggressive Federal Reserve rate cuts. While a strong economy supports risk assets like Bitcoin, fewer rate cuts may impact Bitcoin’s store of value appeal, creating mixed market effects.

TSLA – Just ahead of Tesla’s highly anticipated Robotaxi event, the company is losing its chief information officer. Nagesh Saldi, responsible for developing Tesla’s data centers in Texas and New York, has reportedly stepped down. Catch up with the latest Tesla news.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.