The Daily Breakdown looks at the Dow’s rally to 40,000 and takes a closer look at some the catalysts driving stocks higher.

Friday’s TLDR

- Stocks are back at all-time highs.

- 3 catalysts have helped drive the gains.

- What if markets pull back?

What’s happening?

Another Friday, another Bottom Line breakdown.

On Thursday I explained how a soft retail sales number and a tame inflation report helped spur stocks to all-time highs and Bitcoin to its highest level in nearly a month.

Don’t feel like clicking the link and want the “too long, didn’t read” instead?

In order to cut rates, the Fed needs lower inflation or weakening economic reports, (and preferably the former rather than the latter). Earlier this week, we got both and thus stocks and crypto — two assets that like lower rates and higher liquidity — jumped higher.

On Thursday, the S&P 500, Nasdaq, and Dow hit new all-time highs, with the Dow crossing the 40,000 mark for the first time. That rally came on renewed confidence that the Fed will cut rates at some point in 2024.

Other catalysts

Rate-cut expectations have been a positive, but there have been other catalysts too. While there are still plenty of issues in the world, the geopolitical concerns have quieted down over the past month, taking a little fear out of the market.

Another catalyst has been earnings.

Through May 10th, 92% of S&P 500 companies have reported earnings with 78% of those firms beating earnings expectations, according to FactSet. We’ve seen 5.4% earnings growth so far this quarter, the best growth rate since Q2 2022.

From here, analysts expect an acceleration. According to Bloomberg, S&P 500 earnings are expected to grow 8% to 9% in Q2 and Q3, before accelerating again to double-digit growth for the next three quarters.

For a market that tends to be forward-looking, this earnings acceleration would be a positive development.

Bottom line

Even though markets may wobble a bit after such a strong run, the rally has been a fantastic reminder for investors that pullbacks happen within bull markets and that it’s okay when they do — they can be what sets up the next leg higher.

Remember, the S&P 500 has seen a pullback of 5% or more roughly three times a year over the last 50 years. So when the index rallied about 28% over five straight months, then dipped 5% to 6%, it was pretty routine even if it felt kind of scary.

For investors that weren’t over-leveraged, it was an excellent buying opportunity that helped reset sentiment. For investors that were over-leveraged, the pullback was an excellent lesson on risk management on one’s portfolio.

Going forward, it will be important to keep some of those lessons in mind. When things are going well and we’re having “illusions of grandeur,” that’s precisely the time to think about scaling back and lowering position sizes until there’s more clarity in the market.

Want to receive these insights straight to your inbox?

The setup — SPY

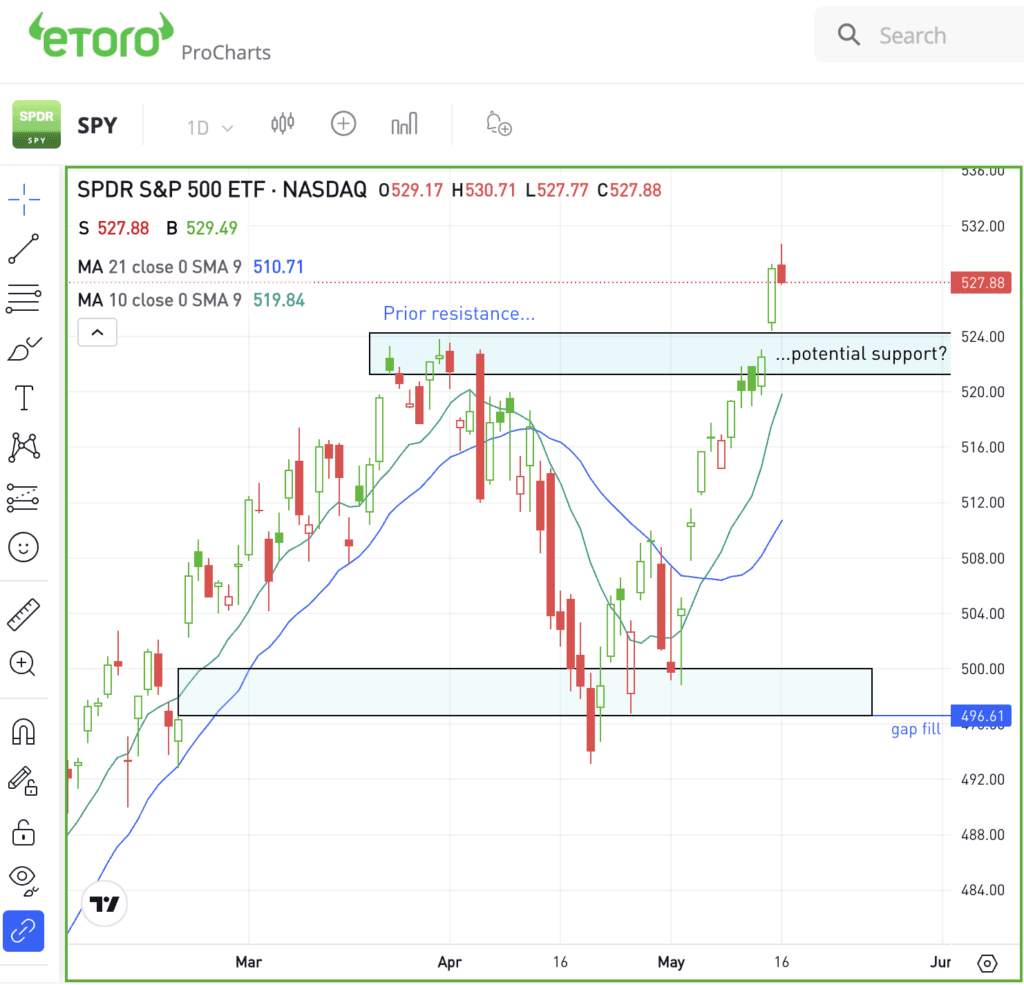

The S&P 500 ETF SPY had rallied in 10 straight sessions and is up 7% from the lows last month. Now back at all-time highs, investors might be wondering if they’ve missed the move.

Remember when the S&P 500 couldn’t break out over the 5,260 area (roughly $524 on the SPY) and it tried for three weeks before failing?

Now back above this level, it would be great to have a pullback into the $520 to $525 zone and see this area act as support.

If we do pull back to this area and support holds up, a healthy “buy the dip” environment can persist.

However, if the SPY pulls back and this level fails as support, investors will need to turn their attention lower for possible support — potentially down to the 50-day.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback in SPY. For those that aren’t feeling so bullish or who are looking for a hedge, puts or put spreads could be one way to take advantage of a deeper pullback in the SPY.

That’s particularly true with implied volatility as low as it is right now.

Implied volatility or “IV” is a component to options pricing. The higher the IV, the more expensive options become. When volatility is lower, the IV is lower as well and options pricing becomes a bit cheaper.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.