All the talks about the election seemingly has investors forgetting about inflation. The Daily Breakdown revisits the CPI report today.

Wednesday’s TLDR

- Today’s inflation report is in focus

- A closer look at Microsoft

- Strong earnings for SPOT, CAVA

What’s happening?

Bulls hate seeing a big rally followed by a swift decline. So far though, crypto and stock markets have done a great job holding up after last week’s rally. Investors that missed the initial move higher are now looking for pullbacks as a possible buying opportunity.

Meanwhile, today’s CPI report will be in focus. Inflation worries seem to have gone out the window given the recent rate cut and the election outcome. However, it’s still very much a key economic release to keep an eye on.

Right now, the bond market is pricing in about a 60% chance of another 25 basis point rate cut from the Fed in December. That number is likely to move based on the CPI report, although other factors — like the PCE report later this month and jobs report in early December — will influence it as well.

If today’s inflation report comes in higher than expected, odds for another rate cut are likely to head lower. If it’s lower than expected, investors will likely grow more confident in another rate cut.

Want to receive these insights straight to your inbox?

The setup — Microsoft

One notable absence amid the market rally? Mega-cap tech. This group isn’t necessarily doing bad, but multiple Magnificent Seven holdings have yet to take out their highs from July.

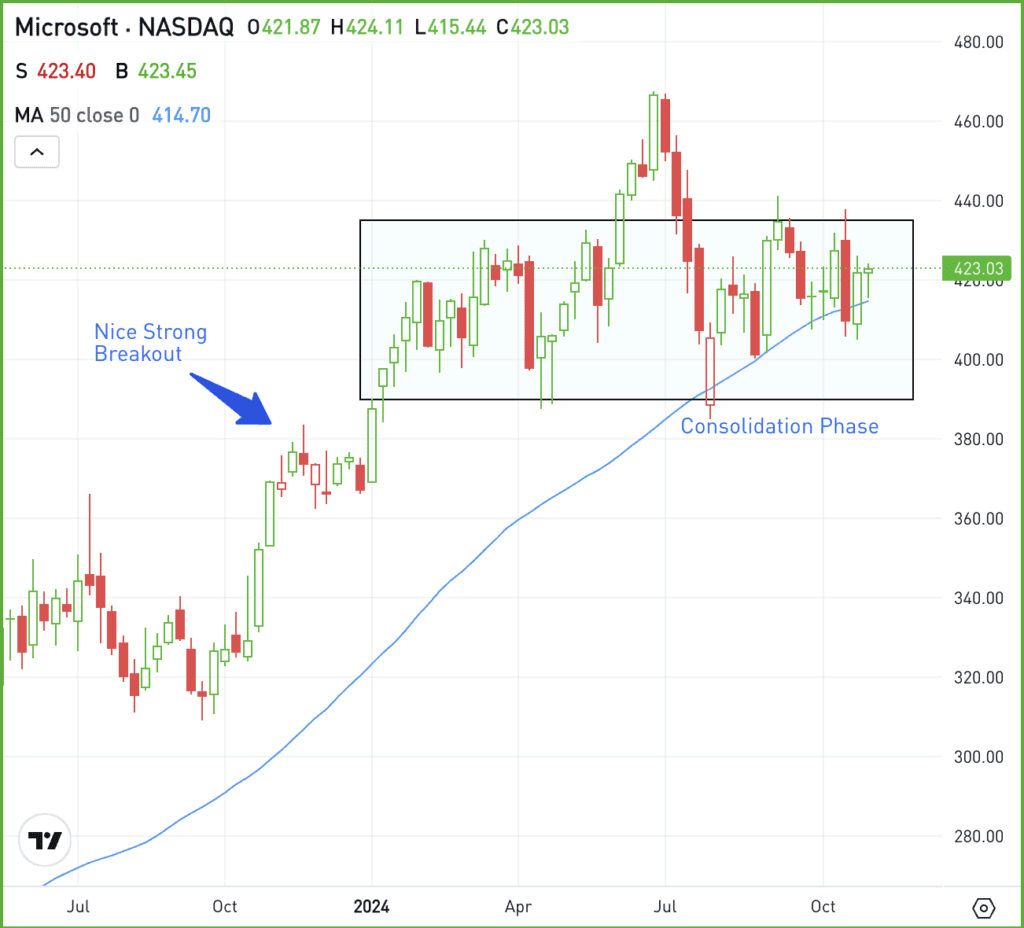

Microsoft is one of those names.

The stock continues to consolidate, chopping in a sideways manner despite reporting strong earnings. That’s as the stock bounces around between $390 and $435.

This price action is fine for patient investors and frustrating for short-term investors. However, if MSFT is able to break out over the $435 to $440 area, it could pave the way for a move higher, potentially putting the prior highs near $470 in play.

On the downside, investors will want to see the $390 area continue to hold as support.

Options

One downside to MSFT is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

SPOT – Shares of Spotify are set to open at all-time highs after the firm delivered impressive quarterly results. Investors are focused on the company’s margin expansion and strong user growth, which topped expectations.

CAVA – The run in Cava has been remarkable this year, with the stock up 237% through Tuesday’s close. However, that number is set to grow even more, with shares sporting a pre-market gain of about 16% after the firm delivered a top- and bottom-line earnings beat.

RKLB – Shares of Rocket Lab USA are roaring higher this morning, up more than 20% in pre-market trading. The firm reported solid quarterly results, however, it was strong guidance and optimism from management that’s helping fuel the rally.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.