The Daily Breakdown looks at the heightened political climate amid a pullback in the US stock market. Can stocks and politics mix?

Friday’s TLDR

- Politics have dominated the headlines lately

- But the market is focused on earnings and the Fed

- Micron stock dips as bulls look for key support

The Bottom Line + Daily Breakdown

Politics have dominated the headlines over the last few weeks, from debate performances, assassination attempts, and jostling around which candidates will square off in November. It’s been heated and the discussion volume continues to crank higher and higher. So hopefully you’ll forgive me for also giving this discussion some amplification.

The political conversation may serve as a hot topic for social media, news outlets, and select dinner table groups. But does it deserve a seat in the discussion when it comes to the markets?

Remember the main drivers

Regulation plays a pretty big role in Bitcoin, Ethereum and the rest of crypto. The hope from investors is that whoever serves next in the White House will be more receptive to crypto in the future. But for stocks, fundamentals are the main driver.

A large part of those fundamentals boil down to earnings and fiscal policy set by the Federal Reserve.

In the case of the Fed, it’s on the verge of lowering interest rates for the first time in years, easing financial conditions after its multi-year battle with inflation. Provided the Fed isn’t lowering rates because it’s worried about the economy — which doesn’t appear to be the case after the Q2 US GDP print just came in at 2.8% vs. estimates of 2% — easing financial conditions would be a good thing for markets.

The other driver is earnings — and it’s good to remember that earnings growth is accelerating for the S&P 500.

In the most recent quarter, Q1 earnings posted one of the best year-over-year growth results in several years. According to Bloomberg, analysts expect 9% earnings growth for the current quarter and 6.7% growth for Q3. Beyond that, the following four quarters call for double-digit growth.

Keep in mind, these are just estimates and are subject to change. However, if we get anything close to these expectations, lower rates, and avoid a recession, it’s an incredible recipe for a sustained bull market.

Volatility on the rise?

For most of the year, volatility remained incredibly low as the S&P 500 and Nasdaq 100 raced toward 20% year-to-date gains. Amid the recent pullback, some may be wondering what the lead up to the election might be like.

My opinion was that the markets didn’t seem to worry about the election, based mostly on the fact that investors have already seen the leadership — and all-time highs — under both Biden and Trump (which were the two candidates for most of the year).

The markets like certainty and now that the presidential race has seen a shake-up in the candidates, the outcome is less certain than before. We could see increased volatility, but neither candidate is a reason for a market crash.

The bottom line

This feels like the loudest lead-up to an election in US history — and the volume has only gotten louder this month. Political policy and regulations do matter, but it’s important to remember that fundamentals drive stocks, not headlines. Further, every president for the last 40 years has seen all-time highs during their presidency. Stocks generally perform pretty well over the long term regardless of politics — spoiler alert: we’ll get into long-term performance next week.

Want to receive these insights straight to your inbox?

The setup — MU

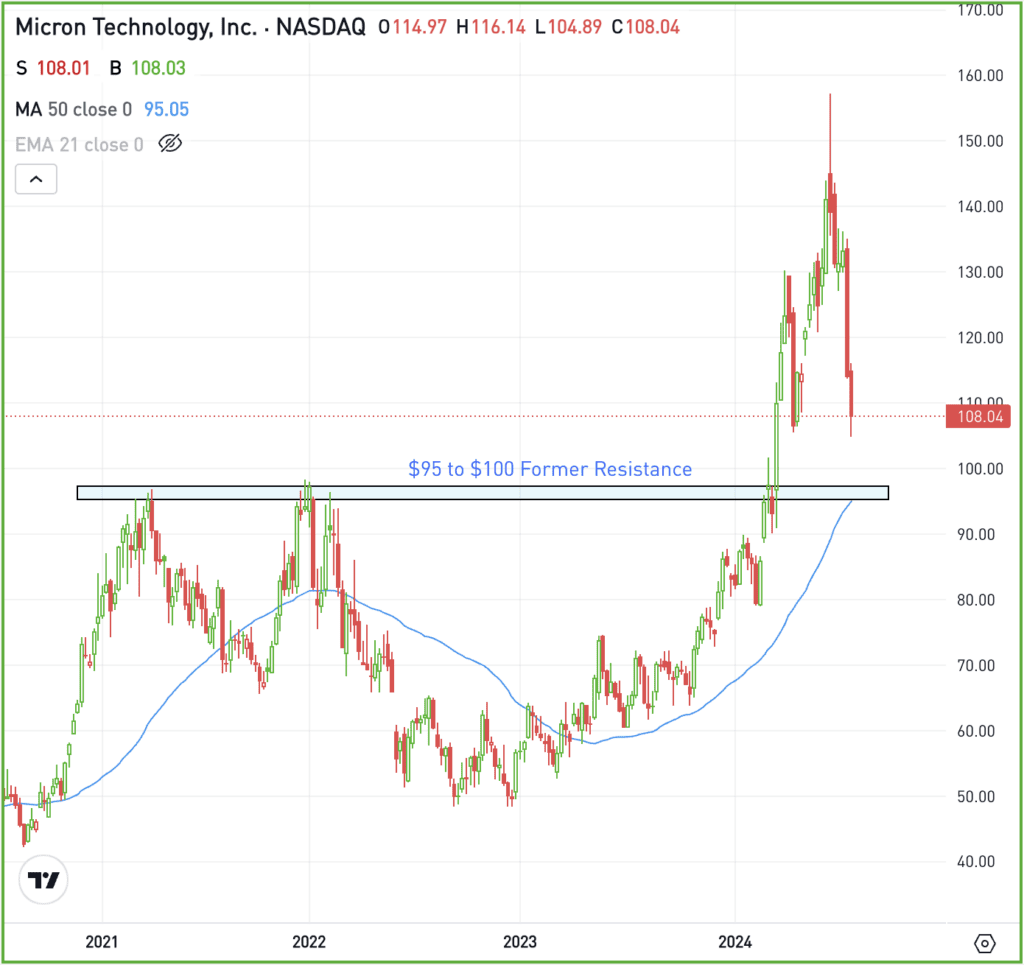

Micron has been on a tear this year. At its highs, shares were up 84% year to date. Now though, the stock has tumbled lower by more than 30%.

I am keeping a close eye on the $95 to $100 area, which previously served as massive resistance — and not just in 2021 and 2022. This area also marked the highs in 2000 amid the dot-com boom.

If MU continues lower, look for a possible retest of the $95 to $100 level. While that level may not hold as support, it could be a spot that draws in buyers. If it does hold, a bounce could follow.

While we’re in the midst of earnings season, the firm already reported in late June. It beat on earnings and revenue expectations, provided solid earnings guidance for Q3, but reported an in-line revenue outlook.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to make sure they have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.