The Daily Breakdown looks at the market’s interpretation of the Fed, as well as the recent breakout in Disney stock.

Friday’s TLDR

- Stocks shrugged off concerns of a rate cut delay.

- Disney broke out over resistance as it tries to rebound higher.

- Meta beefs up its buyback and initiates a dividend.

What’s happening?

The Fed has spoken and the market has listened. Well, sort of.

On Wednesday, Chair Powell tried to tamper down expectations of a March rate cut, saying he doesn’t expect the Fed to feel confident enough on inflation to justify a cut in March.

While the markets swooned a bit on Wednesday — the S&P 500 fell about 1.6% on the day — investors didn’t hesitate to buy the dip on Thursday.

The S&P 500 rebounded 1.3%, while the Russell 2000 jumped 1.4%. Bonds continued to roll higher too, as TLT — the most traded long-term government bond ETF — gained 1.6%, adding to its 1% gain yesterday. It’s quietly up almost 5% so far this week.

All of this is to say that, at least for one day, the Fed’s potential delaying of the first rate hike from March to May didn’t deter bulls all that much.

Now this morning, we’ve got the monthly jobs report to navigate, as well as the post-earnings responses from three of the Magnificent Seven stocks: Apple, Amazon, and Meta.

Want to receive these insights straight to your inbox?

The setup

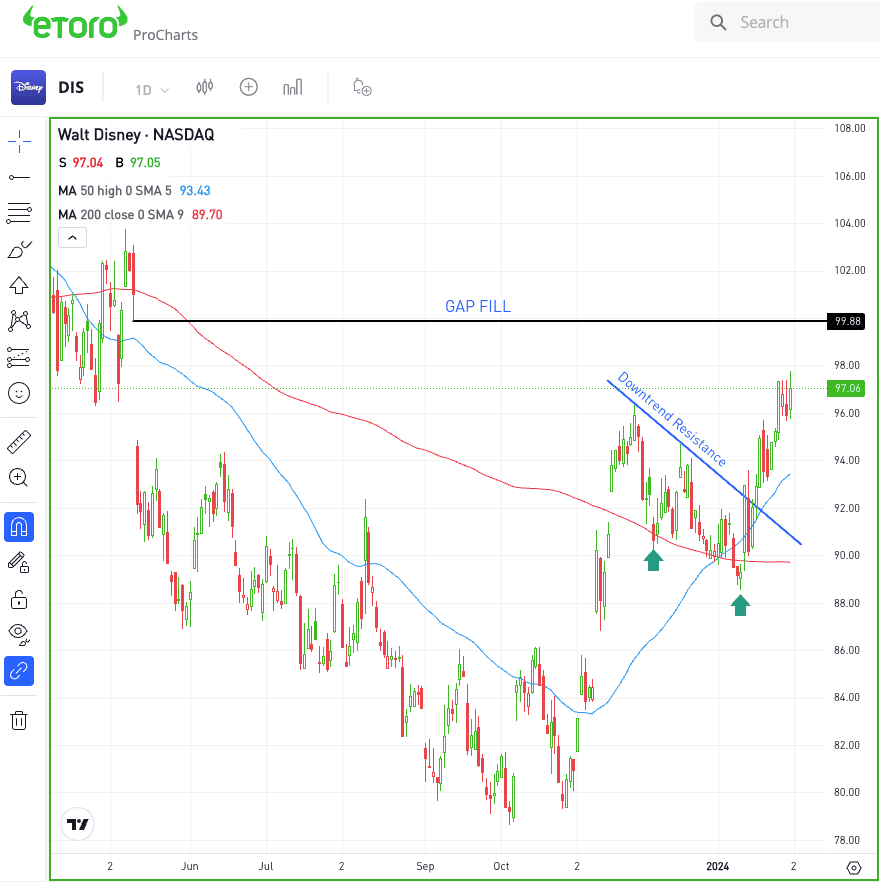

Disney remains well off its all-time high and is still down about 11.3% over the past 12 months.

On the bright side though, it’s been trading much better, up 7.4% year to date and 19% over the last three months. In fact, the stock just hit its highest level since May.

Disney stock enjoyed a strong rally in November, part of which was fueled by the company’s earnings report. The rally was enough for Disney to reclaim its 200-day moving average, a measure it’s been holding as support over the last few months as the stock digests the big run.

Now the stock is breaking out over recent downtrend resistance.

If the stock can continue higher, keep an eye on $100. Not only is that a key psychological level, but that’s also a gap fill level from May. If Disney can regain $100 — and more importantly, stay above this level — it could be the start of a much larger rebound.

On the flip side, bulls don’t want to see Disney break below the low $90s and they really don’t want to see it lose the 200-day again.

Keep in mind, Disney reports earnings next week and those types of events can go either way. But on the plus side, the stock has been trading much better lately.

What Wall Street is watching

META: Meta stock soared higher on earnings as the firm easily topped Q4 earnings and revenue expectations. For Q1, management issued guidance of $34.5 billion to $37 billion, well ahead of the $33.9 billion consensus. The company also upped its buyback plan by $50 billion and initiated a quarterly dividend.

AMZN: Amazon shares popped in after-hours trading, rallying about 9% after the firm delivered a top- and bottom-line beat. Revenue of $170 billion easily topped expectations of $166 billion, while earnings of $1 per share beat estimates of 80 cents per share. Management guided to operating income of $8 billion to $12 billion, with the midpoint ahead of consensus expectations of roughly $9 billion.

AAPL: Apple was muted in after-hours trading, despite beating on earnings and revenue expectations. iPhone revenue of $69.7 billion beat estimates of $68 billion, although Services revenue was a slight miss and China remains a large concern.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.