The Daily Breakdown looks at how mindset and psychology impact investors and their investment decisions. We also look at the TLT ETF.

Friday’s TLDR

- All-in vs. all-out mindset

- TLT stuck in a rut

What’s happening?

When it comes to trading and investing, things can get complicated. Personally, it’s why I like to take a keep-it-simple approach. That’s true for longer term allocations and it’s true for shorter term trading. It’s why so many of the setups you have seen over the past year involve just one or two lines of resistance rather than retracements or complex sequences.

That’s not to say complex solutions can’t work in the world of finance. After all, it can be a messy, complicated place regardless of whether someone’s investing long term or trading short term.

Regardless of one’s approach, I think it’s important to remember that we don’t need to carry an all-or-none approach to our investments.

Looking at the Gray Area

I see and hear this all too often: Should I sell my stocks after such a big run? Should I load the boat on this pullback?

The silver lining to the example above is that it involves “buying low and selling high.” But the problem is that it leaves no middle ground; no gray area — and gray areas are okay, particularly as we sit at all-time highs.

For instance, with Bitcoin at record highs, it’s okay for investors who feel nervous about the big move to take off some of their exposure. That’s called compromise. They don’t have to put it all on BTC and they don’t have to completely exit, either.

In finance, there’s an obsession with nailing tops and bottoms.

In reality, it’s rare to catch either one and nearly impossible to do so on a consistent basis. I say “nearly impossible” because maybe someone or some fund has figured it out and just aren’t telling the rest of us. But for you, me and the rest of retail, we have to accept the fact that we’ll rarely hit the absolute high and the absolute low and more importantly, that’s okay!

What’s important is keeping a level head.

The Bottom Line

As with the Bitcoin example above, an investor doesn’t have to be all-in or all-out.

It’s okay to rebalance positions and/or reallocate capital without exiting in entirety. Subsequently on dips, it’s okay to nibble assets of interest without going all-in on them. Unless that’s part of your preset plan, all-in and all-out decisions tend to come from an emotional decision-making process vs. a rigorous plan made ahead of time.

Investors don’t necessarily need to rebalance or reassess their portfolios. But when they do, remember that drastic decisions don’t always need to be made.

Want to receive these insights straight to your inbox?

The setup — TLT

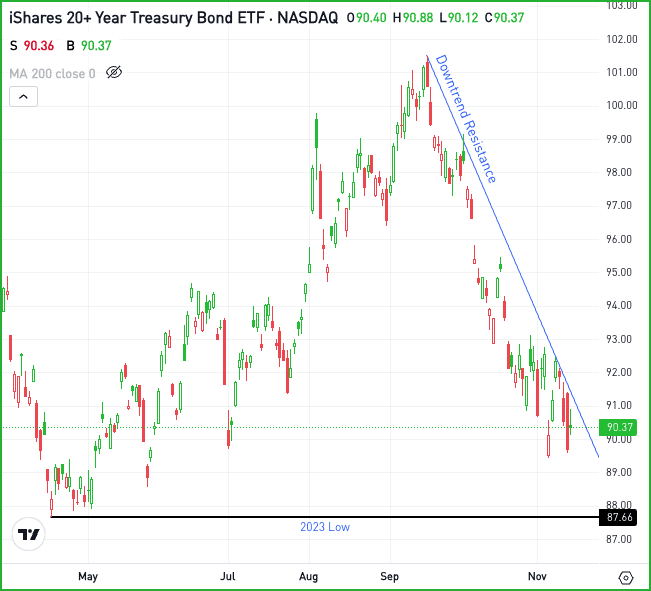

Bonds haven’t been doing very well lately, evidenced by the decline in the TLT ETF. We recently talked about how stubborn Treasury yields have been despite the Fed cutting interest rates and that’s taken a toll on bonds (which go down when yields go up, and vice versa).

When we look at the TLT chart, notice the steep downtrend it’s been in.

If TLT is able to break out over downtrend resistance, perhaps a rebound can ensue. Ideally, bulls would like to see this one move back toward the upper-$90s or $100, but that could take some time.

However, if TLT continues to move lower, then the 2023 lows near $87 could be back in play. If this level doesn’t lend some support to TLT, then a visit to the low-$80s could be in store, which is where the ETF bottomed in Q4 2023.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.