The Daily Breakdown looks at the pullback plaguing Wall Street, as well as Tesla, which sits on a vital level of support.

Tuesday’s TLDR

- Stocks get thumped in a painful session.

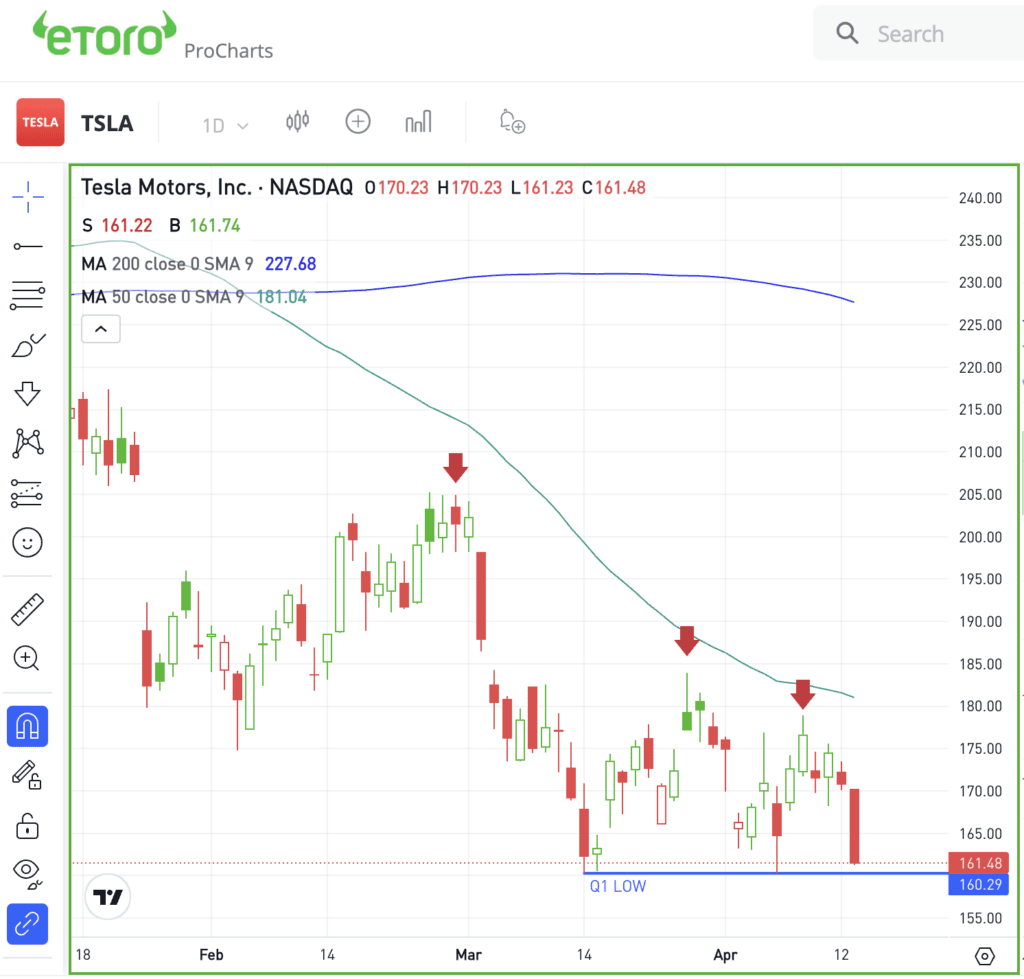

- Tesla stock flirts with a key support level.

- Salesforce tumbles on acquisition reports.

- Goldman Sachs rallies on earnings.

What’s happening?

With a two-day 2.6% dip, the S&P 500 is feeling the heat as sellers gain a bit of momentum.

The Nasdaq 100 is down 3.3% over the past two days, while the Dow is now flat for the year and the Russell 2000 is down 2.5% year to date.

Volatility is picking up as active investors pare down their holdings amid several notable headwinds, including: Heightened geopolitical tensions in the Middle East, rising bond yields, a strengthening dollar, seasonal weakness, and persistent inflation delaying Fed rate cuts.

So far, we have a run-of-the-mill pullback. The S&P 500 is down about 4% from its all-time high — and remember, pullbacks are common in bull markets. That said, they can be tricky.

While the S&P 500 might only be down a couple of percent, many stocks are down 10% to 15% or more. For investors in individual stocks, it makes it a much more painful experience below the surface.

We don’t know when or where the low will be. However, we know that a dip like this is expected and it’s healthy. Remember the long-term trend — which remains bullish — and be patient.

Want to receive these insights straight to your inbox?

The setup — TSLA

Tesla shares hit the brakes on Monday, tumbling 5.6%. The stock is now down more than 8% so far this month and has fallen a whopping 35% year to date.

Tesla is back under pressure following reports of a big layoff. If there’s any good news to salvage from the chart, it’s that the stock didn’t break below the Q1 low on the news. The same can be said for when it reporrted disappointing Q1 delivery results earlier this month.

Notice how the $160 level has been holding as support.

The good news is that support has been holding amid a bevy of bad news.

The bad news is that if support breaks, it could usher in even more selling pressure.

Some investors will look at the chart and want to own the stock as long as Tesla continues to close above $160. Others will look at it and want to short Tesla on a break lower.

This is one area where options can come into play, as the risk is tied to the premium paid.

Bulls can utilize calls or call spreads to speculate on a rebound, while bears can use puts or puts spread to speculate on more downside should support break.

For those looking to learn more about options, consider visiting the eToro Academy.

That being said, investors can be neutral on Tesla and choose to do nothing with the stock. Remember, you don’t have to be involved with every stock all the time.

What Wall Street is watching

TSLA — Tesla shares dropped following an announcement in an internal memo by CEO Elon Musk that the company plans to reduce its workforce by over 10% to cut costs and enhance productivity. Two top executives quit on the news.

CRM — Salesforce was the worst performer in the Dow on Monday, falling over 7% on reports that the company is in advanced negotiations to acquire Informatica, a data-management software provider.

GS — Shares of Goldman Sachs rose after the bank reported Q1 earnings of $11.58 a share on revenue of $14.2 billion. Both results came in ahead of analysts’ expectations and were led by a surge in capital market activities.

DJT — Shares of Trump Media & Technology Group dropped 18% after announcing a plan to issue over 21 million shares. The company, linked to former President Trump’s Truth Social, faces ongoing financial struggles and volatility. Shares are down more than 66% from the peak on March 26.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.