The Daily Breakdown looks at the recent price action in Tesla to determine whether shares can go higher in the short term.

Monday’s TLDR

- Friday is one of four “triple witch” expirations for 2024.

- A chill week of earnings.

- Tesla stock tries to find new bullish momentum.

What’s happening?

We have a pretty quiet week on tap, with a few notable events.

First, it should be pointed out that Wednesday is a market holiday in the US with the Juneteenth holiday. The stock market will be closed that day, making this a four-day trading week.

Just ahead of Juneteenth, we’ll get the retail sales report on Tuesday. While the monthly jobs report had strong headline results earlier this month, there is concern about the consumer right now. This report will give us the latest reading on how they’re doing.

Jumping ahead a few days to Friday and we have a big options expiration week.

Known as a “triple witching” expiration, it only happens four times a year — in March, June, September and December. That’s as we’ll have the monthly options expiration for stock options, the quarterly expiration for index futures, and the monthly expiration of index options.

And while earnings season has slowed dramatically, we’ll get a few reports this week too. Some notable names include Lennar (Monday evening), KB Home (Tuesday evening), Kroger, Accenture, and Dardin (Thursday morning), and Carmax (Friday morning).

Want to receive these insights straight to your inbox?

The setup — TSLA

Tesla has been in the news quite a bit lately, most recently for its annual shareholder meeting. The stock has been a laggard vs. its mega-cap peers, and more recently, it’s been volatile too.

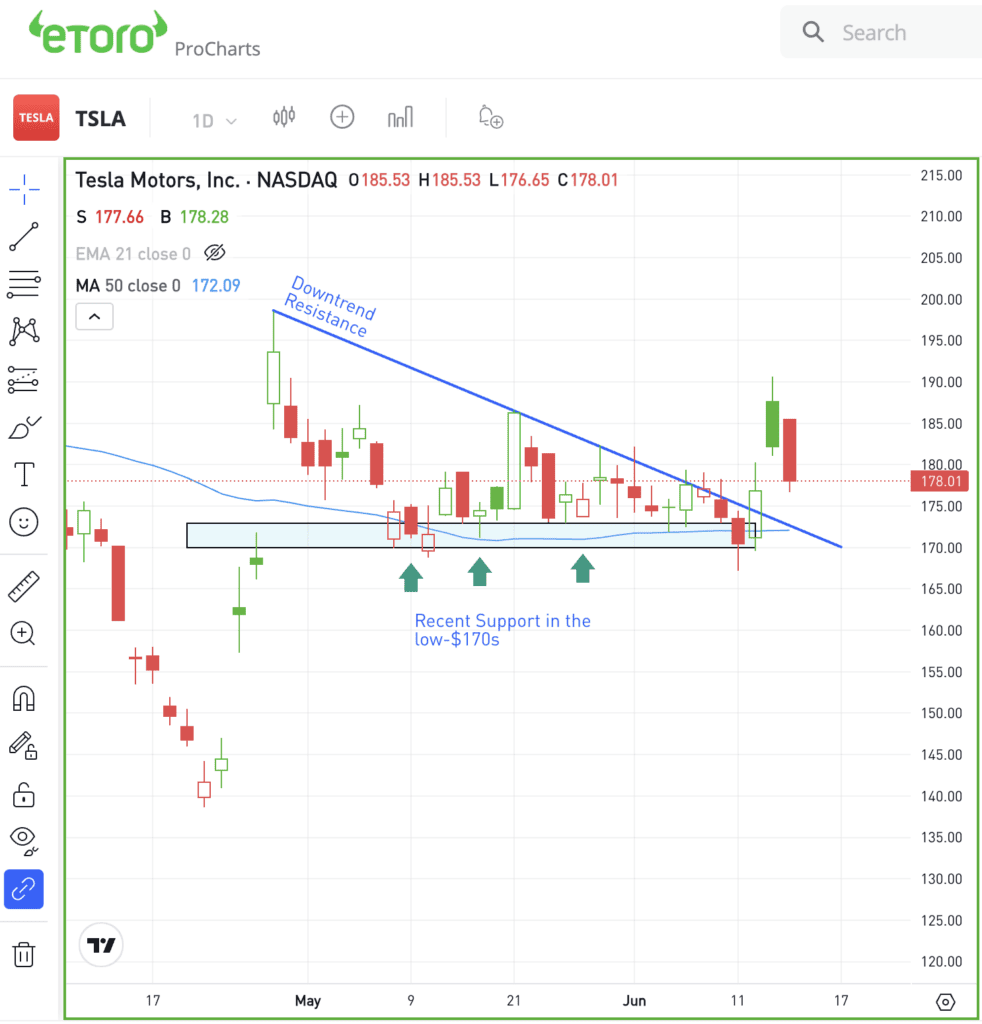

Shares broke down midweek, with the stock hitting its lowest level since April. Then the stock reversed, with a low-to-high rally of 14.1% in just two days. Could that rally spark more gains?

It’s completely possible that the volatility continues for Tesla. But on the plus side, shares are now above downtrend resistance, as well as the 21-day and 50-day moving averages.

As long as the stock can stay above the recent low at $167.41, active bulls can justify a long position. A break below that mark — and especially a close below that level — could have momentum shifting into the bears’ favor.

Ideally, bulls will want to see the low- to mid-$170s hold as support.

Options

For options traders, calls or call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

ADBE — Shares of Adobe erupted on Friday, rallying on the back of a better-than-expected earnings report. Earnings of $4.48 a share beat expectations of $4.39 a share, while revenue of $5.31 billion grew 10.2% year over year and eked past estimates by about $20 million.

AVGO — Broadcom’s winning streak continued on Friday, with shares hitting another all-time high. The stock has now climbed in six straight trading sessions and is higher again in Monday’s pre-market session. As of Friday’s close, Broadcom stock is up 16% since reporting earnings.

SPX500 — The S&P 500 saw its strongest weekly gain in months, driven by the calm inflation report for May. This report, which marked the first non-increase since July 2022, eased investors’ fears about a reflationary environment. Even though the Fed’s outlook called for fewer rate cuts than previously expected, investors remain optimistic that cuts will begin this year.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.