The Daily Breakdown takes a closer look at tech stocks, which lagged badly in Q3 but could have bright prospects here in Q4.

Tuesday’s TLDR

- Tech lagged 9 out of 10 sectors in Q3

- But leads expected quarterly EPS growth

- NVDA stock continues to consolidate

What’s happening?

Tech was the second-worst performing sector in Q3, with only energy performing worse, down 2.9%. The other nine sectors gained at least 5% in the quarter, with utilities leading the charge with a 19.3% gain.

On the plus side, tech finished about flat for the quarter. So while tech continues to lag, the quarter was hardly a disaster.

Remember that the Nasdaq hasn’t made an all-time since mid-July, with only one Magnificent 7 holding doing so since then — that being Meta.

Will Q4 be the time for a rebound? I have talked about tech lately, even though it’s a very healthy development to see other sectors performing so well.

The S&P 500 is forecast to grow earnings by 10% or more in five of the next six quarters. However, consensus estimates call for growth of just 3.8% for the upcoming Q3 earnings season.

However, the technology and communications sectors — remember, communications include tech firms like Alphabet and Meta — have the best earnings growth forecasts this quarter, up 14.9% and 12.8%, respectively.

That doesn’t guarantee a catch-up trade in tech, but as long as the economy continues to chug along and the market remains steady, we could see a rebound.

Want to receive these insights straight to your inbox?

The setup — NVDA

There’s no denying that Nvidia has been leading the charge for AI and semiconductors. However, there’s also no denying that the stock has been both volatile and an under-performer over the past months.

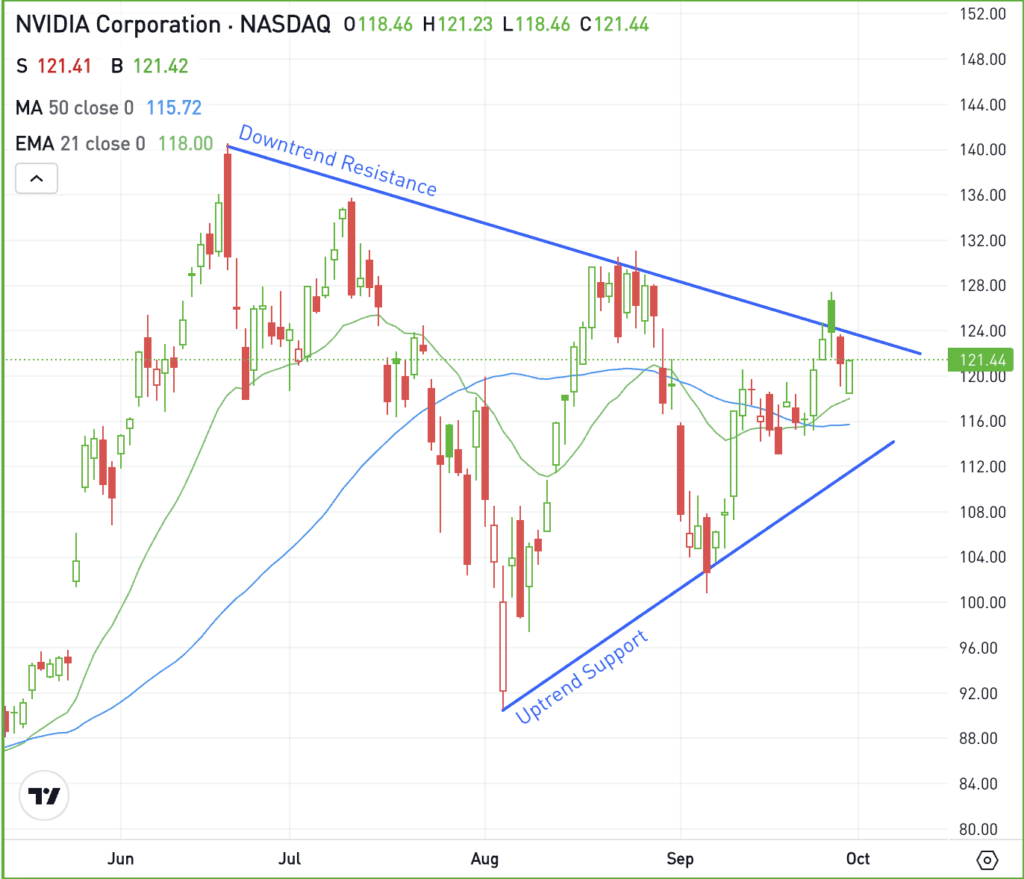

The stock is flat over the past month and down almost 15% from the all-time high. Now investors are watching to see if the stock can clear downtrend resistance:

No one knows for certain if Nvidia will be able to break out in the short term. However, bulls might be comfortable so long as the stock holds up above the $112 to $115 area.

If it can do so, NVDA will remain above its 21-day and 50-day moving averages, as well as rising uptrend support. If shares do end up breaking out, a larger rally can ensue in Q4.

Fundamentally, Nvidia is leading the AI charge. Analysts expect earnings to grow 84% this quarter and 56% next quarter, with fiscal year earnings estimates currently calling for 120% growth.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, consider enough time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TSLA – Shares of Tesla have been on fire, up more than 20% over the past month. Investors are riding the positive stimulus news out of China and are turning their attention to the company’s Robotaxi event on October 10th.

BA – Boeing hit new 52-week lows on Monday and is under pressure again on Tuesday morning. While Boeing has faced a lot of negative headlines lately, the latest selloff may be around the strike, as the firm considers selling stock to replenish its cash position.

NKE – Nike will report earnings after the close and investors are closely watching the athletic apparel maker after the firm announced a new CEO last month. The management shakeup comes as the stock has been under severe pressure.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.