The Daily Breakdown looks at the end of the third quarter and previews what’s to come this week — including earnings from Nike.

Monday’s TLDR

- Monday marks the end of September and Q3

- The S&P 500 continues to knock out record highs

- Chinese stocks continue to rally

Weekly Outlook

Trading for this week will begin on the final day of September and the last day of Q3. Will we go into Q4 with a bang or a whimper?

The S&P 500 is up 20.2% so far this year and — fingers crossed — we’ve made it through spooky September and its volatile seasonality tendencies.

Tuesday marks the start of October and Q4. It’s also when we’ll get earnings from McCormick and Nike, as well as Eurozone CPI and the monthly JOLTs data (job openings) before the open. Given the focus on the labor market, the JOLTs data will be closely watched.

On Wednesday, Levi’s and ConAgra will report earnings.

On Thursday, we’ll get ISM and PMI data, as well as earnings from Constellation Brands, but the main focus this week will be on Friday.

That’s when we’ll get the monthly jobs report. Investors have gone from worrying about inflation to worrying about the US labor market in just a couple of months. This is the biggest report for the labor market in any given month, so a lot of emphasis will be put on it.

Plus, it will hold sway on whether the bond market will start pricing in a 25 or 50 basis point cut at the Fed’s next meeting in November.

Want to receive these insights straight to your inbox?

The setup — SPY

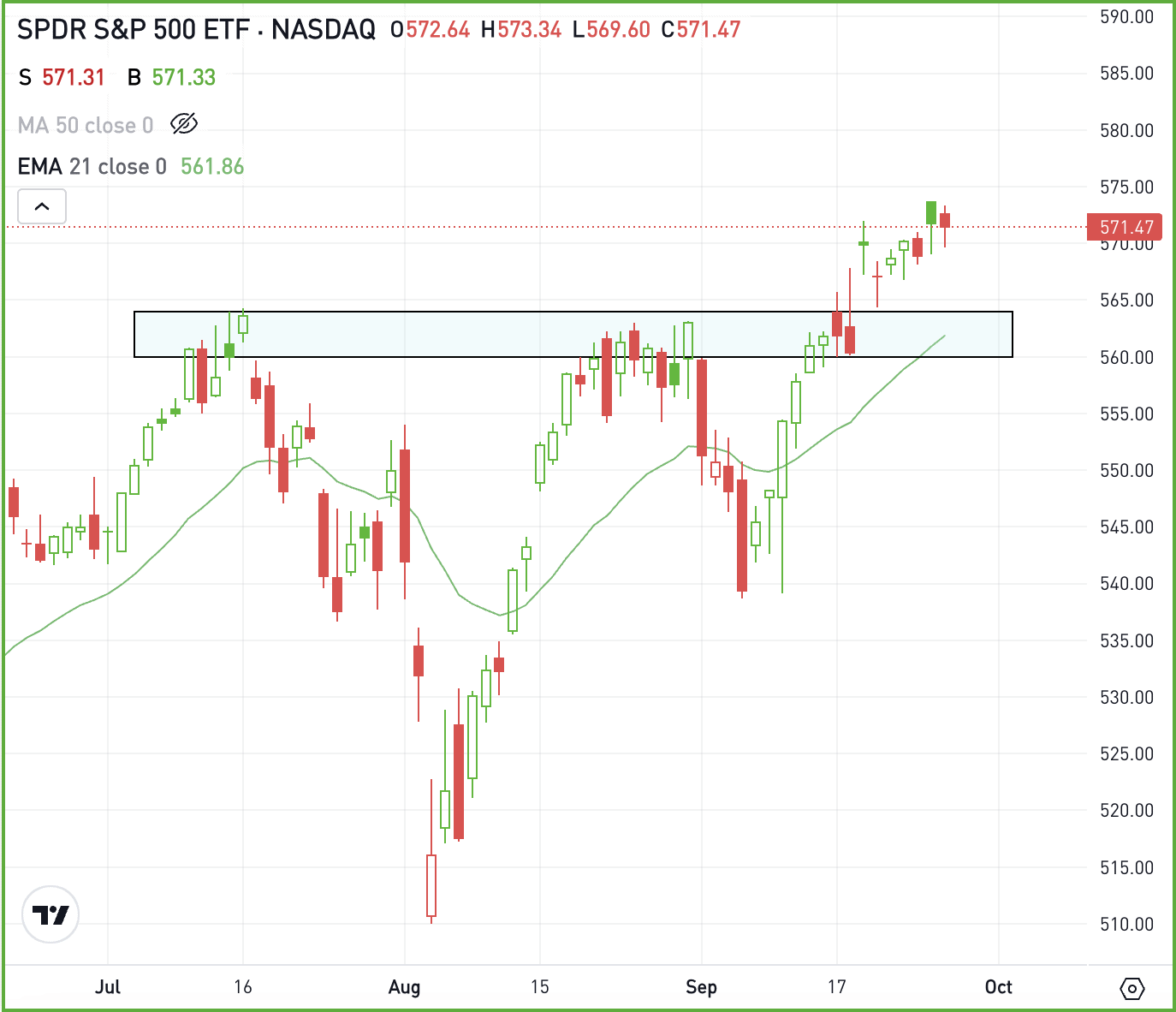

Some investors may feel left behind as the S&P 500 ETF continues to grind out new highs. If that’s the case, a pullback may serve as an opportunity.

Specifically, I’m watching the $560 to $564 zone, which was notable resistance in July and August before the SPY was able to break out earlier this month. A dip to this area may also see the 21-day moving average come into play, too.

If the SPY pulls back to this area and holds it as support, a rebound could ensue. However, a pullback to this zone that fails to hold could usher in more selling pressure.

Remember, earnings season kicks off in mid-October, while the US election is slated for early November.

Options

If SPY is going to remain in an uptrend, bulls will want to see these measures hold as support.

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock/put.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

FXI – The iShares China Large-Cap ETF has roared higher, as Chinese stocks like Alibaba, JD.com, PDD Holdings, Baidu, and others have soared in recent trading thanks to stimulus efforts from the country’s central bank. The FXI ETF gained more than 18% last week and is rallying again in Monday’s premarket session.

CVS – Shares of CVS rallied 4% on Friday and are up another 3% in premarket trading on Monday. The rally comes on hopes that activist investor Glenview Capital can help spur a turnaround for the struggling retailer.

MSFT – OpenAI anticipates a $5 billion loss this year on $3.7 billion in revenue, with a projected jump to $11.6 billion next year. The company, backed by Microsoft, is pursuing a funding round valuing it over $150 billion.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.