The Daily Breakdown takes a closer look at Starbucks stock, as well as the busy week of earnings that are up coming up.

Monday’s TLDR

- This week will be marked by earnings

- Starbucks CEO lifts sentiment

- Bitcoin’s big rally

Weekly Outlook

From an economic perspective, it’s going to be a pretty quiet week on Wall Street. That’s a good thing though, given that earnings season is really starting to heat up.

On Tuesday, we’ll hear from companies like General Electric, General Motors, Verizon, Enphase Energy and Texas Instruments.

Wednesday is a big day, with Boeing, AT&T, Coca-Cola and NextEra Energy reporting earnings in the morning. After the close, we’ll hear from companies like Tesla and IBM, among others.

On Thursday, American Airlines, UPS, Southwest Airlines, and Deckers will report earnings. Then on Friday, we’ll hear from companies like Wisdomtree and Colgate-Palmolive.

It’s not peak earnings season by any means, but we’re certainly seeing the calendar fill up. Coming into this week, we’ve only had about 14% of the S&P 500 report earnings so far, but 79% of those firms have beat earnings expectations, according to FactSet. Let’s see if that trend can continue.

Want to receive these insights straight to your inbox?

The setup — Starbucks

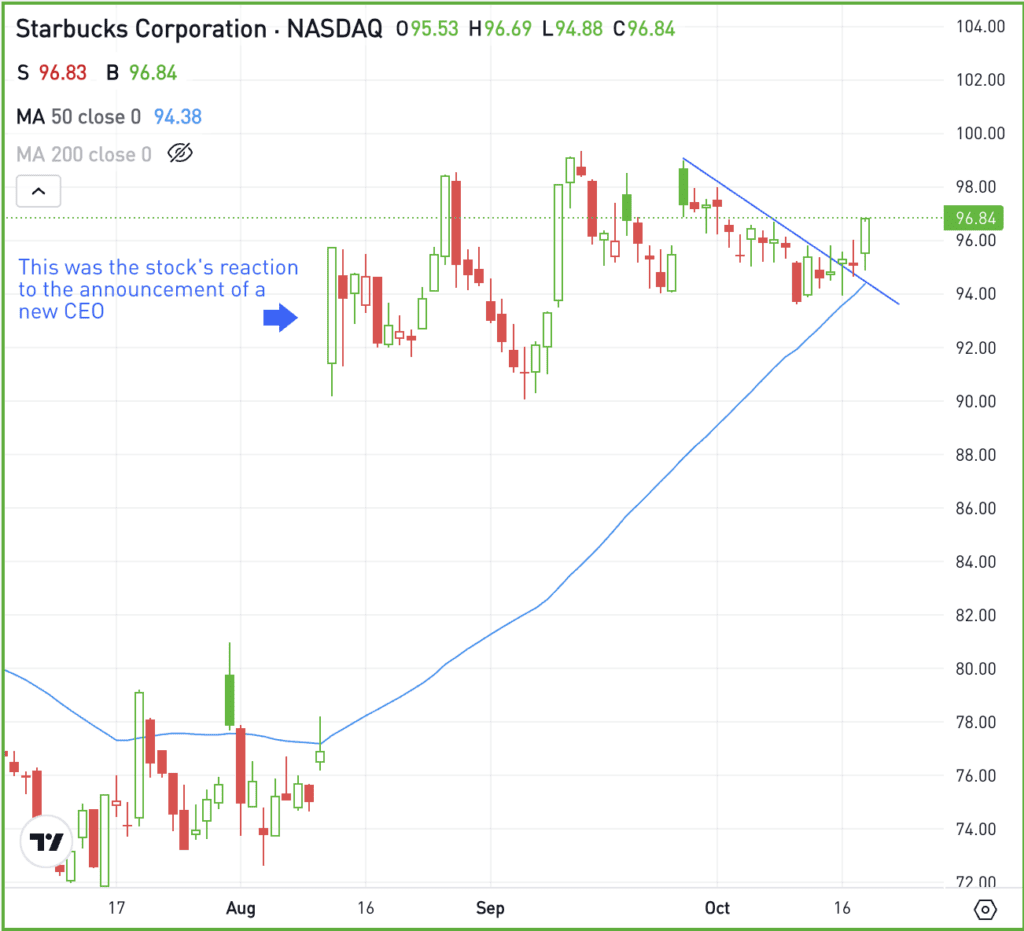

Starbucks hasn’t had a great year, only up about 1% so far in 2024. However, shares have done much better lately, up more than 30% from this year’s low after naming Brian Niccol as its new CEO. Niccol previously served as CEO of Chipotle.

Since that announcement, SBUX has been trading around in the $90s and recently rallied off the 50-day moving average.

The company will report its Q4 results on Wednesday October 30th. This could be a volatile time, too. If investors like what they hear from Niccol & Co., they could send the stock higher as it’s been consolidating its gains for several months.

However, if management takes this opportunity to reset expectations lower, then we could see SBUX give back some of its recent gains.

Options

For options traders, calls or call spreads are one way for investors to speculate on more upside, while puts or put spreads allow them to speculate on further downside (or allow bulls to hedge their long positions).

Using options around big events — like earnings — tends to be more expensive. However, one advantage is that the total risk of the trade is tied to the premium paid when buying options or option spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

NFLX – Shares of Netflix surged more than 11% on Friday, making new all-time highs in the process. The firm delivered a top- and bottom-line earnings beat, topped expectations for new subscriber growth, and issued better-than-expected guidance.

CVS – At one point, shares of CVS were down almost 10% on Friday, but ended the day down just over 5%. The decline comes after CEO Karen Lynch abruptly stepped down, paving the way for David Joyner. The company also said it expects earnings of $1.05 to $1.10 a share for Q3 — well below consensus expectations of $1.64 a share.

BTC – On Sunday, Bitcoin hit its highest price since late-July, as the top cryptocurrency by market cap continues its rally. BTC was up almost 10% over the last week and is trying to work out of a large consolidation pattern known as a “bull flag” pattern. Check out the chart.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.