The Daily Breakdown takes a closer look at small caps, after the Russell 2000 erupted more than 10% in the month of July.

Friday’s TLDR

- Small caps enjoyed a powerful July, rallying 10.1%

- Historically, this bodes well for the Russell 2000

- Bonds are breaking out over resistance

The Bottom Line + Daily Breakdown

Everyone’s talking about small caps after the Russell 2000 posted a 10.1% return for the month of July…and how could they not be? Gaining 10% in a year would typically mark a pretty good annual return, so to do it in a month is insane — although, not unheard of.

Going back to 1979, there’s now been 21 instances where the Russell has generated a monthly return of 10% or more. In 18 of the other 20 instances, the Russell 2000 was higher 90% of the time six months later with an average return of 11.4%.

Admittedly, the 12-month mark has a less-impressive but still respectable winning percentage, up 14 of the prior 19 measurable instances (~74%) with an average return of 15.6%.

Can the rally continue?

To keep the gains coming, the Russell 2000 needs more than just a good month of gains — it needs a catalyst.

Right now, that catalyst is a rate cut from the Fed. Earlier this week, Powell all but said the Fed plans to cut rates this quarter provided that there’s not a big increase in inflation between now and the next Fed meeting in September.

The risk: Rate cuts matter, but they’re not the only thing that matters. They help small cap companies because they are typically more reliant on borrowing costs than well-established mega-cap firms. However, if the economy takes a hit, these stocks can too.

If small caps do well, will large caps do bad?

While the Russell put together a 10.1% gain in July, the S&P 500 climbed just 1.1%, while the Nasdaq 100 fell 1.6%. It’s been hard to argue about the profit-taking in tech and the rotation into small caps.

Will this rotation last forever?

“No” is the short answer, but it’s more complicated than that.

First, it’s healthy to see broadening leadership in the market. Remember when 10 out of the 11 S&P 500 sectors were positive in Q1? That wasn’t a bad thing for tech, even though investors were finally able to lean on stocks aside from the Magnificent 7. That quarter, the S&P 500 rose more than 10%.

In other words, it’s possible for small caps and mega-cap tech to both do well…which brings me to my second point.

At some point the rotation out of mega-cap tech will stop, mostly because these are the most popular names in the market. And more than popularity, these are some of the best businesses in the world, many of which boast steady growth, robust balance sheets, and massive cash flows.

The bottom line: Keep an eye on the current rotation and small caps through the second half of 2024.

Want to receive these insights straight to your inbox?

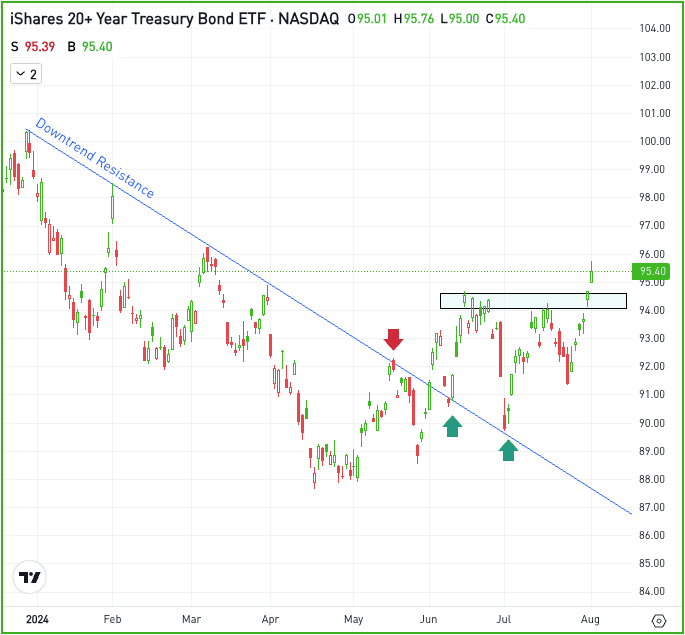

The setup — TLT

Yesterday, the 10-year yield closed below 4% for the first time since early February. Since bonds and yields have an inverse relationship — meaning one goes up and the other goes down — bond prices are the move higher.

As the bond market begins to price in the likelihood of lower interest rates from the Fed, yields are coming down and bonds are going up.

Take a look at the TLT, the most traded long-term government bond ETF.

TLT is breaking out over recent resistance near $95. As long as it can stay above this level, it’s possible that bulls can maintain momentum. If that’s the case, the ETF could potentially rally back to the one-year highs near $100.

However, a break back below $95 could sap that momentum and possibly open the door back down to the 200-day moving average — and potentially lower.

Options

For some investors, options could be one alternative to speculate on TLT. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and TLT rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.