The Daily Breakdown looks at semiconductor stocks like AMD and Nvidia, which have been trading pretty well over the last few days.

Tuesday’s TLDR

- Stocks waver after Friday’s rally

- But semiconductors held up well

- PepsiCo reports mixed earnings

What’s happening?

Stocks ended last week on a high note, but started this week under selling pressure. The S&P 500 slipped about 1%, while the Nasdaq 100 fell 1.2%. Even Bitcoin couldn’t hold onto its gains after rising 2.6% at one point.

However, one group that did hold up? Semiconductors.

The VanEck Semiconductor ETF (SMH) eked out a 0.2% gain yesterday, and while that stat may not turn many heads, the ETF was able to notch its fourth straight daily gain.

In other words, semiconductor stocks are starting to show some strength. Both the tech sector and the SMH topped out in July, but given the leadership role that semiconductors have had amid this bull run, it could be a good sign to see semiconductors outperforming lately — even if it’s only a few sessions so far.

Nvidia makes up roughly 20% of the SMH ETF, followed by a 7.9% weighting for Broadcom and a 5.4% weighting for Advanced Micro Devices — a roughly 33% weighting for the top three holdings.

Applied Materials and Qualcomm round out the top five holdings, which account for weightings of 4.6% and 4.2%, respectively.

Want to receive these insights straight to your inbox?

The setup — CHTR

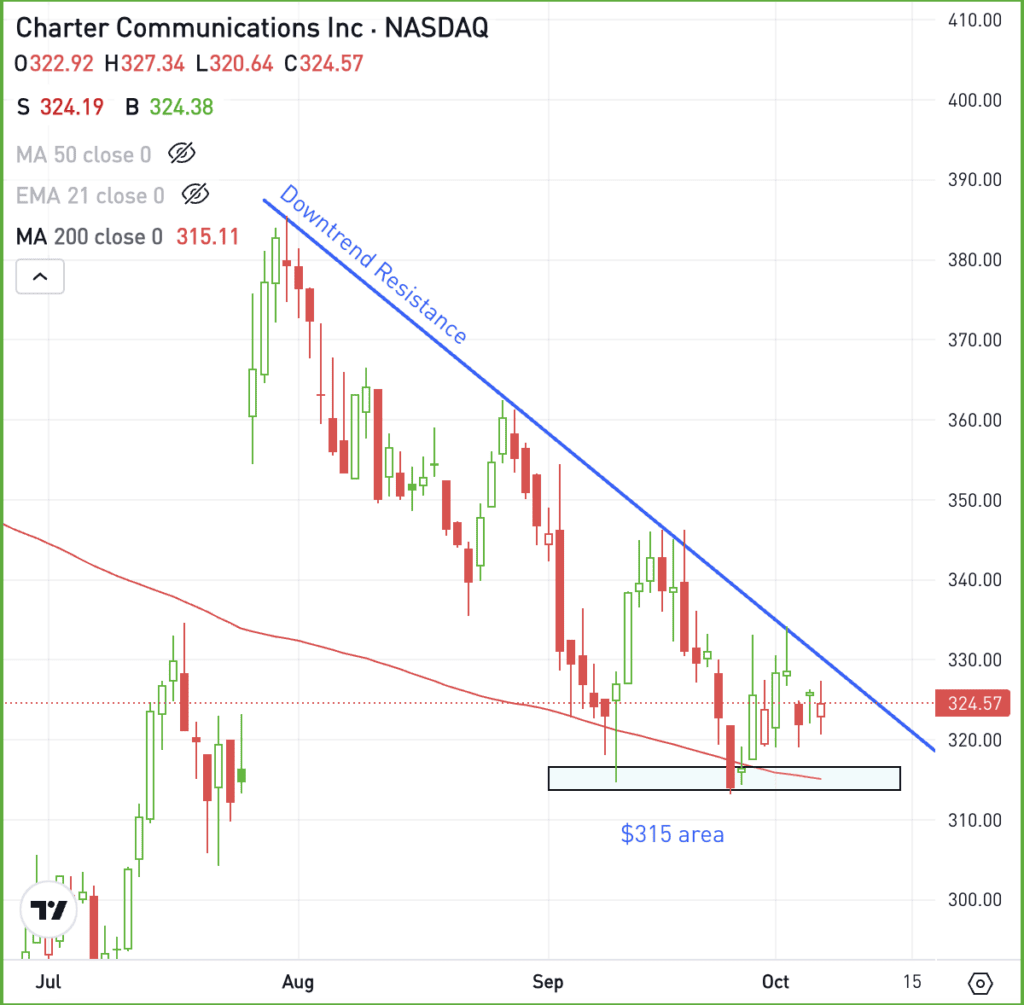

Charter Communications has not had a great year, with the stock down more than 16% so far in 2024. However, shares have been showing some promise when it comes to the chart.

That’s as the stock continues to trade above the 200-day moving average. More recently, the $315 level has been acting as support as shares work to clear downtrend resistance:

If shares can stay above the $315 area, bulls may hope for an eventual breakout over downtrend resistance, which could help fuel a Q4 rally. However, if the stock breaks below $315 and the 200-day moving average, more selling pressure could ensue.

Although sales growth forecasts are basically flat for 2024, analysts expect 11.5% earnings growth this year — including Q3 earnings growth of 5% and Q4 earnings growth of 27.8%. The stock trades at just under 10 times earnings, making it a potentially attractive name for value investors.

What Wall Street is watching

PEP – Shares of PepsiCo are slightly lower in pre-market trading after the firm reported mixed Q3 results. While earnings of $2.31 a share beat expectations of $2.29 a share, revenue of $23.32 billion missed expectations by $460 million. The company also had to trim its full-year organic growth outlook.

AMZN – Amazon tumbled on Monday, falling over 3% after an analyst downgrade. That’s as Wells Fargo downgraded Amazon to equal weight from overweight citing concerns over profit margins. Shares are now 10% below its July high. Check out the chart.

SMCI – Super Micro Computer had its best day in months, rallying more than 15% on Monday. The rally came after the company said it had deployed more than 100,000 GPUs with liquid cooling solution. Despite the jump, the stock remains more than 60% below its 52-week high from March. It closed at $47.74, with the all-time high set at $122.90.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.