The Daily Breakdown takes a closer look at PepsiCo stock as shares try to break out over recent resistance.

Tuesday’s TLDR

- The S&P 500 is about 1% from all-time highs.

- PepsiCo breaks out over resistance. Can it keep rallying?

- Palo Alto Networks delivers an earnings beat.

What’s happening?

What a rebound it has been. Two weeks ago, we were on the verge of a 10% correction in the S&P 500. Now, the index is just 1.1% away from its all-time high.

Remember, the S&P 500 is weighted by market cap, so the largest companies have a bigger impact. However, when we look at the equal-weighted S&P 500 index — many investors use the ticker symbol “RSP” — it’s only down 0.6% from the highs.

This shows that market breadth is strong and that it’s not just a handful of mega cap stocks doing the heavy lifting, but multiple sectors are pitching in.

In fact, of the 11 S&P 500 sectors, 7 of them have generated a double-digit return so far this year. Of those seven, four sectors are up 16% or more in 2024. Lastly, all 11 sectors are higher this year, with the worst performer (consumer discretionary) still up 3.7% year to date.

All of this is to say that we’re in a bull market until proven otherwise. If the last pullback had you sweating bullets, maybe now — after a big rebound — is a good time to go over your investment objectives and risk tolerance.

Want to receive these insights straight to your inbox?

The setup — PEP

Yesterday we looked at dividend champ Johnson & Johnson. Today we look at PepsiCo, which has not only paid but has raised its annual dividend payout for more than 50 consecutive years.

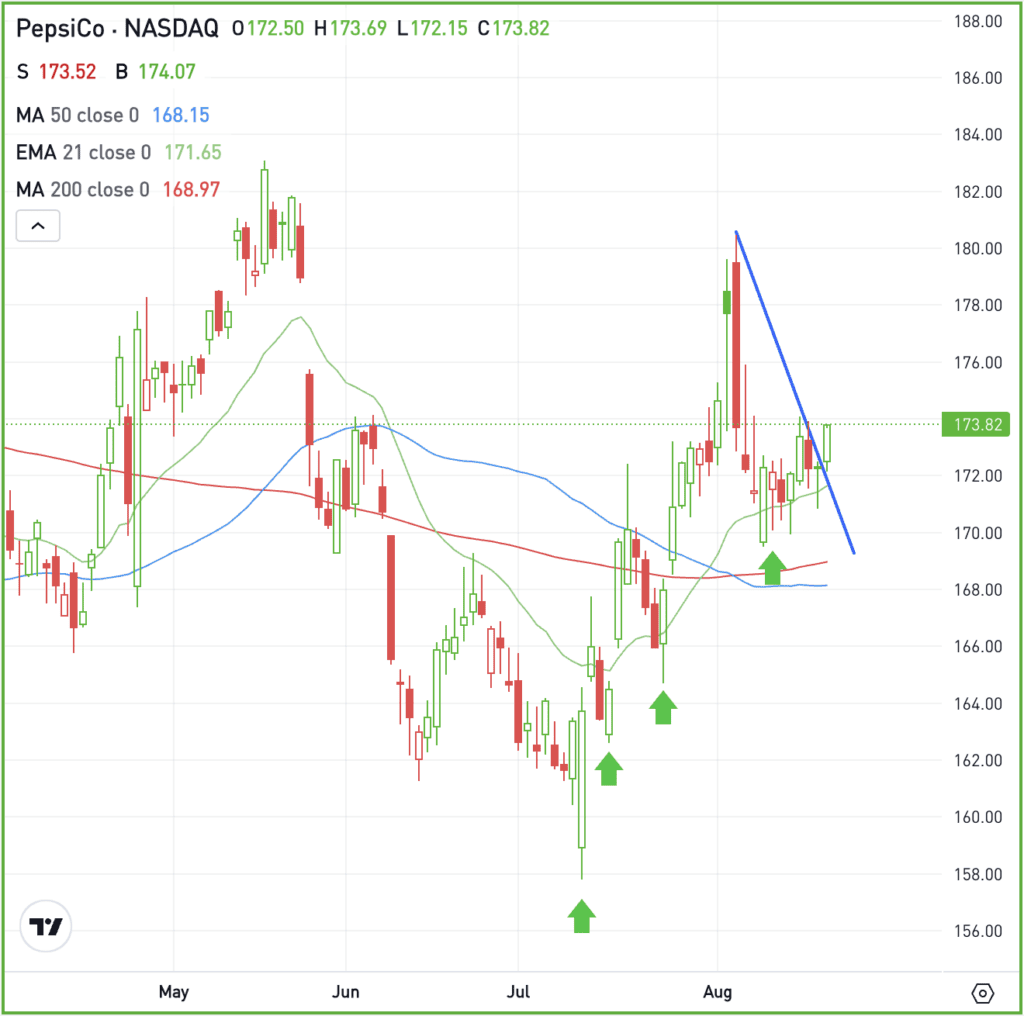

The stock has recently regained all of its daily moving averages and has been putting in a series of higher lows (illustrated on the chart with green arrows). Now PEP is clearing downtrend resistance, too.

If the stock can maintain momentum, perhaps it can make another charge back up toward the recent highs around $180.

Conversely, active investors will want to see PepsiCo stay above the $168 to $170 area. If it breaks below that zone, it will drop below the recent low, as well as the 50-day and 200-day moving averages. It will also lose the recent momentum from the breakout.

For fundamental investors, PepsiCo currently pays a 3.1% dividend yield, is expected to grow this year’s earnings about 7%, and trades at roughly 20 times forward earnings expectations.

Options

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and PEP rolling over.

Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

USO — Oil extended its decline as the US announced Israel’s acceptance of a Hamas cease-fire proposal, potentially reducing supply risks. Brent crude dipped toward $77 a barrel, while WTI fell below $74. Secretary Blinken noted Hamas must still agree for de-escalation.

PANW — Palo Alto Networks reported stronger-than-expected Q4 earnings, with revenue up 12% to $2.18 billion, surpassing estimates. CEO Nikesh Arora credited “strong execution” of their platform strategy. Full-year revenue and profit also exceeded expectations, reflecting growth and innovation plans for 2025.

DXY — The US dollar index hit a seven-month low, its lowest level since early January. It’s now down more than 2% so far this month and has fallen in six of the last seven weeks. The decline comes as investors continue to speculate on a coming rate cut from the Fed.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.