The Daily Breakdown looks at the stock market after Fed Chair Jerome Powell’s comments over the weekend, plus McDonald’s potential breakout.

Monday’s TLDR

- It’s another busy week of earnings.

- McDonald’s faces key resistance.

- Palantir reports earnings tonight, Eli Lilly reports tomorrow.

What’s happening?

The S&P 500 finished higher last week, which was no easy feat with earnings, the Fed, and the big jobs report on Friday. The index is now up in 13 of the 14 last weeks.

This week is quieter on the economic front, but remains busy when it comes to earnings.

McDonald’s reported this morning and Eli Lilly reports tomorrow morning. Then Snap, Ford, PayPal, Disney, and PepsiCo are among those that round out the week.

In an interview aired over the weekend, Fed Chair Jerome Powell reiterated the low likelihood of cutting interest rates in March. Further, he said he doesn’t expect a dramatic change in the Fed’s prior forecast for 2024, which called for roughly three rate cuts in 2024.

Prior to last week, the market had been pricing in five to six rate cuts this year.

As of Monday morning, Powell’s comments don’t seem to be weighing on stocks all that much, although bonds are under pressure to start the week.

Want to receive these insights straight to your inbox?

The setup

McDonald’s reported its Q4 results this morning, delivering an earnings beat despite a small revenue miss.

Even with mixed results, McDonald’s stock is bouncing between pre-market gains and losses. In other words, investors haven’t decided how they feel about the quarter yet.

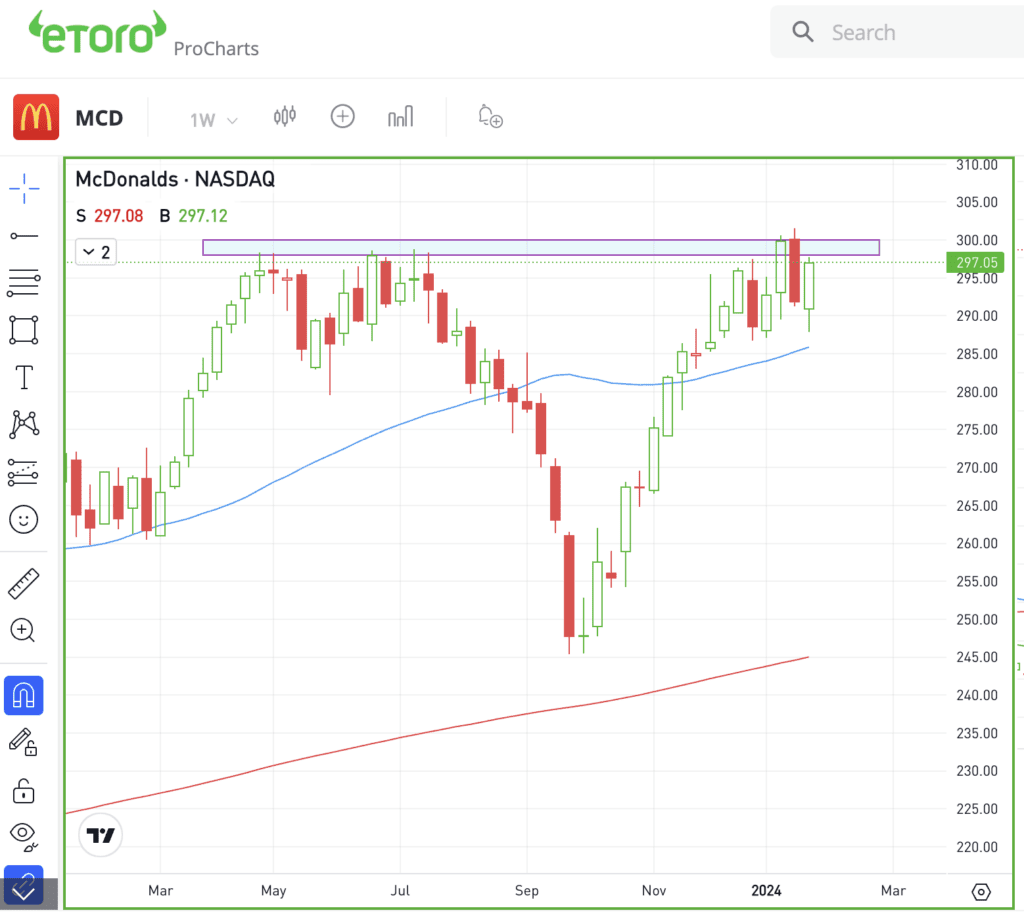

As investors digest the results, keep an eye on the $300 level, which has been resistance since May.

The stock momentarily poked above this level last month — hitting an all-time high of $302.39 — but then faded back below $300.

It would be meaningful if the stock broke out over this level and cleared last month’s high. That said, I wouldn’t be surprised if $300 remains resistance and McDonald’s needs more time to clear this level.

And by the way, that’s okay if it needs more time.

While shares are roughly flat over the last nine months, McDonald’s is up more than 20% from the October low.

But keep an eye on $300. An eventual breakout over that mark is significant and could point to more upside.

What Wall Street is watching

RACE: Ferrari surpassed Q4 earnings expectations and achieved 17% revenue growth on its way to celebrating a record year in 2023. Management remains confident in the future and provided a strong outlook for the year ahead. Shares rallied 11.5% last week to new record highs.

CHTR: Shares of Charter plunged on Friday after the company reported disappointing quarterly results. Earnings of $7.07 per share missed expectations of $8.76 a share, while revenue grew just 0.3% year over year. Despite the fall, shares narrowly avoided making fresh 52-week lows.

PLTR: Palantir will report its Q4 results after the close. Investors will be focused on the company’s commercial division, and will be hoping for a promising full-year outlook. Shares are flat year to date and down about 10% over the last three months. However, the stock has more than doubled over the past 12 months.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.