The Daily Breakdown takes a closer look at gold, as the precious metal continues to climb toward new all-time highs amid uncertainty.

Wednesday’s TLDR

- Big reports on tap with CPI and retail sales.

- Gold has shined in 2024, up 21%.

- SBUX surges 24.5% on CEO shakeup.

What’s happening?

By Thursday afternoon, we’ll have a better idea of how consumers are doing.

The retail sales figure will be released on Thursday morning at 8:30 a.m. ET, but we’ll also get earnings from Walmart before the markets open. We heard from Home Depot yesterday, with management noting that consumers have been more sensitive to economic uncertainty and are deferring larger projects.

Will Walmart tell a similar story or will the retailer — which recently hit all-time highs — paint a brighter picture?

Home projects are obviously different from buying a new TV or groceries, but hearing from retailers will help give some clarity on how the consumer is really doing.

If you’re curious about consumers in China, both Alibaba and JD.com will report earnings on Thursday morning as well.

As for today, the main focus is the CPI report, due up before the open. The report will provide the latest update on inflation. While this report could create a bit of volatility, it’s unlikely to deter the Fed from cutting rates in September — so long as it doesn’t come in wildly above expectations.

Want to receive these insights straight to your inbox?

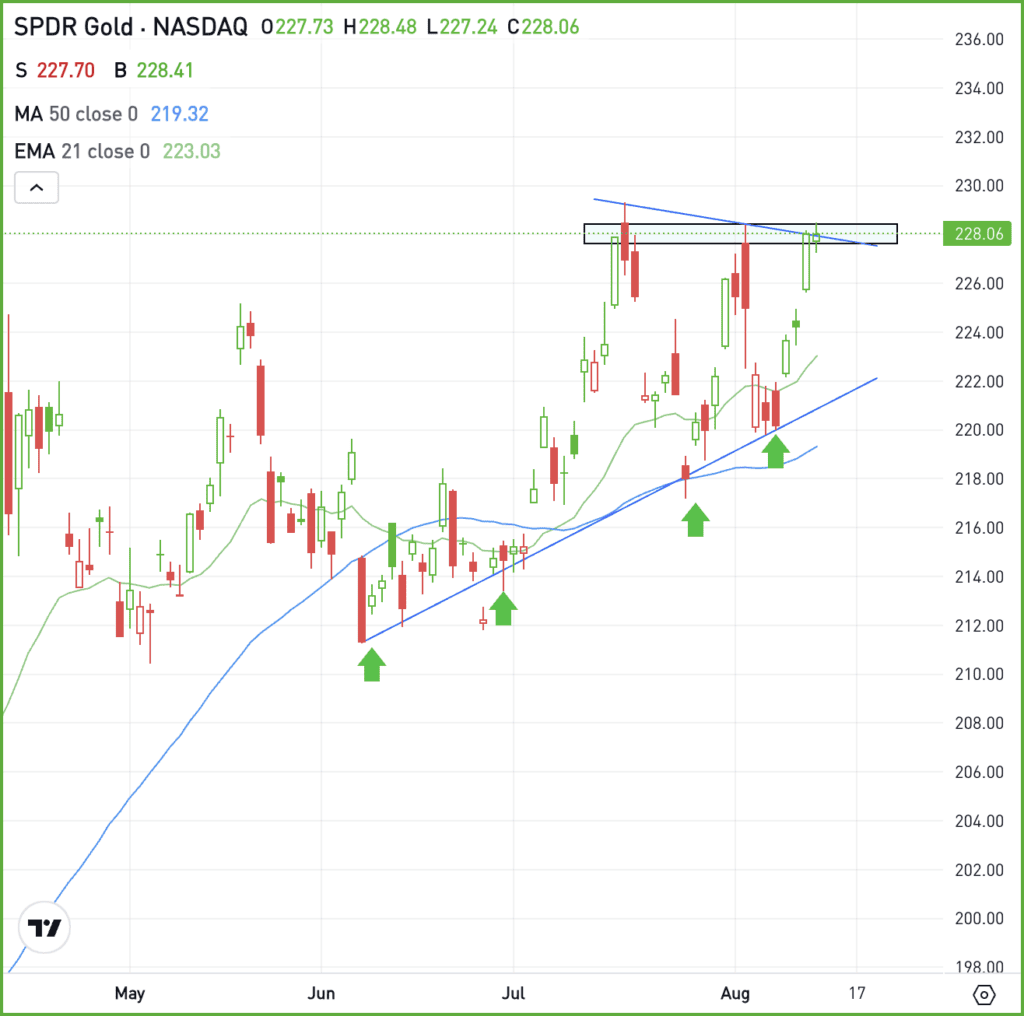

The setup — GLD

Gold prices have been shining this year, up more than 21% so far in 2024.

Despite the recent volatility, gold is knocking on the door of new all-time highs, as spot prices hover near $2,500 an ounce.

The largest gold ETF — the GLD — has traded higher in five of seven months so far this year, and is up in eight of the last ten months. The only two monthly declines in that stretch were a 1.4% fall in January and a 0.1% decline in June.

The GLD has been stalling in the $225 to $228 region for the last few months. If it can clear the recent highs, more bullish momentum could ensue. On the downside, notice how each pullback makes a low higher than the previous pullback (the green arrows on the chart). That’s a healthy trend. If GLD pulls back and support doesn’t hold though, more selling pressure could ensue.

Fundamentally, gold acts as a “safe-haven” asset, particularly when volatility and geopolitical issues heat up. For instance, notice how well it’s held up this month. Further, gold tends to do well in lower-rates environments, so a decline in interest rates could bode well for it.

Options

Options could be an alternative for investors who want exposure to GLD. Remember the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and GLD rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

SBUX — Shares of Starbucks erupted on Tuesday, climbing nearly 25% after naming Brian Niccol CEO and Chairman. Niccol has been serving as the CEO of Chipotle Mexican Grill since 2018 and as Chairman since 2020. SBUX shareholders are applauding the move given Chipotle’s success under Niccol’s leadership.

JBLU — JetBlue stock remains pressured after plunging over 20% on Monday, its largest drop ever. The decline followed a plan to raise over $3 billion in debt, mainly backed by its TrueBlue loyalty program, leading to a credit downgrade by major rating agencies.

GOOG — According to reports, the Justice Department could be weighing a breakup of Alphabet. The DoJ recently won a big case against Google and its search business, and if it chooses to pursue a breakup, it would be the first attempt to do so against what it deems a monopoly since Microsoft in the early 2000s.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.