The Daily Breakdown looks at what “triple witch” expiration means and how it can impact traders. We also look at the rally in gold.

Friday’s TLDR

- Triple witch expiration is today.

- This type of expiration day happens just four times a year.

- Gold tries to add to its 2024 gains with a recent breakout.

The Bottom Line + The Daily Breakdown

On the third Friday of a typical month, investors can look toward the monthly expiration for stock options and stock index options. However, this Friday is more unique. That’s as it’s a “triple witching” Friday.

Four times a year — specifically in March, June, September, and December — there’s also a third expiration to watch for. That’s as index futures expire as well.

To make it a little less confusing, let’s look at the S&P 500 for example. Options will expire on the:

- SPY ETF — stock options

- S&P 500 index (or ticker SPX) — index options

- S&P 500 futures contracts (which trades under the symbol “ES” on the Chicago Mercantile Exchange).

So why does this matter? For long-term investors who don’t pay much attention to the market, triple-witch expirations don’t really matter. However, for active investors, it’s definitely worth keeping on your radar.

How it works

Most retail investors trade stocks, crypto, and options. However, large institutions are big players in the options and futures market, and given the amount of leverage tied to these products, it can make big waves in the underlying asset.

As expiration approaches, these firms are forced to buy back their short positions, sell their long positions, exercise their options, and/or consider rolling their positions forward.

By “rolling,” I mean keeping a similar position, but extending the length of the trade. Say someone is long the SPY $500 calls and they’re sitting on big gains ahead of Friday’s expiration. They can either: Sell the position for a profit, exercise the option to take ownership of the common stock, or “roll” it by selling the option and buying more SPY call options with a later expiration date.

Volume and volatility

All of this activity creates a lot of volume — and potentially volatility. As these larger investors make their moves, the underlying stocks can move in unpredictable and erratic ways. It can also take a few days or weeks to see how those investors reposition their portfolios.

It’s no surprise than when you look at a chart like the SPY, many of its highest-volume sessions come on triple witch expiration dates.

Want to receive these insights straight to your inbox?

The setup — GLD

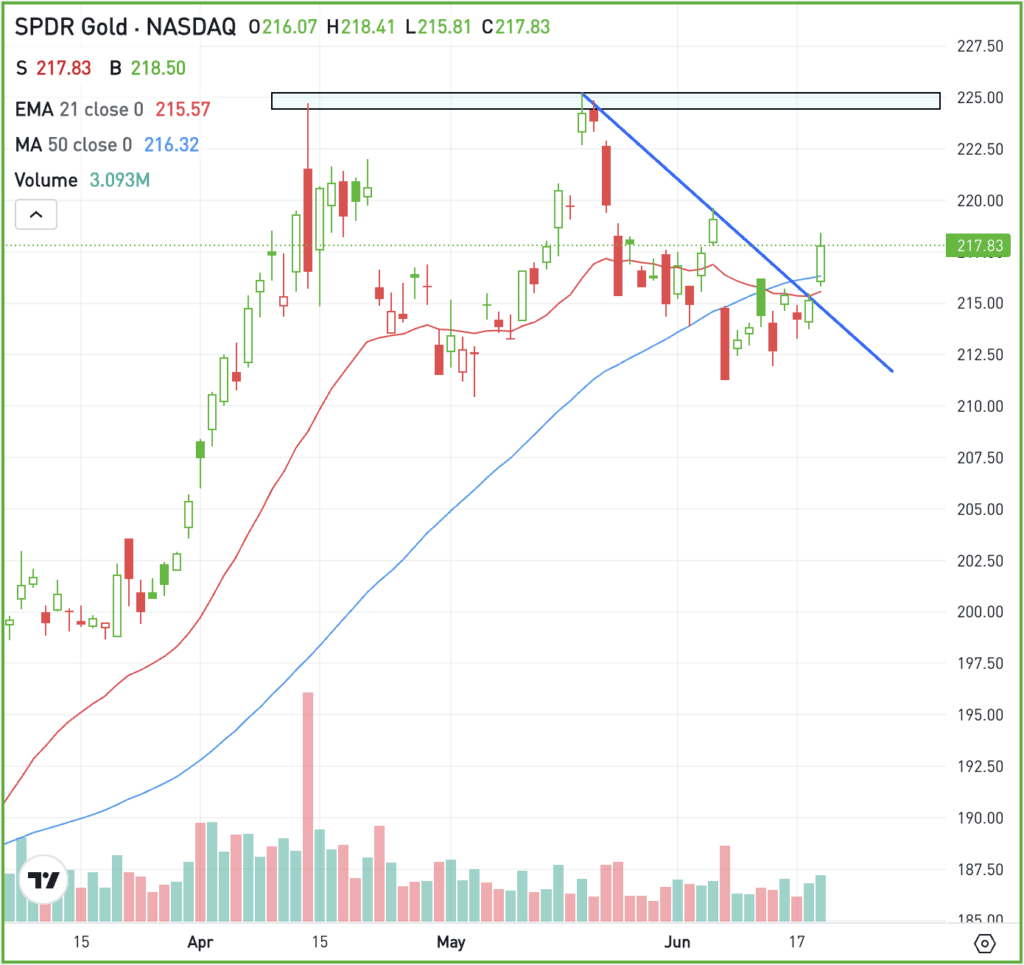

Precious metals have been trading better lately and that’s clear when looking at the GLD and SLV ETFs.

Looking specifically at the GLD, the recent rally has bulls hopeful for more upside. That’s as it regains its key moving averages like the 21-day and 50-day, as well as clears downtrend resistance.

Gold has performed pretty well on the year, with the ETF up 14.1% so far in 2024. Investors are looking at moderate inflation and the potential for lower interest rates as positive catalysts, alongside gold’s industrial use (and use in AI chips).

If GLD can continue higher, bulls will likely focus on the recent highs near $225. However, if the current rally gets derailed and GLD breaks below the recent low near $213.75, support just above $210 will be back in focus.

Options

Options could be an alternative for investors who want exposure to GLD, but are nervous to get long. Remember the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and GLD rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.