Bitcoin is making new all-time highs. Can Ethereum follow its lead and make new highs as well? The Daily Breakdown digs in.

Monday’s TLDR

- Earnings continue to roll in

- Ethereum is back above $3,000

- Bitcoin clears $80,000

Weekly Outlook

When we wrote last week’s outlook, we hadn’t seen the election results or heard from the Fed yet. Those events feel like they happened a month ago, but here we are a few days later previewing this week.

The S&P 500, Nasdaq, Bitcoin and others come into the week with plenty of momentum with all three at record highs. That will be the focus on Monday, which should be a quiet session in regards to earnings and economic reports.

That changes Tuesday, with companies like Home Depot, Shopify, and Spotify reporting earnings.

On Wednesday, the monthly inflation report will hit when the CPI report is released at 8:30 a.m. ET.

On Thursday, companies like Disney and Applied Materials will report earnings. Then on Friday, we’ll check in on the consumer when the retail sales report is released at 8:30 a.m. ET, along with Alibaba reporting earnings before the open.

Want to receive these insights straight to your inbox?

The setup — Ethereum

We’ve talked about Bitcoin a lot (and that’s not surprising with it at all-time highs). But what about Ethereum?

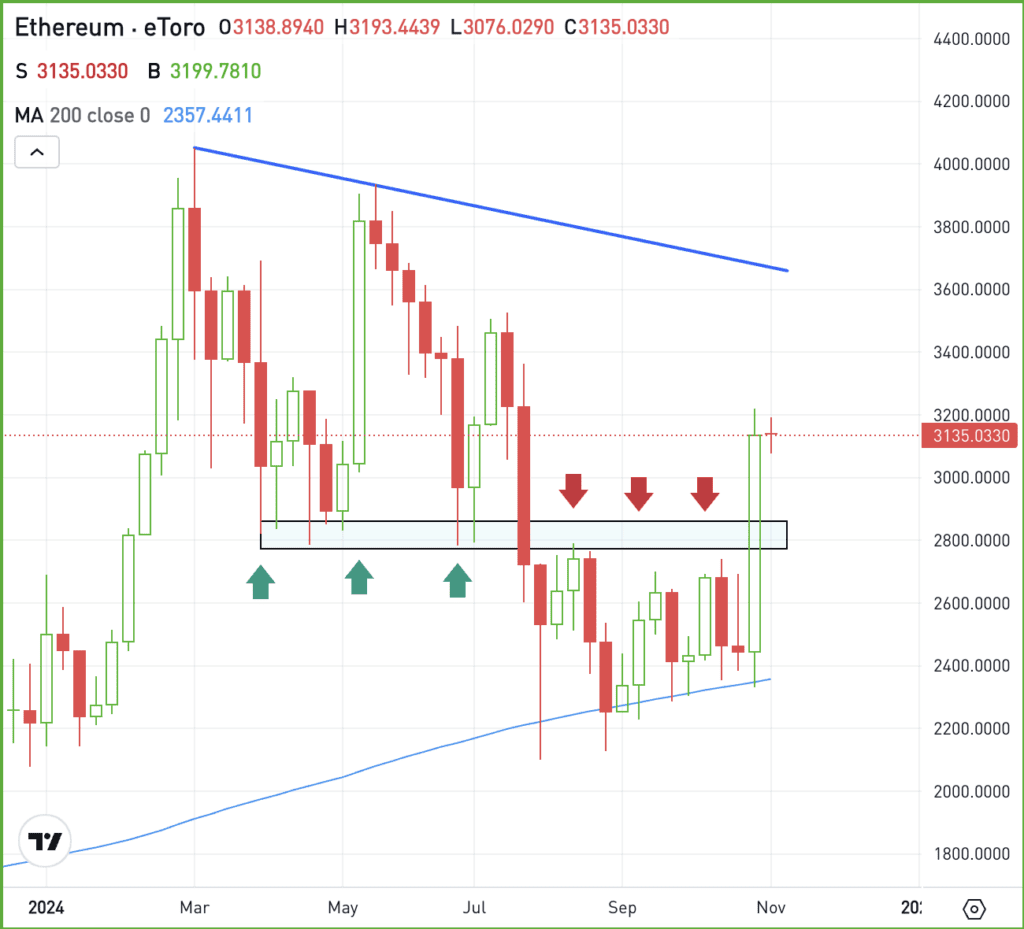

ETH surged higher at the start of the year, briefly clearing the $4,000 mark before falling down toward $2,200. If you notice on the chart below, the $2,750 area was critical.

First it served as support until the summer, before it ultimately failed and then turned into resistance:

Now Ethereum is back above this key mark and has even regained $3,000.

If ETH can stay above $2,750, the bullish momentum could continue. However, if Ethereum drops back below that mark, a retest of the 200-week moving average — which has been key support this year — could be retested.

What Wall Street is watching

TSLA – Shares of Tesla have been on fire, roaring higher by 31.3% last week. CEO Elon Musk’s association with president-elect Donald Trump is certainly giving the stock some momentum. Shares are rallying again in pre-market trading, up almost 7% as TSLA is set to hit fresh 52-week highs on the open.

BTC – Bitcoin is on fire too. The top cryptocurrency by market cap cleared the $80,000 level over the weekend, its latest hurdle as it continues to hit record highs. Now trading near $82,000, some investors will start wondering if and when it can get to the key $100,000 mark.

IWM – While the other major US stock indices have notched record highs, the Russell 2000 has yet to do so. However, small caps continue to do quite well. The IWM ETF gained about 9% last week and is up another 1% in pre-market trading — easily outpacing the S&P 500. This morning’s rally has the IWM within a stone’s throw of new record highs.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.