The Daily Breakdown looks at the earnings bounce in Tesla, as well as the leadership from the energy sector.

Wednesday’s TLDR

- Oversold bounce continues for the S&P 500.

- Meta, Ford set to report earnings tonight.

- Tesla pops despite earnings miss.

What’s happening?

The S&P 500 rallied 1.2%, the Nasdaq 100 climbed 1.5%, and the Russell 2000 jumped 1.8% on Tuesday.

The rally was a continuation from Monday, as the S&P 500 is now up 2.1% so far this week. Some might have argued that the index was due for a bounce after enduring a six-day losing streak.

When we get a quick correction in the stock market — and currently, that’s the main focus right now — it can be easy to forget just how far we’ve come in a short period of time. Remember, we rallied more than 28% off the October low to the recent high as the S&P 500 rallied in five straight months.

With that perspective, a mild dip made sense.

However, it’s fair to wonder just how big of a bounce we might see. Is this just an oversold bounce that will run out of steam or will this be the dip that helps set up the next move higher?

To answer that question, it may come down to earnings.

The post-earnings reaction in Tesla was strong, but we have plenty more reports to get through this week. Most immediately, we have names like Boeing and AT&T reporting this morning, then Meta, Ford, IBM, and Chipotle reporting after the close, among others.

Want to receive these insights straight to your inbox?

The setup — XLE

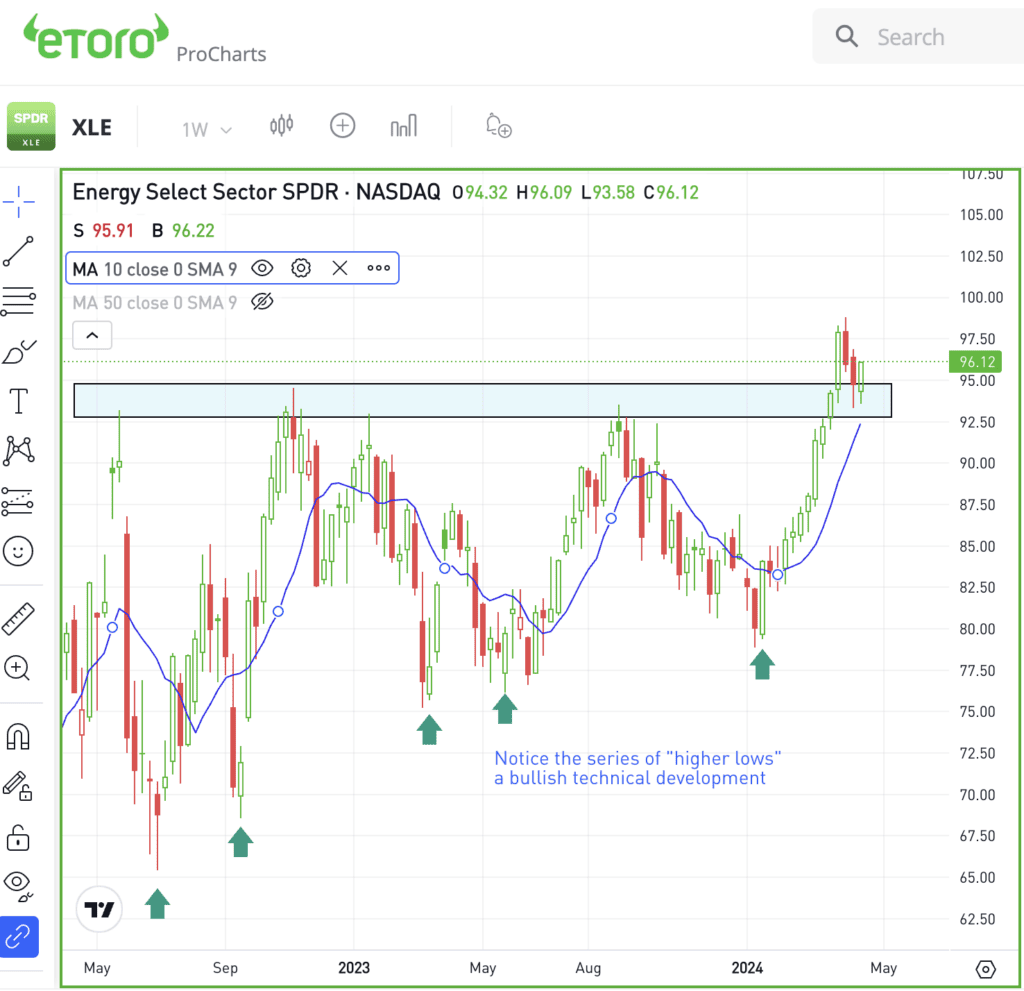

Over the past month, we’ve spent some time talking about the energy sector, the best-performing sector in the S&P 500 so far this year.

Earlier this month, the energy sector ETF — the XLE — underwent a major breakout, sending the ETF to new 52-week highs. Now, it’s pulling back into the zone that had acted as multi-year resistance.

On the weekly chart below, notice how the $92 to $93 area had been resistance since mid-2022.

As long as the XLE stays above this $92 to $93 zone, it’s hard to get too bearish on energy stocks.

One risk? The two largest stocks in the ETF — Exxon Mobil and Chevron — command a weighting of about 40%. In other words, how these two stocks perform can have an unexpectedly large impact on the XLE.

That can be both good or bad. By the way, both companies report earnings on Friday morning. That’s certainly something for investors to keep in mind.

What Wall Street is watching

TSLA — Shares of Tesla are popping in pre-market trading, up about 12% as of 8:00 a.m. ET. The rally comes despite the automaker missing both earnings and revenue estimates. However, CEO Elon Musk spoke positively about the future, including the use of autonomous vehicles.

GM — Elsewhere in the auto space, General Motors reported strong Q1 earnings of $2.62 a share, easily beating expectations of $2.11 a share. Revenue of $43 billion grew 7.5% year over year and topped analysts’ expectations, while management raised its full-year profit outlook.

GE — General Electric shares have been on fire this year and are now up 60% year to date after the stock climbed to new 52-week highs on Tuesday. The rally was spurred by strong Q1 results, including a top- and bottom-line beat of earnings and revenue.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.