Bitcoin is helping lead the recent rally in crypto and The Daily Breakdown takes a closer look to see if the rally can continue.

Tuesday’s TLDR

- Earnings, elections, and the Fed loom

- Bitcoin, stocks enjoy strong rally

- Boeing looks for capital boost

What’s happening?

A month from now will land us in mid-November. At that time, we’ll look back and have been through a significant portion of earnings season, the US election, and the Fed’s next interest rate decision.

In between will be other events too, like a monthly jobs report and the Fed’s preferred inflation gauge — the PCE report.

Those are a lot of events and topics to unpack in just a couple of weeks. Yet despite the potential calamity that could stem from one (or a combination) of these events, markets continue to chug higher.

The S&P 500 and Dow surged to another all-time high on Monday, while the Nasdaq 100 is within a stone’s throw of making its first new high since mid-July. Bitcoin and Ethereum both jumped more than 5% on Monday too.

It’s a great example of the markets “tuning out the noise.” When we look at the positives — a solid economy, strong earnings growth, and easing fiscal policy from the Fed — it’s easier to see why asset prices continue to push higher despite what appears to be a minefield just ahead.

For some investors, hedging or locking in some profits could make sense with stocks near their highs. But for many others, sticking with their current investment plan has got them this far and they may not see a need to change things up.

Want to receive these insights straight to your inbox?

The setup — Bitcoin

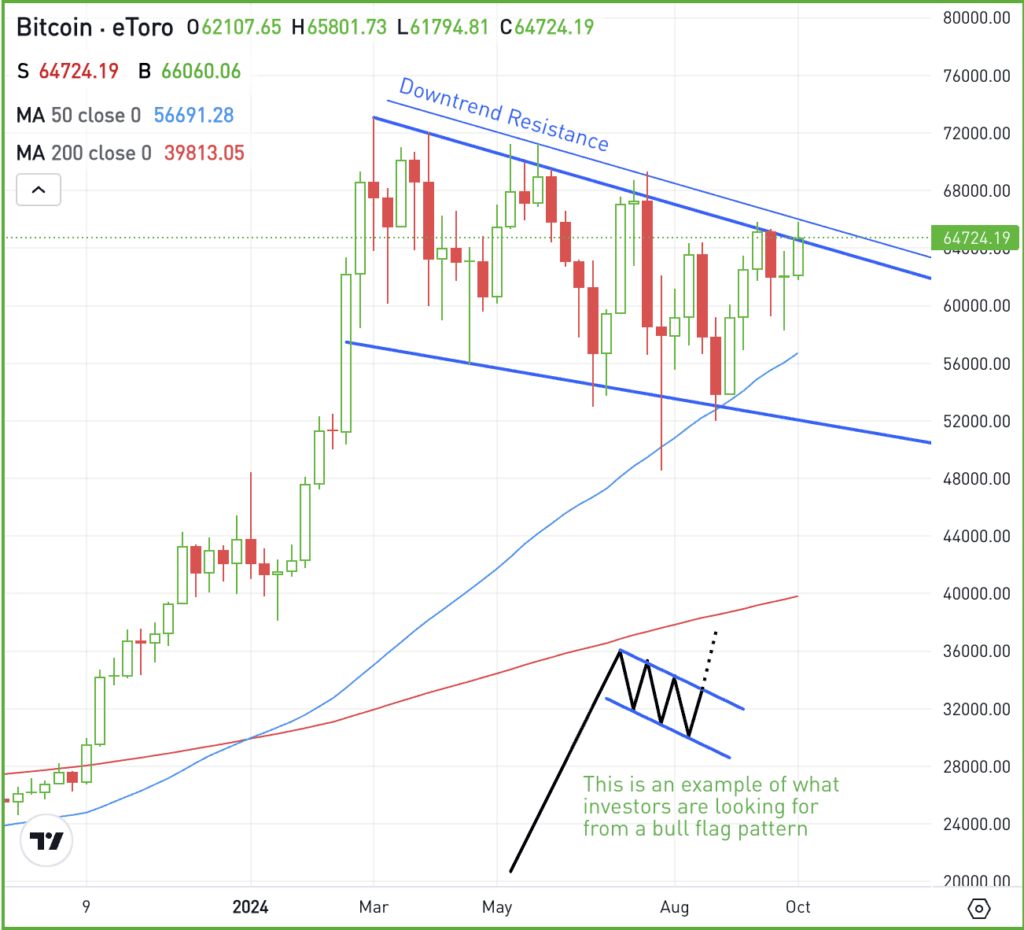

We’ve been talking about Bitcoin for a while as it continues to digest in a giant consolidation pattern (drawn on the chart below).

Known as a “bull flag,” this consolidation pattern can happen after a giant rally. Generally, this type of consolidation is viewed as healthy price action. Remember, Bitcoin is still up 56% so far this year and more than 140% over the past 12 months.

It’s impossible to know if Bitcoin will resolve higher out of this pattern and if it does, it’s hard to know when it will do so.

That’s a frustrating sentence to write and it’s possibly even more frustrating to read. But the silver lining is that Bitcoin’s price action is doing exactly what it should be doing after a massive rally.

If it’s able to break out over downtrend resistance and clear the 2024 high, it could ignite a much larger move to the upside. For now though, that move may require more patience.

What Wall Street is watching

BA – Boeing stock is slightly higher in pre-market trading after saying it has a new credit agreement in place for $10 billion and could raise as much as $25 billion by considering an equity raise. The move comes as the company tries to shore up its balance sheet amid a strike that has crippled its production.

JNJ – Shares of Johnson & Johnson are trying to rally on Tuesday morning after the firm delivered a top- and bottom-line earnings beat. Sales of $22.4 billion topped expectations of $22.2 billion, while earnings of $2.42 a share easily topped estimates of $2.21 a share.

NVDA – The Biden Administration has reportedly discussed capping sales of advanced AI chips from Nvidia and other American firms on a country-specific basis in order to limit AI capabilities for certain countries. Shares of Advanced Micro Devices are also down slightly on the news this morning.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.