The Daily Breakdown looks at the recent rally in Bitcoin, which is trying to make a push to all-time highs.

Wednesday’s TLDR

What’s happening?

It’s a busy three-day stretch for investors, as several large macro reports loom. When investors hear the term “macro,” many readers understandably get turned off, dismissing the incoming data as boring or over their heads. It’s kind of like bonds, if I’m being honest.

But those macro reports can provide a lot of helpful data, even if you don’t have a finance degree or work as an analyst.

Today we get the Q3 GDP report at 8:30 a.m. It will provide investors an update on how the US economy performed last quarter and specifically, what drove the results.

For anyone that wants to flex a little knowledge on their friends and family, feel free to let them know that “more than two-thirds” or “roughly 70%” of US GDP is driven by the consumer.

Expectations call for about 3% annualized growth last quarter, but keep in mind, this report will be revised two more times in the coming months. And for what it’s worth, that 3% figure is pretty solid.

As for the remaining macro reports this week, we’ll have the Fed’s preferred inflation gauge on Thursday morning when the PCE report is released at 8:30 a.m., while the monthly jobs reports will be released on Friday morning — again, at 8:30 a.m.

Want to receive these insights straight to your inbox?

The setup — Bitcoin

After months of consolidation, Bitcoin is finally waking up and the recent rally nearly sent the king of crypto to new all-time highs. In fact, for certain currencies, Bitcoin did hit new record highs.

When measured in US dollars though, it did not.

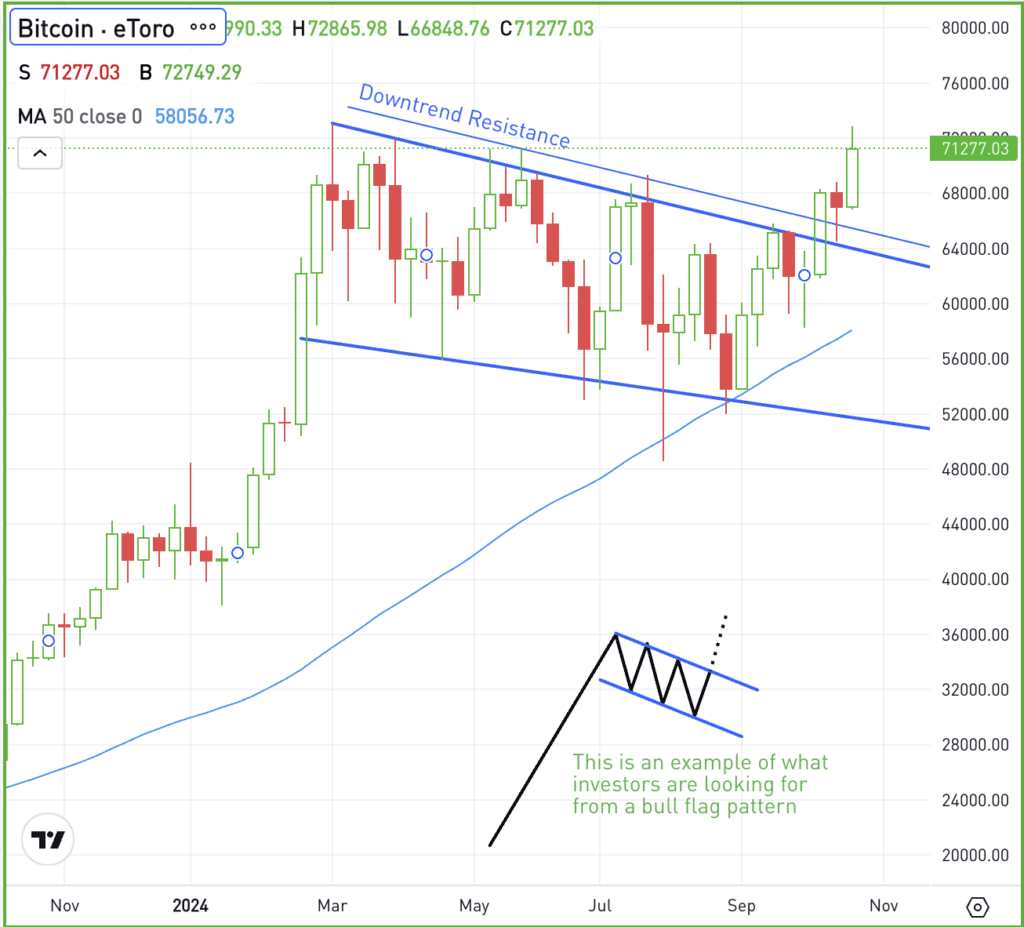

We posted this chart of Bitcoin a couple of weeks ago, as it has been consolidating in what’s known as a “bull flag pattern” for months. But now, it has finally cleared downtrend resistance and is trying to push higher:

If it can get above the 2024 high and gain momentum above that level, that momentum could power a large move to the upside.

If it can’t, it will be discouraging — but from a technical perspective, not all hope will be lost. As long as Bitcoin can stay above the $64,000 level, the charts remain constructive.

Fundamentally, you can attribute a bunch of catalysts for the recent breakout. The election appears to be an obvious one, but falling interest rates, inflation, bullish seasonality, and a strong economy justifying a “risk-on” approach by investors could all be catalysts, too.

What Wall Street is watching

GOOG – Shares of Alphabet are trading higher in the premarket, gaining after the firm delivered a Q3 earnings and revenue beat. Alphabet spoke positively about AI on its conference call and reported better-than-expected cloud results. That’s giving a boost to Amazon and Microsoft, which also report this week, as investors hope these firms can deliver similar results when it comes to the cloud.

AMD – Advanced Micro Devices delivered in-line earnings results and slightly beat revenue expectations. While guidance was roughly in-line with analysts expectations too, shares are moving lower in pre-market trading. Clearly investors were hoping for more, particularly after AMD’s AI event earlier this month. Check out the chart now.

LLY – Like AMD, Eli Lilly shares are not reacting well to earnings. The stock is down about 10% in pre-market trading after a top- and bottom-line miss. Earnings of $1.18 a share missed expectations of $1.47 a share, while revenue of $11.44 billion missed estimates of $12.1 billion.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.