The Daily Breakdown takes a closer look at Bitcoin as it tries to break out, while also taking a look at the week ahead.

Monday’s TLDR

- Earnings season is about to get very busy.

- Inflation and US GDP are on watch this week too.

- Bitcoin has rallied more than 20% in the past two weeks.

What’s happening?

The S&P 500 and Nasdaq 100 are trying to shake off last week’s decline, while earnings are picking up and a few big economic reports are on the schedule. In fact, roughly 30% of the S&P 500 is scheduled to report earnings this week, according to Bank of America.

On Monday, we’ll get earnings from Verizon and see how the markets react to the news that President Biden will not be seeking re-election. So far, markets are handling the news pretty well.

On Tuesday, Spotify, United Parcel Service, General Electric, Coca-Cola, Visa, Tesla, and Alphabet will report earnings. A bunch of others will too.

On Wednesday, AT&T, Ford, and Chipotle Mexican Grill will report earnings, among others.

Thursday and Friday have other notable earnings too — like American Airlines, Honeywell, and 3M Co — but the focus will be economic reports. That’s as the Q2 GDP report will be released on Thursday morning and the PCE report will be released on Friday morning.

Remember, the PCE report is the Fed’s preferred inflation gauge. If this number comes in too hot, investors will worry about a potential delay to the Fed’s first rate cut of this cycle.

Want to receive these insights straight to your inbox?

The setup — BTC

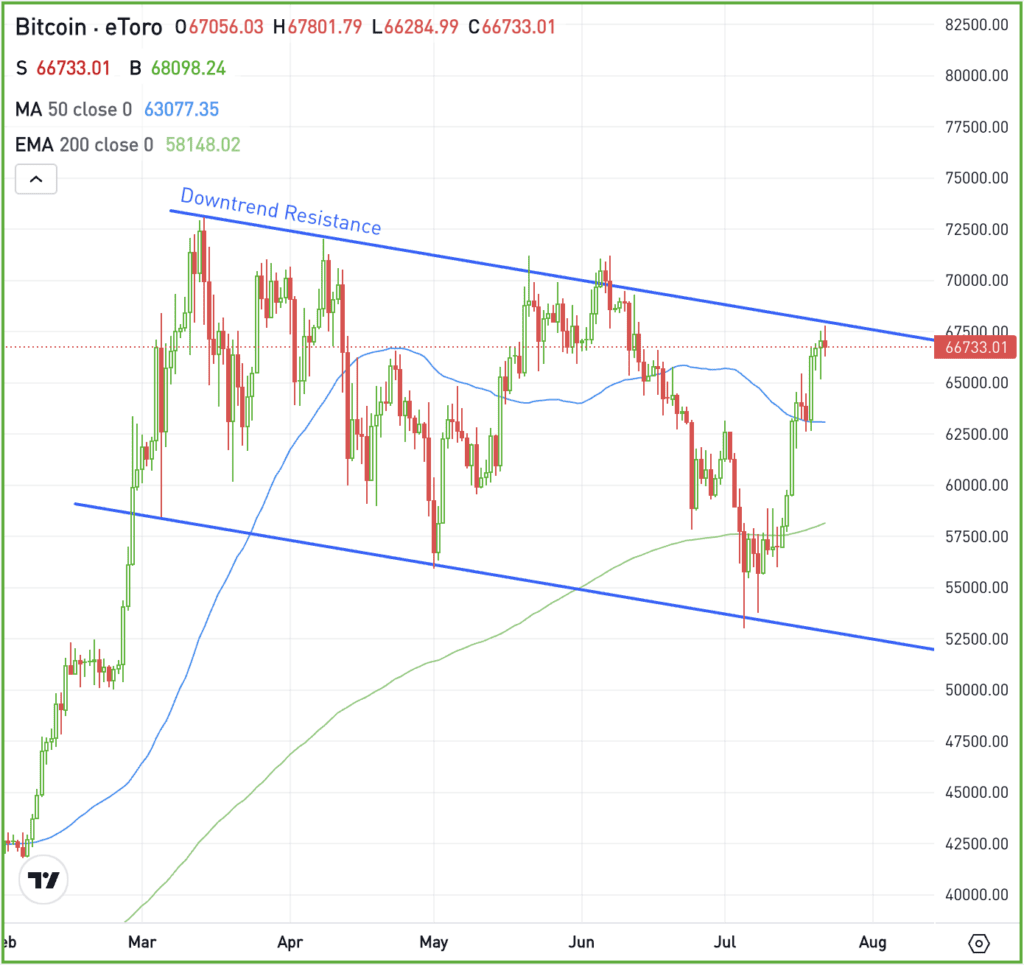

Bitcoin hit a new high in March, but has been trading sideways-to-lower since. Known as “consolidation,” this type of price action helps an asset digest a large rally.

Bitcoin nearly doubled from its January low near $38,000 to its recent high above $70,000. So while the recent action has frustrated many investors, a few months of consolidation is actually incredibly healthy.

Some investors may draw their trendlines in different ways — and that’s okay. For me though, I’m looking at resistance coming into play between $67,500 and $70,000.

If BTC can clear this zone, it’s possible it could run to its prior all-time high, then potentially even higher. However, if resistance remains intact, we could see another dip.

The bottom line: Consolidation is super healthy after a big rally, but keep an eye on the technicals — they could tip off investors on when the next move is about to happen.

What Wall Street is watching

RTY — Wall Street had its worst week since mid-April, with the Nasdaq down 3.65% and the S&P 500 down 1.96%. A rotation out of tech stocks and into small caps — sparked by a weak consumer inflation report — drove the rotation. The Dow rose 0.72% for the week, while the Russell 2000 climbed 1.68%.

AMZN — Amazon set a new Prime Day record, with higher sales and more Prime members shopping compared to last year. Independent sellers sold over 200 million items, while shoppers spent $14.2 billion, up 11% from 2023.

AXP — American Express reported a 39% increase in Q2 profit on Friday, driven by a broad rise in cardmember spending and more customers carrying a balance. Revenue of $16.3 billion grew 8.5% year over year, but missed analysts’ expectations of $16.6 billion.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.