The Daily Breakdown looks at the breakout in Microsoft, as it has lagged the broader market’s rally but is trying to finally wake up.

Wednesday’s TLDR

- Russell 2000 roars into the lead

- Microsoft stock breaks out

- GM tumbles on tariff worries

What’s happening?

We’re in the last full trading session of this week, as well as this month, as November is on the verge of wrapping up.

Currently, the S&P 500 is up 5.6% this month — its best monthly performance since November 2023 when it climbed 8.9%. Assuming it is able to finish higher this month, it will be the 11th monthly gain in the last 13 months.

That’s pretty impressive. So is the fact that it’s up more than 40% since the beginning of last November.

But perhaps even more interesting is that the Russell 2000 — AKA small caps! — is the best-performing US index since that time. Up 45.6% so far since Nov. 2023, the Russell narrowly tops the gains from the S&P 500 and Nasdaq 100, up 43.3% and 45.9%, respectively, as well as the Dow’s 35.6% gain.

Let’s see if stocks are able to finish the year on a strong note and deliver a solid December, too.

Thanks for riding with eToro and taking time to read these daily notes. It means a lot to me and the people who work on them. Enjoy the holiday!

Want to receive these insights straight to your inbox?

The setup — Microsoft

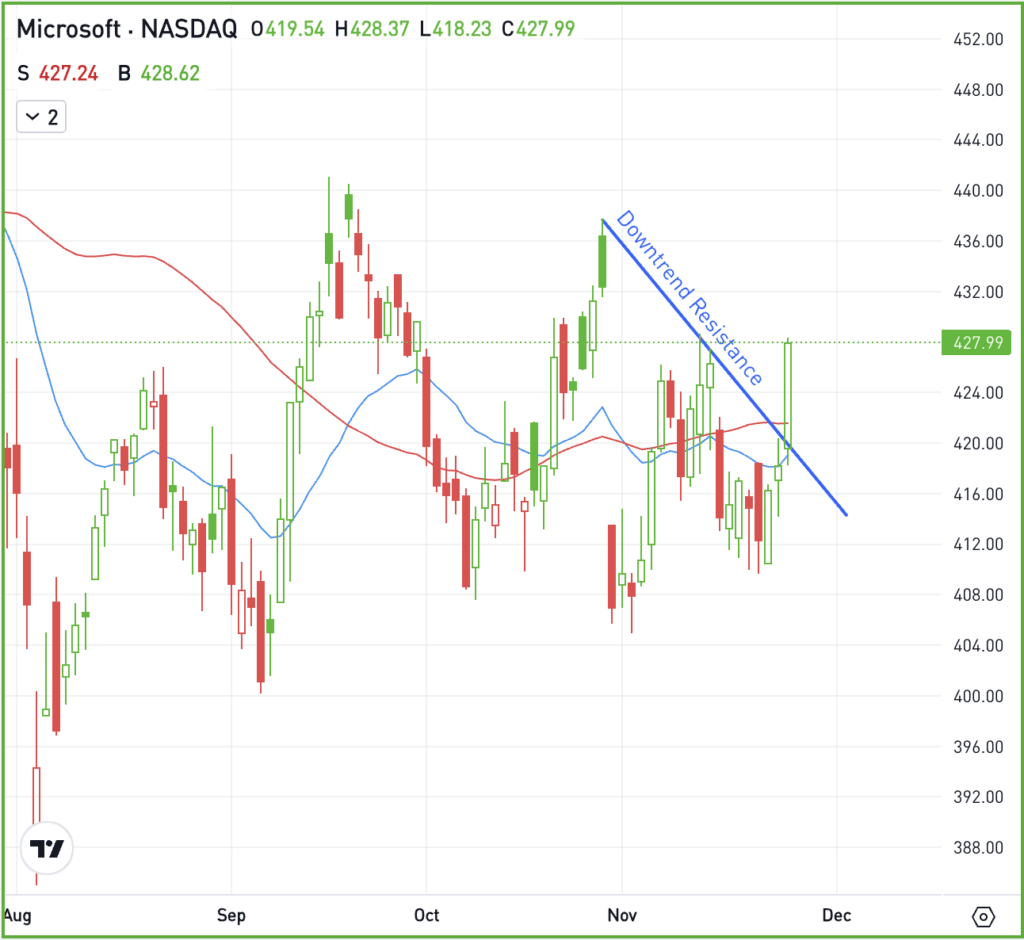

I wanted to write about Microsoft yesterday, but thought it might be better to wait for a breakout confirmation. Well, MSFT stock delivered just that, breaking out over downtrend resistance, while regaining its 50-day and 200-day moving averages.

It was an impressive move for a high-quality stock, yet one that has lagged the broader market. Microsoft’s 15.5% rally in 2024 lags the S&P 500’s ~25% gain. Further, shares haven’t made a new high since July.

If MSFT can maintain momentum, the recent highs near $437 to $440 could be in play. However, bulls may be looking for an even larger rally in this stock, given that the all-time highs are up near $468.

On the flip side, if Microsoft fell back below $415, it would put it back below downtrend resistance, as well as the 50-day and 200-day moving averages.

For long-term investors, that’s not a big deal, as it sets up more consolidation (and requires more patience). For short-term traders though, it reverses the recent breakout and drains the bullish momentum currently on display.

Options

One downside to MSFT is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

CRWD – Shares of Crowdstrike are down slightly this morning, despite the firm beating on earnings and revenue expectations and delivering a solid full-year outlook. Despite a major outage in the summer, the firm boasted a 97% retention rate among its customers. One reason for the dip? It could be because shares are up over 80% from the summer low. See for yourself by checking out the chart.

DELL – Unfortunately for Dell, this morning’s pre-market losses are larger, with the stock down about 12%. The decline comes after the firm reported earnings of $2.15 a share, beating expectations of $2.06 a share, but missed on revenue. That’s as sales of $24.37 billion missed expectations by $350 million.

GM – Shares of General Motors were hammered yesterday, falling about 9% on tariff concerns. As President-elect Trump talks about tariffs on goods from China, Canada, and Mexico, stocks like GM and Ford have not been very receptive to the news.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.