The Daily Breakdown takes a closer look at the CPI report, which has positives and negatives. We also dive into the QQQ charts.

Thursday’s TLDR

- Good and bad news with CPI

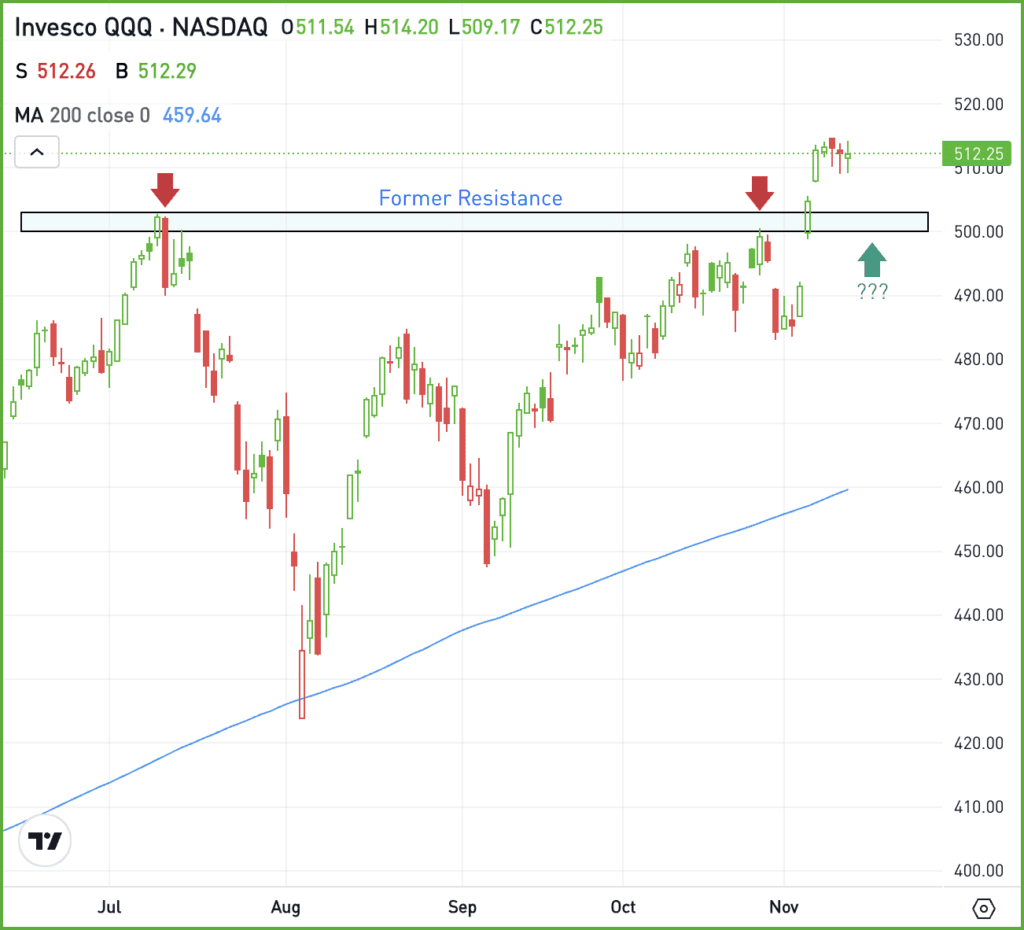

- Charting possible support for QQQ

- DIS pops on earnings

What’s happening?

Bitcoin hit record highs and the S&P 500 inched higher on Wednesday as investors digested an in-line CPI report. Without nitpicking every aspect of the report, three things stood out to me.

First, “in-line” results kept the status quo in play. There was nothing shocking in this report — either good or bad — and as such, confidence in a December rate cut has grown. Going into yesterday’s report, odds favoring a rate cut stood at about 60/40. Now they’re at about 80/20.

Second, in-line results seem fine because that was the consensus expectation, but keep in mind that it also meant an uptick in inflation. Core CPI increased for the third straight month while headline CPI increased vs. the September reading (both on a year-over-year basis).

Lastly, shelter accounted for more than half of the increase in CPI. The good news is that a majority of pricing pressure continues to move lower — including “goods” and “energy.” The bad news is that the shelter component remains incredibly sticky and the Fed can’t do all that much to help with housing and rent costs. Simply put, we need higher supply for housing and apartments.

Want to receive these insights straight to your inbox?

The setup — Nasdaq

One of investors’ favorite sectors is tech and with the latest rally, the Nasdaq has finally joined the S&P 500 and Dow in hitting all-time highs.

With the rally to new highs, investors will want to see stocks hold above prior resistance. For the Invesco QQQ ETF, that means holding up above the $500 area.

Ideally, we’ll see the former resistance area near $500 turn into support, giving buyers a clear “line to hold” on the dips.

If the QQQ stays above this area, bulls can maintain momentum. While a break back below $500 isn’t necessarily devastating for the long-term bull trend, it could mean the QQQ needs more time to consolidate.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

DIS – Shares of Disney are moving higher this morning, rallying after the company reported earnings. The company beat on earnings and revenue expectations, growing sales more than 6% to $22.6 billion. Further, the company laid out full-year guidance for 2025 that came in ahead of analysts’ expectations. Check out the chart.

JD – JD.com stock is higher this morning as investors digest the company’s latest quarterly results. Earnings of $1.24 a share beat expectations of $1.04 a share, while revenue of $37.1 billion beat expectations by more than $1 billion. Investors who follow JD may also be watching Alibaba too, which reports tomorrow morning.

GOLD – Gold prices have quietly tanked in recent trading, falling almost 10% from the recent all-time high and down almost 7% from the close on November 5. The GLD ETF has suffered a similar fall, while the top-traded silver ETF — the SLV — has fallen more than 13% from its highs.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.