Bitcoin is hitting record highs, while Ethereum has soared over the past week. The Daily Breakdown looks at everything moving in crypto.

Tuesday’s TLDR

- Bitcoin is up 30% since Nov. 5

- It’s boosting the entire crypto space

- Shopify, Home Depot earnings in focus

What’s happening?

Many investors are focused on Bitcoin right now, which surged to new record highs yesterday and nearly touched $90,000 this morning. With the rally, it’s pushing many other assets higher too.

Ethereum cleared $3,400 and is up 40% in the past week, while a number of BTC and ETH related ETFs have done well lately too. Stocks associated with crypto — either through ownership or through their operations — are enjoying the rally as well, including Microstrategy, Riot Platforms, and Coinbase, among others.

The rally has many investors wondering if Bitcoin can get to the key $100,000 mark — and if it can, how long it will take to get there.

Bitcoin is up more than 30% since Monday Nov. 5th. If that type of momentum continues, it may not take long to hit the coveted six-figure mark.

At the very least, bulls should be enjoying their moment in the sun.

People tend to forget how well Bitcoin traded in Q4 2023 and Q1 2024, before consolidating for the last several quarters. Now waking from its slumber, we’re seeing the reaction many had been hoping for.

Want to receive these insights straight to your inbox?

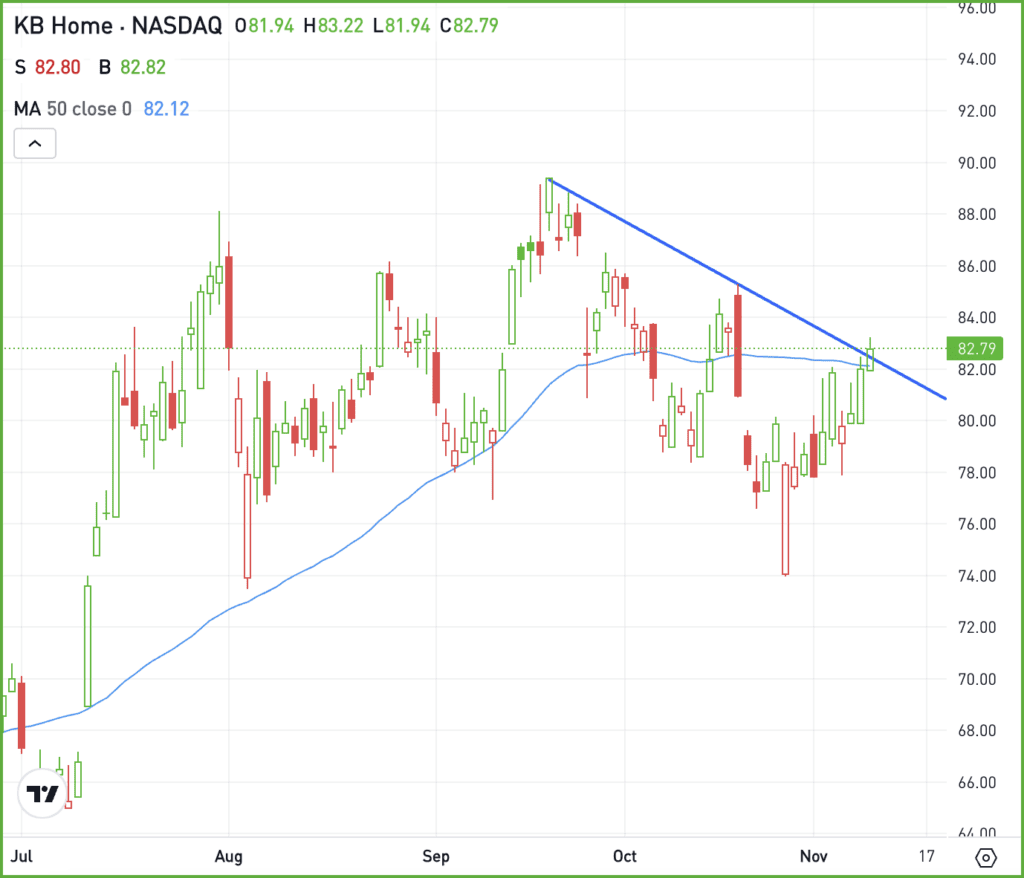

The setup — KB Home

With the rally in crypto and with stocks at record highs, KB Home may not get investors as excited. But investing isn’t about excitement — it’s about uncovering opportunities.

Investors have seemed to forget about homebuilders like KB Home.

Shares enjoyed a big rally in July, but the stock has been consolidating since. Now back above the 50-day moving average, KBH looks like it’s trying to wake up.

We may not see a Bitcoin-like reaction, but if KBH can gain momentum, it could put more upside in play — potentially back up to the recent highs near $90.

On the downside, bulls will want to see the stock stay above $80. A break back below this level could put the recent lows back in play in the low-$70s.

On the fundamental front, analysts expect about 8% revenue growth this year, helping to fuel a roughly 20% jump in earnings. Shares trade at about 10 times this year’s expected results.

What Wall Street is watching

HD – Shares of Home Depot are inching higher this morning after the firm reported its Q3 results. Earnings of $3.78 a share beat expectations of $3.65 a share, while revenue of $40.2 billion grew 6.6% year over year and beat estimates by almost $1 billion. The results are also giving Lowe’s a boost.

SHOP – Shares of Shopify are set to open at new one-year highs after it reported earnings. The firm beat on revenue expectations, growing sales 26% year over year. Further, management’s Q4 outlook topped analysts’ expectations, setting off a large pre-market rally.

ABBV – Unfortunately for AbbVie, the stock had a rough day on Monday, falling over 12%. The decline came after the company’s “experimental schizophrenia treatment failed in a pair of midstage studies.” That helped push shares of Bristol-Myers Squibb higher, since it has a schizophrenia treatment.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.