The Daily Breakdown looks at the pullback in Bitcoin, which just hit its lowest level since February while investors digest the recent Fed comments.

Thursday’s TLDR

- Volatility climbs amid Fed day noise.

- Support cracks for Bitcoin.

- Starbucks tumbles to 52-week lows on earnings.

What’s happening?

As expected, the Fed kept rates unchanged on Wednesday. While the markets were volatile on the day, the tone was more dovish than expected.

Initially, the market cheered the Fed’s statement and Chair Powell’s press conference. At one point, the S&P 500 was up 1.2% with less than an hour to go before the close. It then tumbled lower and closed near session lows, down 0.3%.

Chair Powell made two key distinctions.

First, Powell said he doesn’t see stagflation as a current risk. (Remember how nasty stagflation is). Second, Powell was pretty firm about no rate hikes. Instead, the Fed seems committed to a “when, not if” approach to rate cuts — which is a good thing for stock and crypto bulls.

The market didn’t have much time to react to Powell’s comments. Let’s see how investors — particularly the big institutions — behave today once they’ve had some time to digest the new information from the Fed. The day after the Fed tends to be more telling anyway, in my opinion.

Remember, we have Apple and Coinbase earnings after the close, as well as the monthly jobs report on Friday morning.

Want to receive these insights straight to your inbox?

The setup — BTC

Yesterday we looked at Ethereum, but Bitcoin prices have been under pressure too.

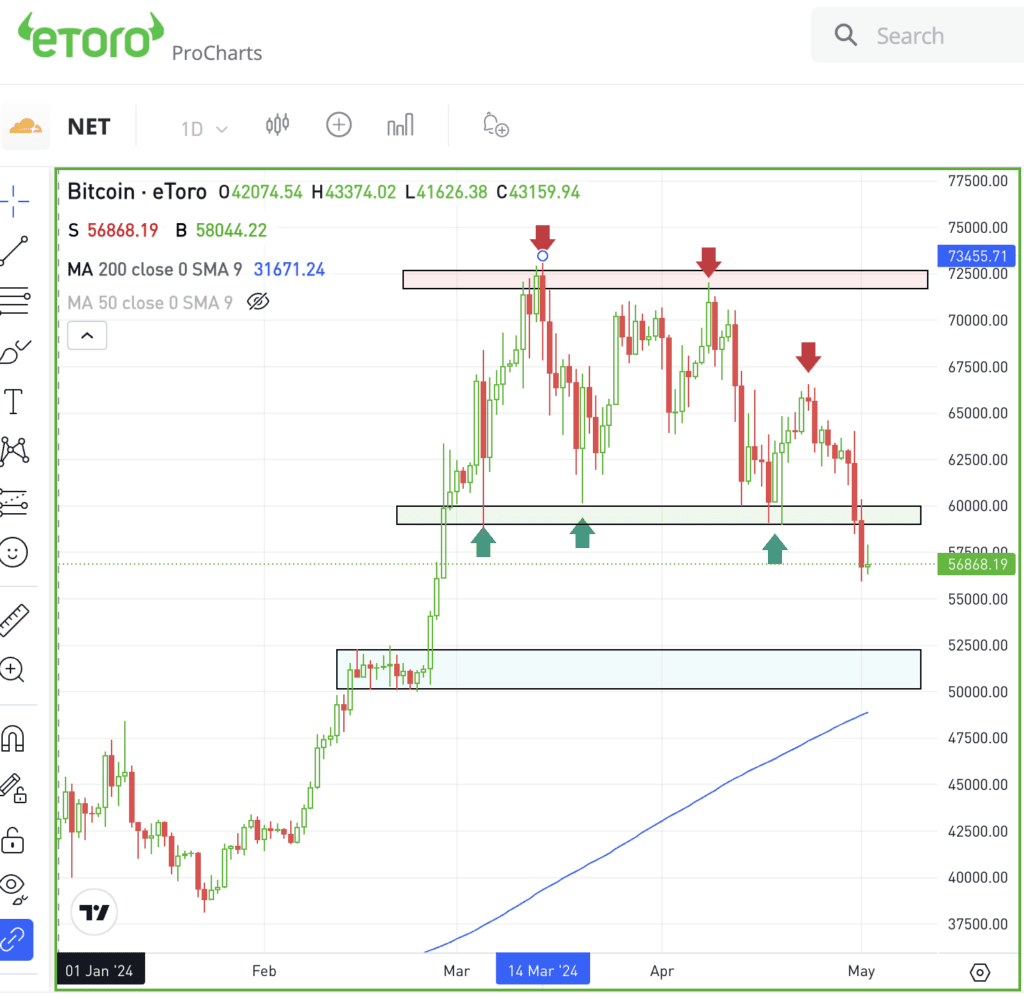

It was healthy to see Bitcoin trade between $60,000 and $72,000 for the last two months. This is called “consolidation” — and it’s good to see after a massive rally like the one we saw from late February to mid-March.

In that stretch, Bitcoin rallied more than 40% from about $50,000 to new all-time highs above $73,000. Now though, recent support is giving out.

Notice the series of “lower highs,” which is a bearish technical development in technical analysis. It’s marked on the chart with red arrows. With Bitcoin breaking below the key $60,000 area, bulls have to shift their focus lower.

Specifically, the $50,000 to $53,000 area sticks out. Not only was that a prior area of interest before the February breakout, but the rising 200-day moving average is near this zone too. This doesn’t mean Bitcoin will fall this far — it’s just an area I’m watching.

Here’s the positive: If investors are bullish on Bitcoin for the long term, this type of decline would be a healthy development. Not only does it help reset the charts and sentiment, but it gives interested buyers a chance to buy the dip.

On the flip side, let’s see how Bitcoin handles prior support near $60,000. Does this area act as resistance on a bounce? Or does Bitcoin climb back above this area and try to push higher? I’ll be watching this level on the upside and the mid- to low-$50,000s on the downside.

What Wall Street is watching

SBUX — Starbucks shares had a rough day, plunging to fresh 52-week lows. In fact, the stock hit its lowest level since June 2022. The decline comes after the firm reported disappointing quarterly results, missing on earnings and revenue as sales declined 1.8% year over year.

CVS — A similar fate struck CVS yesterday too, as the stock plunged to 52-week lows and had its worst one-day performance since 2009. The decline happened after a top- and bottom-line miss. Further, management revised its full-year guidance lower.

PFE — Pfizer reported higher-than-expected revenue and raised its profit forecast, driven by cost cuts and a smaller-than-anticipated decline in Covid drug sales. Despite challenges in its Covid business, non-Covid products and strategic acquisitions are bolstering growth, maintaining investor confidence.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.