The Daily Breakdown examines Bitcoin as it rallies to all-time highs on the day, which is helping to drive Bitcoin ETFs higher as well.

Monday’s TLDR

- The monthly Inflation report in focus.

- Bitcoin rips to another new high.

- Bitcoin ETFs continue to grow.

What’s happening?

Stocks fell last week, giving the S&P 500 just its third weekly loss in the last 19 weeks. That said, the index fell less than 0.3% last week — hardly a catastrophe.

As we swing our attention to this week, I have to wonder if we’ll eventually see more selling pressure.

It’s a busy week, with the monthly inflation report on Tuesday, then the monthly retail sales results on Thursday. Investors are hanging on every word from the Fed and on every meaningful economic report, looking for clues on when the Fed will cut rates.

In that respect, these reports are important as they will shine a light on both inflation and the consumer.

Outside of economic reports, earnings continue to trickle in this week, while Friday is a “triple witching expiration” day in the options market.

Remember, triple witching is when we have three major expirations on the same day, which include stock options, index options, and index futures. This event happens four times a year, on the third Friday of March, June, September, and December.

Now let’s talk about Bitcoin.

Want to receive these insights straight to your inbox?

The setup — BTC

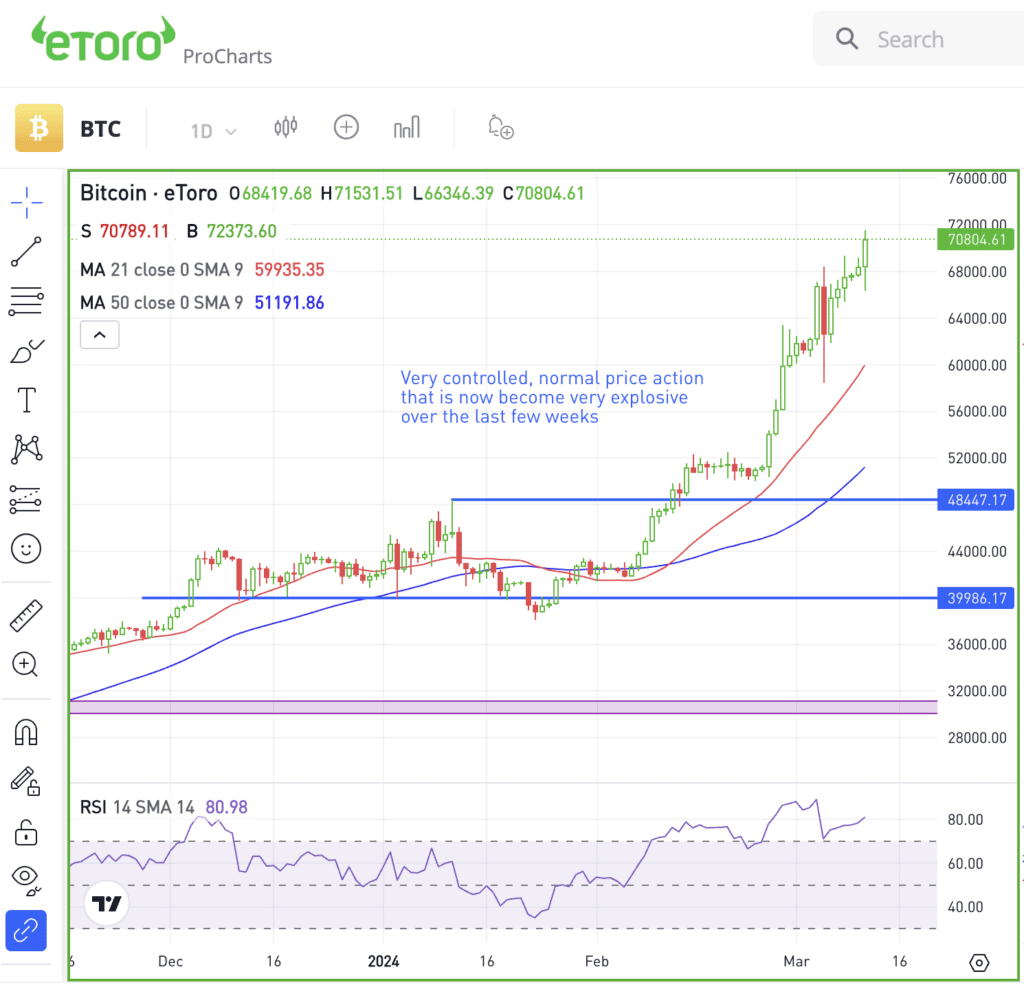

Bitcoin has continued to barrel higher so far, now topping $70,000 as it hits new all-time highs.

We’re seeing powerful moves in other corners of the crypto market too, as Ethereum, Solana, Litecoin, Cardano, and many others rally higher. We’re also seeing that on the stock side, with Marathon Digital, Riot Platforms, Coinbase, and MicroStrategy all enjoying strong rallies lately.

The rally is pulling in investors who are afraid of missing out on more gains, while the Bitcoin ETFs that were approved in January create another way for investors with more traditional investment accounts to participate.

These ETFs now have more than $55 billion in combined assets under management, showing the robust demand helping to fuel the recent rally. While Bitcoin has been a solid performer, it’s been downright explosive over the past few weeks.

For long-term bulls, this rally has been a long time coming, as Bitcoin recently took out its prior all-time high from 2021.

However, the rally could also be an opportunity for some investors to lighten up their exposure a bit, selling into the recent strength and looking to diversify into other assets or buy the dip on a potential pullback.

That doesn’t mean Bitcoin prices can’t go higher, but taking some profits off the table is just one consideration for certain investors. Plus, it doesn’t have to be an all-or-none proposition — active investors can consider lightening up on just a portion of their holdings if they wish to.

In the short term, I’m curious to see how Bitcoin handles the $75,000 and $80,000 levels if it continues higher. Next month’s Bitcoin halving event is likely acting as a positive catalyst at the moment. How it trades into that event — and after — will also be of interest.

What Wall Street is watching

NVDA — Nvidia shares experienced significant volatility on Friday, initially rising by 5.1% before plummeting to a 5.6% loss on the day, marking its largest one-day decline since May 2023. However, the stock is still up more than 75% so far this year.

PFE — Pfizer is focusing on cancer drugs to rebound from its post-Covid downturn, aiming to revive its fortunes after a sharp fall in its Covid business and a 40% drop in its stock price last year. The company projects that its collaboration with Seagen on cancer treatments will lead to at least eight major drugs by 2030.

IBIT — In under two months, BlackRock’s iShares Bitcoin ETF (IBIT) has outpaced MicroStrategy in Bitcoin holdings, with IBIT holding 195,985 Bitcoin compared to MicroStrategy’s 193,000. IBIT’s swift growth positions it as a leading new spot ETF, second only to Grayscale’s Bitcoin Trust. This demand has played a key role in Bitcoin’s price jump of over 60% this year, pushing it to a new high above $72,000.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.