The Daily Breakdown examines why it’s important to lock in profits and looks at Bitcoin’s rally to $50,000.

Tuesday’s TLDR

- Semiconductors acted wobbly yesterday.

- CPI report will be released this morning.

- Bitcoin hits $50,000 — its highest level since December 2021

What’s happening?

Stocks hit new all-time highs on Monday, but backed off in afternoon trading.

The move coincided with similar action that we saw in semiconductor and AI-related stocks.

Nvidia, Super Micro Computer, Arm Holdings and others continued their magnificent moves higher in the morning, with all three hitting all-time highs. However, many of the stocks in these groups slipped notably from their session highs in afternoon trading.

Yesterday’s fade certainly wasn’t enough to unnerve many bulls, but it serves as a reminder to those that have been overwhelmingly bullish over the last two to three months to consider being a bit more cautious moving forward.

While the S&P 500, Nasdaq 100, and Dow Jones have climbed in 14 of the last 15 weeks, investors must also recognize that that’s not a sustainable pace.

At certain points within a rally, active investors and traders should consider locking in some profit, raising stop-losses and reducing position size.

Eventually, we’ll have a period where markets consolidate or pull back and those who took some chips off the table will be able to redeploy them at more optimal entry points.

As for today, remember that the CPI report will be released before the market opens, at 8:30 am ET. The latest inflation figures will be highly scrutinized given the Fed’s current stance on interest rates.

Want to receive these insights straight to your inbox?

The setup

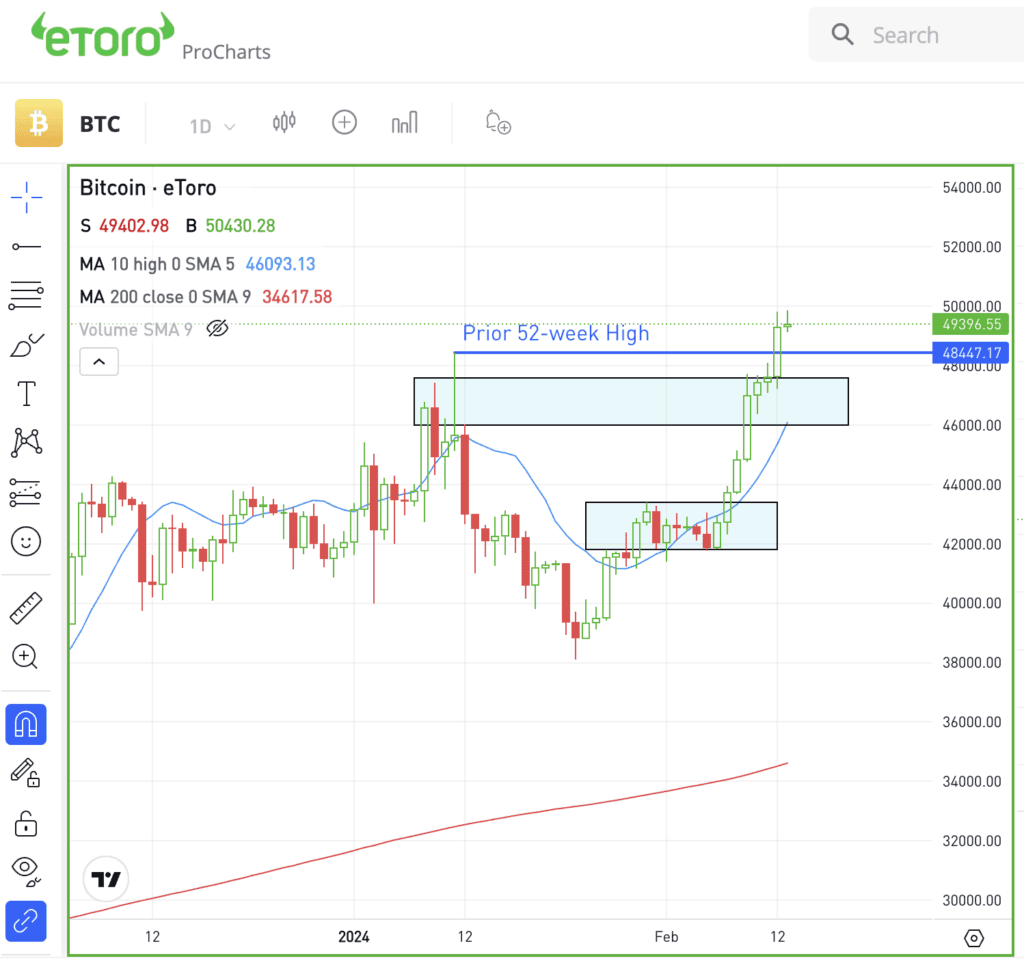

Bitcoin eclipsed the $50,000 mark yesterday, hitting its highest level since December 2021.

We talked about Bitcoin last week, but with the cryptocurrency stitching together an eight-day win streak and rallying more than 17% amid that stretch, it’s time for another look — especially with the halving event coming up in April.

For Bitcoin to maintain strength, let’s see if it can stay above recent resistance in the $47,000 to $48,000 area. If it can hold above last month’s high near $48,450, that would suggest that momentum remains quite strong.

Further, if Bitcoin can stay above these levels while holding short-term key moving averages like the 10-day and 21-day, then its trend will remain bullish.

Conversely, if it breaks those levels and measures, it may need more of a breather.

What Wall Street is watching

JBLU: JetBlue shares are soaring 15% in premarket trading as Carl Icahn acquired a near-10% stake, deeming the airline undervalued and eyeing potential board representation amidst JetBlue’s recovery efforts.

ARM: Arm extended its impressive performance following last week’s robust earnings, gaining an additional 29.3% on Monday. At one point, shares were up more than 42% yesterday, and at the highs, the stock price had more than doubled since the company reported earnings on February 7.

NVDA: Nvidia momentarily outpaced Amazon and Alphabet in market cap before retreating. Nvidia’s meteoric rise has propelled its valuation to more than $1.7 trillion, equaling the collective market cap of all companies listed on the Hong Kong Stock Exchange, as per a Bank of America note by Michael Harnett.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.