The Daily Breakdown looks at earnings from Microsoft, Alphabet and AMD, as well as the big day on tap with the Fed’s FOMC meeting.

Wednesday’s TLDR

- AMD, Alphabet, and Microsoft fall on earnings.

- The Fed is in focus.

- Expedia stock is consolidating and eyeing a breakout.

What’s happening?

Big tech stepped up to the plate and went 0-for-3 last night.

We’re seeing notable declines in AMD and Alphabet this morning, while Microsoft is down slightly after all three failed to inspire investors with their earnings.

That’s not to say they had bad quarters necessarily, but remember, tech has been on a big run lately and anything short of amazing had the potential to draw in a “sell the news” reaction — sort of like what we saw with Bitcoin when the Bitcoin ETFs were approved by the SEC.

Keep in mind, these stocks sported strong year-to-date gains just a few weeks into 2024, with AMD up 16.7%, Alphabet up 8.4%, and Microsoft up 8.7%. Over the last year, Alphabet was the worst performer with a 53.2% gain.

That tells you what kind of run this trio — and big tech in general — has been on.

Investors won’t have long to wallow in this morning’s dip, with the Fed’s interest rate announcement and policy update this afternoon.

While the bond market doesn’t expect a rate cut at the current meeting, investors are torn on whether the Fed will cut rates at its next meeting in March. In that regard, the market will seek clarity from the Fed today on when to expect the first rate cut.

Want to receive these insights straight to your inbox?

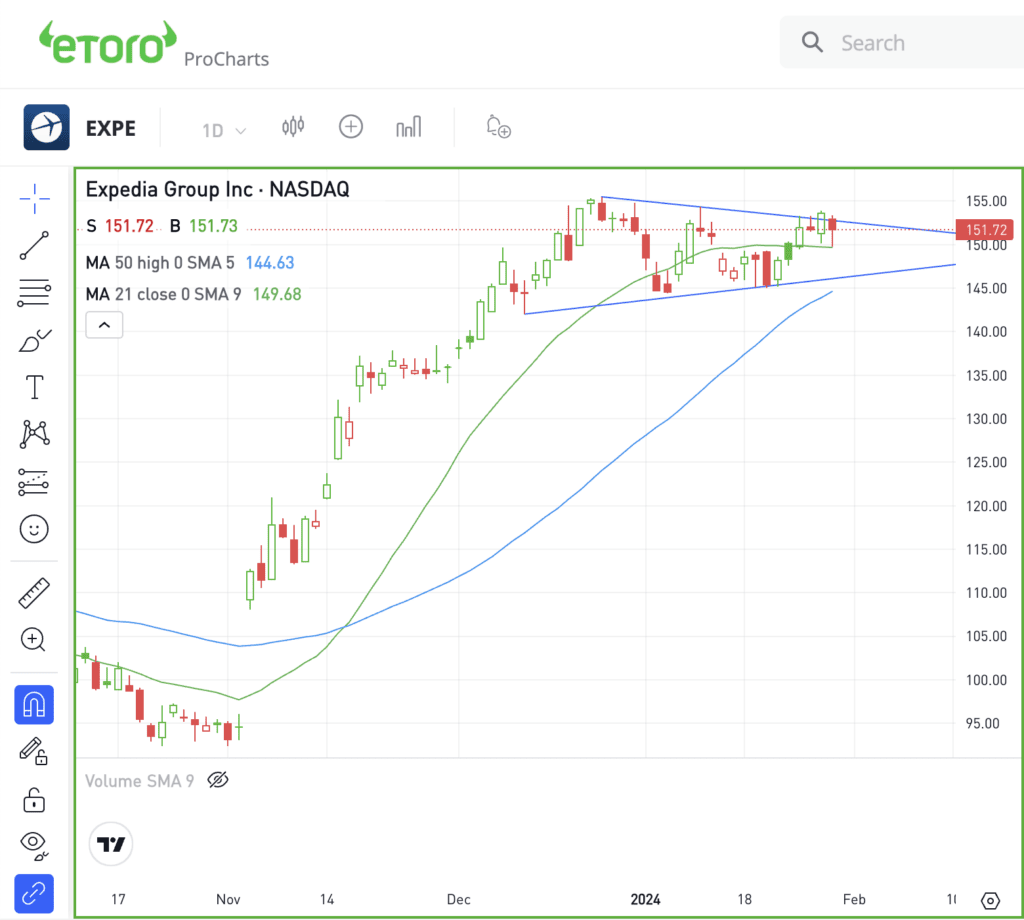

The setup: EXPE

Expedia has benefited from consumers’ desire to get back into the world and travel. That’s clear in the company’s stock price as well, with shares up almost 60% in the last three months.

Despite the recent surge, shares are roughly flat year-to-date as the stock price consolidates its massive gains. It’s not unlike what we saw with Pinterest.

Notice Expedia’s big rally from $95 in early November to more than $150 now. That’s a huge move and honestly, it’s healthy to see this type of sideways consolidation.

For a breakout, investors will need to see a move over downtrend resistance near $154. To gain steam, shares will need to clear the 52-week high at $155.84. Above that and shares could enjoy a strong move higher.

On the downside, it’s possible for Expedia to keep consolidating. In the short term, that could mean another visit into the mid-$140s, where investors will look for potential support from the 50-day moving average.

What Wall Street is watching

MSFT: Microsoft’s net profit jumped 33% last quarter, fueled by AI and its cloud computing unit, Azure. Earnings of $2.93 a share topped expectations of $2.79 a share, while revenue grew 17.7% year over year and topped analysts’ estimates.

GOOGL: While Alphabet delivered a top- and bottom-line earnings beat, its ad revenue fell short of consensus expectations. Further, the firm took $2.1 billion in charges in 2023 due to job cuts, with more than half of those charges coming last quarter.

GM: General Motors rallied on Tuesday after the company delivered better-than-expected Q4 results. Earnings of $1.24 per share and revenue of almost $43 billion beat consensus expectations, while management’s full-year outlook impressed Wall Street.

UPS: United Parcel Service tumbled after it delivered disappointing Q4 results. While earnings of $2.74 per share beat expectations, revenue of $24.9 billion fell 7.8% year over year and missed expectations of $25.4 billion. Making matters worse, management expects 2024 revenue to be in the range of $92 billion to $94.5 billion, below Wall Street’s estimate of $95.6 billion.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.