The Daily Breakdown looks at the week ahead, including earnings from Nvidia, while also taking a look at the charts for Clorox.

Tuesday’s TLDR

- Capital One, Discover agree to $35 billion deal.

- Walmart beats on earnings and revenue estimates.

- Nvidia reports earnings on Wednesday.

What’s happening?

US stocks fell last week, with the S&P 500 dipping 0.4%. It was hardly a massacre, but the decline snapped a five-week win streak.

Last week had a lot of economic data and plenty of earnings to keep investors occupied ahead of a big monthly options expiration.

This week kicks off on Tuesday due to the Presidents’ Day holiday on Monday, and investors are already parsing through earnings reports from retailers like Home Depot and Walmart.

They’ll have plenty of earnings to keep track of — with Nvidia getting the bulk of attention — but at least it’s quieter on the economic front.

On the M&A front, Capital One will acquire Discover Financial Services in a $35 billion all-stock deal, the largest deal so far this year.

In a bull market, it’s good to see IPOs and big M&A deals taking place. It shows a “risk-on” mentality from management teams that are focused on growth and expansion rather than survival and capital preservation.

M&A and IPOs are just two factors within a bull market, but they are good to see nonetheless.

Want to receive these insights straight to your inbox?

The setup — CLX

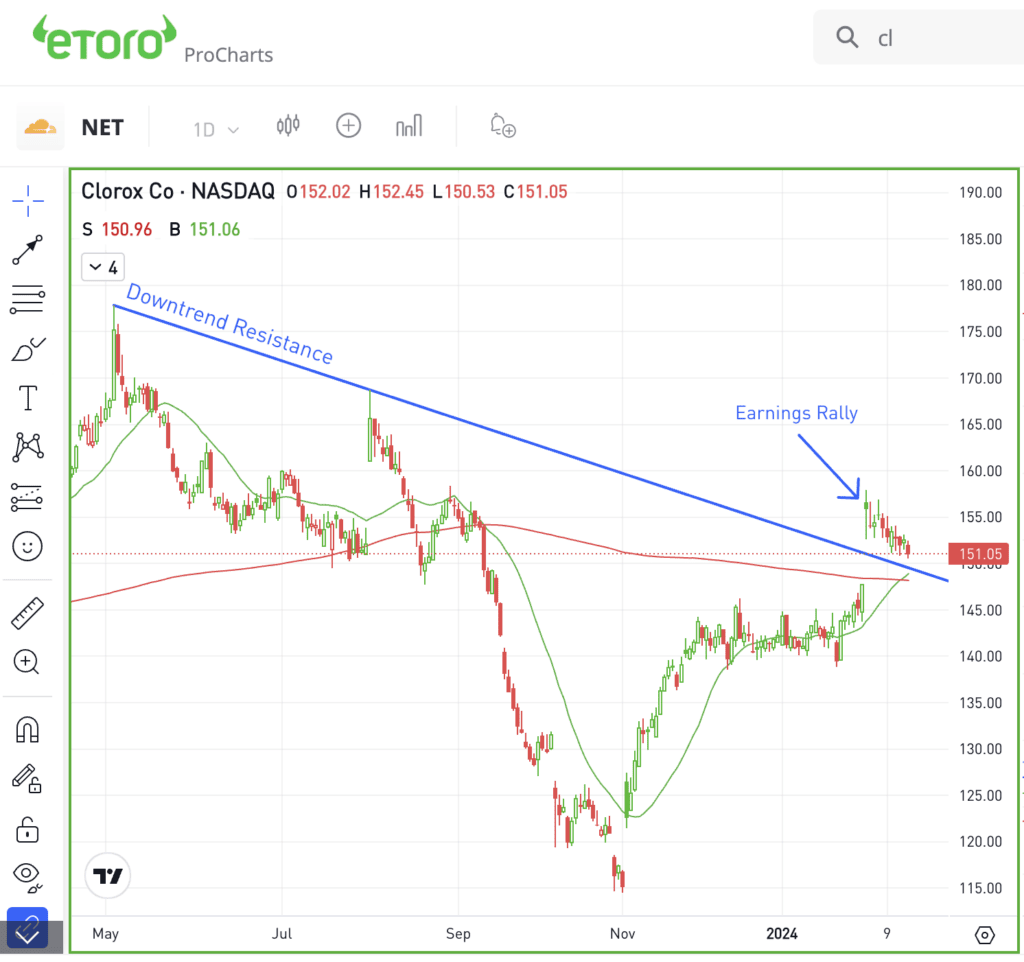

Clorox reported earnings at the start of the month and enjoyed a one-day rally of 5.6%. With the rally, Clorox stock broke out over downtrend resistance and the tight trading range it was stuck in between $140 and $145.

Since that earnings-powered pop though, shares have been slowly sliding lower.

As Clorox stock comes into the low-$150s, it’s facing a key area. That’s as it trades back down toward its prior downtrend resistance line, as well as the 21-day and 200-day moving averages.

Bulls want to see this level hold as support. If it does, they will want to see a potential rebound back toward the post-earnings highs near $159.

If support doesn’t hold, Clorox stock could slip back into the mid-$140s. While this wouldn’t necessarily doom the stock, it would be much healthier from a technical perspective if Clorox could stay above the levels outlined above.

What Wall Street is watching

ETH: Ethereum soared past $2,900 as co-founder Vitalik Buterin hinted at AI integration for bug fixing, a critical technical challenge for Ethereum. This development precedes the anticipated Dencun upgrade, set for March 13.

DFS: Capital One is acquiring Discover for $35 billion in an all-stock deal, valuing Discover shares at a 26.6% premium to Friday’s closing price. The deal will form the US’s largest credit card firm by loan volume, with proponents of the deal hoping that it will bolster competition with top banks.

WMT: Shares of Walmart are inching higher on Tuesday morning after the firm delivered its Q4 results. Earnings of $1.80 per share beat estimates of $1.64 per share, while revenue of $173.4 billion topped expectations of $170.9 billion. Later this week, Walmart stock will undergo a 3-for-1 stock split, too.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.