The Daily Breakdown looks at Apple, which is sitting on key support despite a strong start to the year for stocks.

Wednesday’s TLDR

- Earnings and economic reports remain in focus.

- Apple sits on a key support level.

- Beyond Meat stock soars in after-hours trading.

What’s happening?

The crypto show continues, with Bitcoin and Ethereum hitting more 52-week highs.

While we have one more day in February due to leap year, these two have been surging higher this month. So far, Bitcoin is up 39% and Ethereum is up 44%.

As we approach midweek, we’ve got a fairly tight range forming so far in the S&P 500. Notably, some events in the next few days could expand that range.

That starts with earnings, as Salesforce, Snowflake, AMC Entertainment, and C3.ai, all report tonight, among others.

Then we’ll get the PCE report on Thursday morning at 8:30 am ET. While this report may not get a ton of attention from everyday investors, it’s the Fed’s preferred inflation gauge.

So investors who are looking for clues on the Fed’s next step on rates may want to keep an eye on this report. A higher-than-expected result could increase the odds that rate cuts get delayed.

The setup — AAPL

Down about 5% year to date and Apple is the second-worst performing Magnificent Seven stock so far in 2024.

Now, bulls are hoping that support will hold as the company prepares for its Annual Meeting later this afternoon.

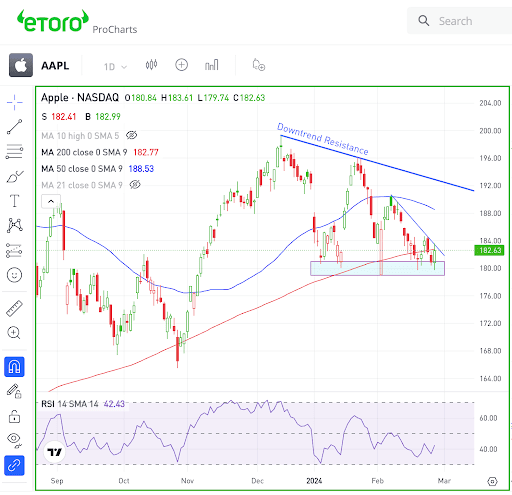

Apple stock hit its high in December and has been quietly making a series of lower highs since then. Meanwhile, the $180 level and 200-day moving average have been acting as support.

For some traders, how Apple trades may mean nothing. But keep in mind, this company still boasts a $2.8 trillion market cap. That’s important to the market — even if all the focus seems to be on AI and Nvidia right now.

Watch ~$180.

A close below this area could open the door to lower prices. If $180 holds, bulls will want to see a close above the $184 level to give the stock a shot at a larger rebound — and to see if it can test a larger resistance level.

For options traders, puts or bear put spreads could be one way to speculate on further downside. It could also be a way for Apple bulls to hedge their long positions.

Find out more about options trading with our free Academy courses, and practice draft trading risk-free until you’re ready to try options trading for real.

What Wall Street is watching

BYND: At one point, Beyond Meat shares doubled in after-hours trading last night after it reported its Q4 results. The plant-based meat company reported revenue of $73.7 million, beating expectations of $66.7 million. According to FactSet, Beyond Meat stock has a short interest of 37.8%, which is likely adding to upside volatility.

XLY: Consumer confidence slipped in February, marking its first downturn since November as economic uncertainty persists. The Conference Board’s index dropped to 106.7, missing expectations of 114.8, and was below January’s revised level of 110.9.

AAPL: Apple canceled its decade-long electric car project, surprising nearly 2,000 employees. COO Jeff Williams and Kevin Lynch shared the decision, shifting many employees to the AI division.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

[Can add additional disclaimer text here if required by compliance]