The Daily Breakdown looks at Apple’s recent rally ahead of its WWDC event. We also look at the week busy week ahead.

Monday’s TLDR

- Investors will get a key inflation report this week.

- They’ll also hear from the Fed.

- Apple has rallied in six of the past seven weeks.

- Nvidia’s stock split has officially gone into effect.

What’s happening?

After hitting record highs in the S&P 500 and the Nasdaq 100 on Friday, we’re coming into a busy calendar this week.

That starts with Apple’s WWDC event later this afternoon at 1 p.m. ET, but it’s mainly led by Wednesday’s calendar.

That’s as we’ll get a critical inflation report in the morning, with the CPI report being released at 8:30 a.m. ET. Later in the day is important too, as the Fed will announce its latest interest rate decision at 2 p.m. ET.

While the bond market is not pricing in any expected change in rates, Chair Powell’s commentary around interest rates, the economy, and inflation will likely be a market-moving event.

This will be a key day in the short term, although other events this week stand out too.

For instance, Oracle, Broadcom, and Adobe will report earnings this week. We’ll also get the PPI report on Thursday and consumer expectations on Friday.

Investors will also be keeping a close eye on the GameStop situation as volatility continues to roar through the meme stock leader. They’ll also be watching Bitcoin to see if the crypto leader can make an upside move over resistance.

Want to receive these insights straight to your inbox?

The setup — AAPL

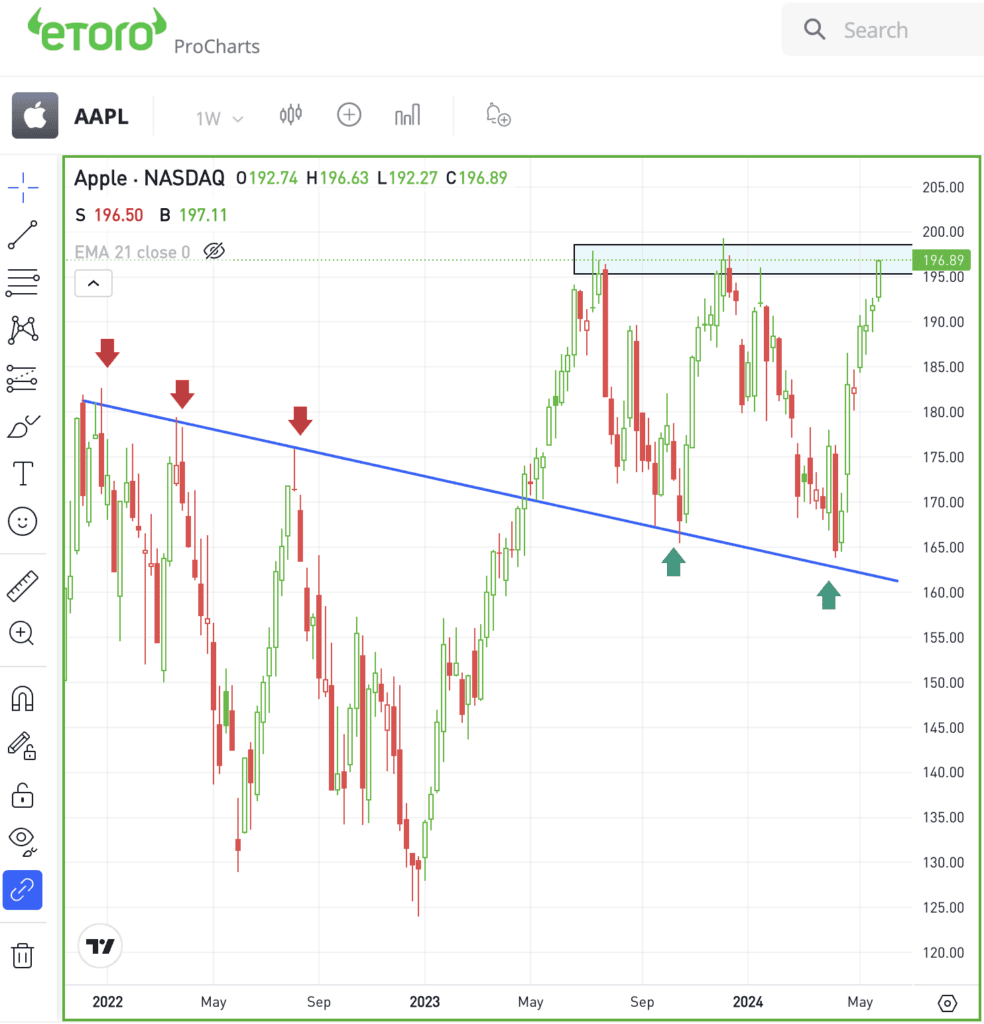

A month ago, I wrote that “bulls would love to see more leadership from Apple,” and we’ve certainly seen more leadership!

The stock is up 7.6% over the last month and is up 20% from its April low. After rallying in six of the prior seven weeks — and where the lone down week was a decline of just 0.2% — Apple shares are approaching a key level.

That’s not to say that Apple can’t break out over this area and make a push to new highs.

However, for those that are trading this name on a shorter time frame (vs. holding a long-term position) it may be worth knowing that it’s in this key area.

A breakout over $200 could send Apple into a new uptrend. However, failure to break out could lead to a pullback, allowing the stock to reset and digest the recent gains.

Options

For some traders, options could be one way to approach Apple. Investors who want to speculate on further upside and/or a potential breakout could consider calls or call spreads. For those that want to speculate on a pullback, puts or put spreads could be one consideration.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

NVDA — Nvidia completed its 10-for-1 stock split after the close on Friday and will begin trading on a split-adjusted basis on Monday. You’ll notice that the share price is now one-tenth what it was on Friday, while any shareholders will see their number of shares being held multiply by 10.

LUV — Shares of Southwest Airlines are jumping this morning following reports that activist investor Elliott Investment Management has built a stake in the airline company worth almost $2 billion.

DO — Shares of Diamond Offshore are in focus this morning after agreeing to be acquired by Noble Energy in a cash and stock deal. Diamond Offshore shareholders will receive 0.2316 shares of Noble in the deal, plus $5.65 in cash for each share of Diamond stock.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.