Apple stock breaks out to record highs, while The Daily Breakdown looks at the upcoming CPI report and upcoming Fed meeting.

Wednesday’s TLDR

- We’ll get the CPI report this morning…

- And the Fed this afternoon.

- Apple breaks out and soars to all-time highs.

What’s happening?

Today’s a big day for the S&P 500, Bitcoin, and bonds as we get a key inflation report in the morning and an update from the Fed this afternoon.

The CPI report will be released at 8:30 a.m. ET, giving investors the latest update on inflation. A few hours later, the Federal Reserve will make its interest rate announcement at 2 p.m. Chair Powell will then follow up with a statement at 2:30, followed by a Q&A session.

Here’s a quick rundown on what to expect.

According to Bloomberg, CPI is expected to jump 3.4% year over year. Core services have remained stubbornly high, particularly shelter and medical services. Investors are hoping to see some weakness in core services to help drive down overall inflation.

As for the Fed, the overwhelming expectation is for no change in interest rates.

Usually the most notable update will come from Chair Powell during his Q&A session. That’s still likely to be the case — and this also tends to be the most volatile portion of Fed days, for what it’s worth — but today we’ll also receive the Fed’s updated summary of economic projections.

Often referred to as the Fed’s “dot plot,” it will give investors an update on the Fed’s expectations for a range of economic matters, including unemployment, interest rates, and GDP growth.

Want to receive these insights straight to your inbox?

The setup — AAPL

Apple shares did not respond well on Monday after the company’s WWDC event, with the stock falling 1.9%.

However, it had rallied quite a bit leading up to that event and it was near a key resistance level on the chart.

Then, it had a massive breakout yesterday, hitting record highs.

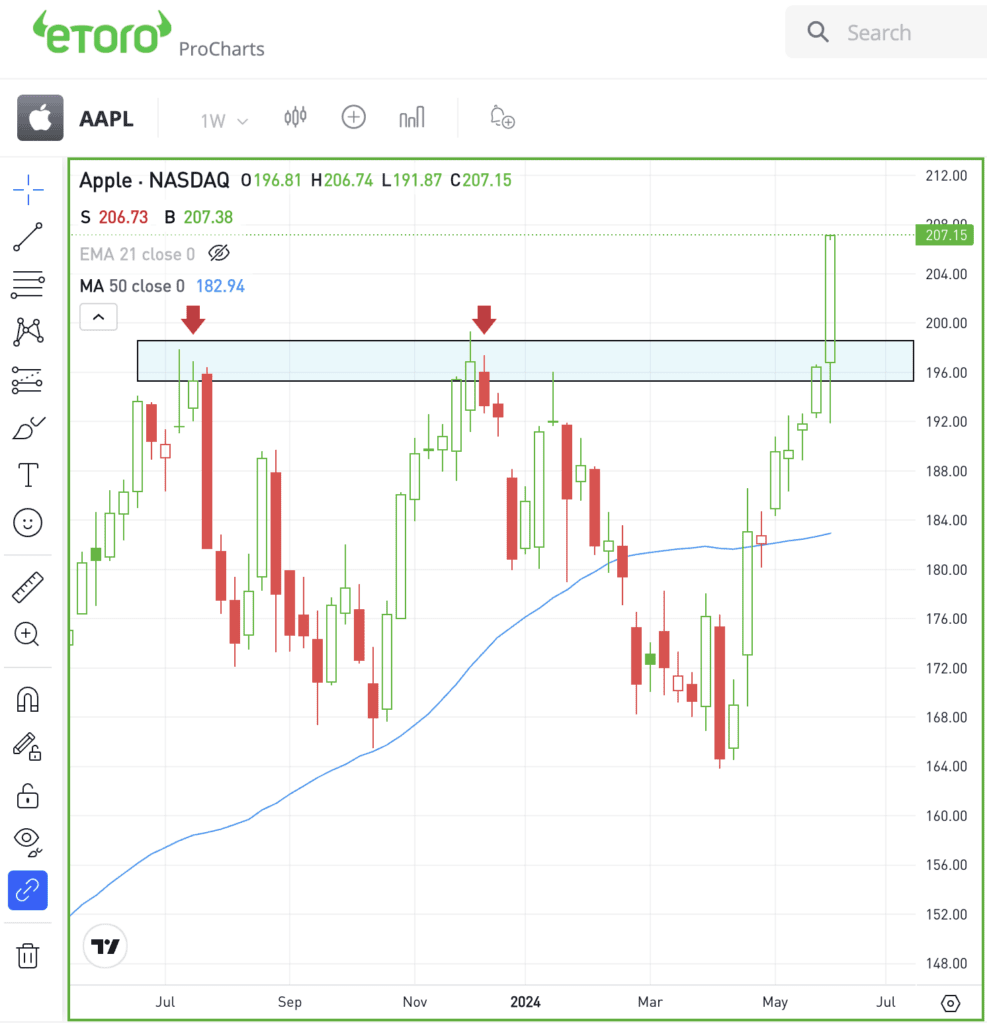

The weekly chart shows how Apple erupted through the key $198 resistance level and powered up through $200.

Moving forward, this area can act as a “line in the sand.” In other words, for right now Apple’s price action looks healthy if it’s above $198. Below this level and momentum likely shifts into the bears’ favor.

At least for right now, the breakout could help spark a continued uptrend and potentially make Apple a buy-the-dips candidate moving forward.

Options

For options traders, calls or call spreads could be one way to buy the dip in AAPL if and when it does pull back. In these scenarios, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect downside could speculate with puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

ORCL — Shares of Oracle are rallying this morning despite reporting and top- and bottom-line miss. The firm’s Q4 earnings of $1.63 a share missed expectations of $1.61 a share, while revenue of $14.3 billion missed estimates of roughly $14.6 billion. However, management spoke positively about the upcoming fiscal year, saying they expect double-digit revenue growth on the back of strong AI demand.

TGT — Target stock currently pays a dividend yield of 3% and that payout just received a modest boost this morning. The retailer bumped its quarterly payout from $1.10 a share to $1.12 a share and said this year is “on track to be the 53rd consecutive year in which Target has increased its annual dividend.”

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.