The Daily Breakdown takes a closer look at the meme stock madness surrounding GameStop, Roaring Kitty and Keith Gill.

Monday’s TLDR

- Meme stocks make a comeback.

- Looking at Tesla’s technical setup.

- AMD lays out a new roadmap for its AI plans.

What’s happening?

Meme stocks are back in focus on Monday with GameStop leading the way. AMC Entertainment, Tupperware, Faraday Future Intelligent Electric, and others are on the move this morning too.

Keith Gill — AKA Roaring Kitty — kicked things off last month with his first post on Twitter/X in years. This ignited AMC, GameStop and others higher a few weeks ago.

Known as a “whale,” it was clear someone was buying a massive options position in the June $20 calls for GameStop and paying millions of dollars to do so.

As it turns out, this was Gill.

According to his recent screenshot on Reddit, Gill has 5 million shares of GameStop at $21.27 and 120,000 of the June $20 call options.

The news is sparking a massive rally in GameStop and with a short interest of roughly 25.5%, there’s potential for this name to move higher in the short term.

Real talk. Nobody knows when this “meme-ness” will end. However, we’re in a very different environment than we were a few years ago when meme stocks first took off. Interest rates are much higher and many investors were burned by the roller-coaster type of move in these names, with many unwilling to participate again.

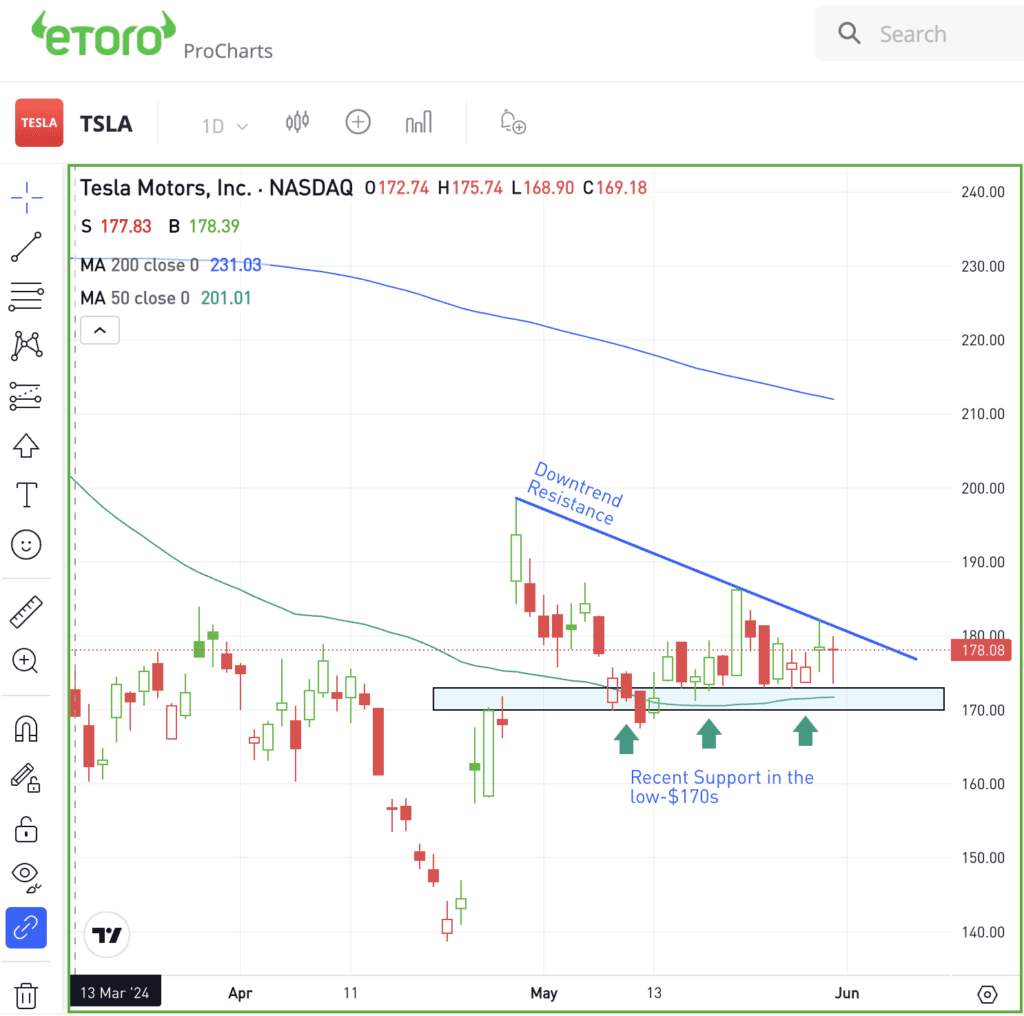

The setup — TSLA

Tesla shares had a big rally in late April after reporting earnings. Since then though, it has struggled for upside momentum.

While each rally has been cut shorter than the last, buyers continue to show up in the low-$170s, as highlighted below.

If Tesla stock can clear the $180 level, it’s possible that momentum can shift into the bulls’ favor. However, if support gives out and the stock closes below $170, more potential downside is possible.

Given how tight the trading range has been over the past two weeks, Tesla is on my radar this week.

Options

For some investors, options could be one alternative to speculate on TSLA. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on TSLA rolling over. Both bulls and bears could wait for a breakout over resistance or a breakdown below support to take a position, too.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

NIO — In May 2024, Chinese EV giant NIO turned heads by reporting a staggering 234% jump in vehicle deliveries, hitting a total of 20,544 vehicles. That’s leagues ahead of rivals Xpeng and Li Auto. Breaking it down, NIO delivered 12,164 luxury SUVs and 8,380 sedans, significantly overshadowing the totals from Xpeng and Li Auto, even with their latest models rolling out.

COST — Shares of Costco Wholesale fell as much as 3.4% on Friday, but recovered a bulk of those losses before Friday’s close. The move came despite the retailer delivering a top- and bottom-line beat for its fiscal Q3 results.

AMD — Advanced Micro Devices announced its latest chip as the AI race with Nvidia and others continues to heat up. The company unveiled the AMD Instinct MI325X accelerator, which is expected to be available in Q4 this year, and laid out a two-year roadmap for its AI plans.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.