The Daily Breakdown takes a look at how the markets are shaping up after last week’s action, then zooms in on the rally in Exxon Mobil.

Tuesday’s TLDR

- There’s less certainty now than a few months ago.

- Exxon Mobil is trying to break out — again.

- Home Depot dips on earnings

What’s happening?

Bitcoin is higher by almost 20% from Monday’s low, while the S&P 500 and Nasdaq 100 have completely erased the losses from last week.

Last week’s selloff was mechanically driven by the unwinding of the carry trade, as opposed to being fundamentally driven. That said, volatility can come in waves, reappearing even when things seem calm. For instance, not many investors were expecting the type of action we saw on Monday Aug. 5.

Remember this: Markets like certainty.

Certainty helps bring out a bit of confidence in investors and it’s certainty that allows markets to trend higher amid low volatility. When uncertainty increases, so too does volatility, as risk assets — like stocks and crypto — typically see pullbacks.

Right now, there are more uncertainties than there were a few months ago. There are unknowns around the carry trade, geopolitical tension in the Middle East, political outcomes in the US, and now worries about the US economy.

The positive side of this is that pullbacks generally translate to long-term opportunities, but that doesn’t necessarily make the emotional part of it any easier. That’s why it helps for long-term investors to have a financial plan and for short-term traders to focus on managing risk — for example, through smaller position sizes.

Want to receive these insights straight to your inbox?

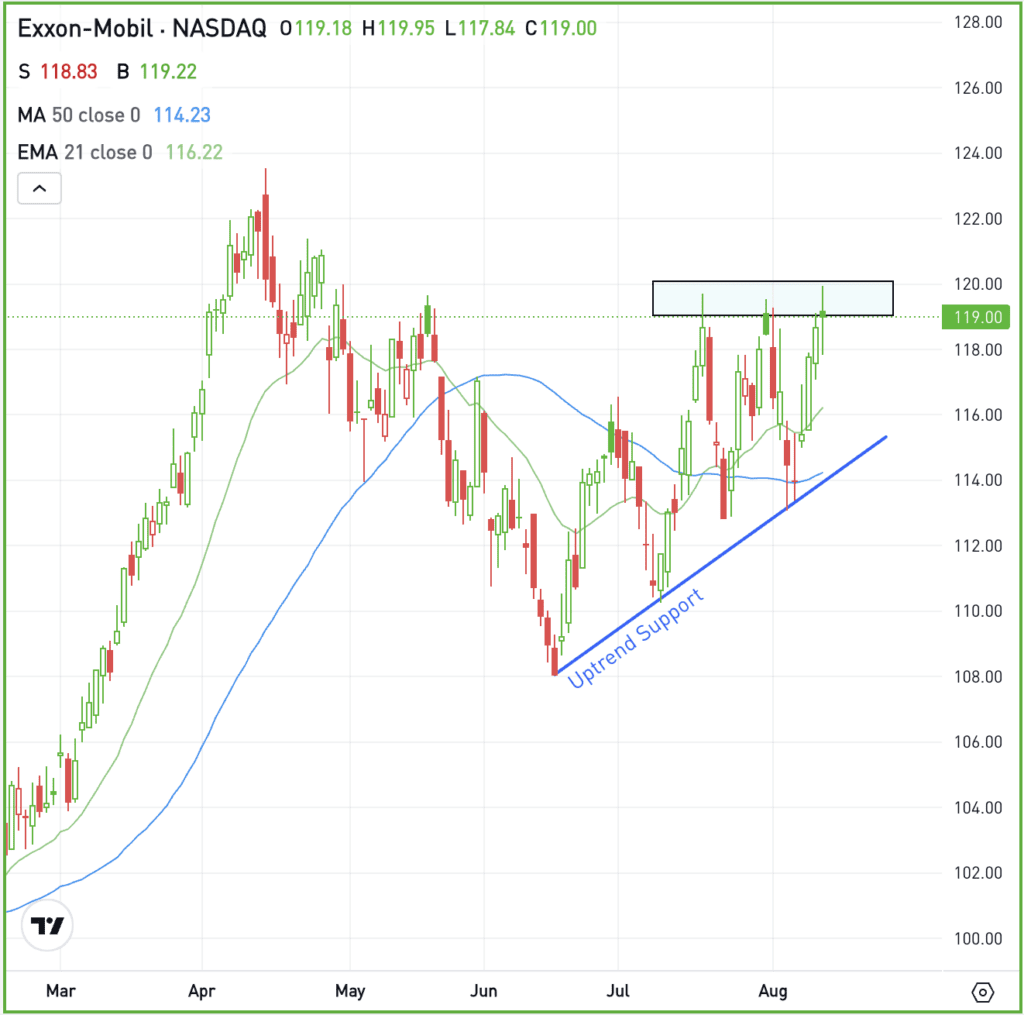

The setup — XOM

With a market cap north of $500 billion, Exxon Mobil is the largest US company in the energy space.

Despite the recent struggle for energy stocks, XOM has been performing pretty well by rallying back to the key $120 level. Remember, this level has been stiff resistance for quite some time.

So how do we approach XOM?

A breakout over $120 resistance could potentially put the recent highs in play near $124. On the flip side, a pullback from here could put uptrend support back in play, giving dip-buyers a chance to speculate on more upside.

Of course, one outcome is also that the stock pulls back, breaks below support and continues to retreat. But XOM is a leader in its sector and its price action has been bullish lately.

This may be one to add to your watchlist and keep an eye on.

Options

Buying calls or call spreads is one way to speculate on further upside — either after a pullback or a breakout. For call buyers, it may be advantageous to make sure they have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TSLA — Tesla has halted orders for its least expensive Cybertruck, raising concerns about demand. The entry-level model is no longer available, leaving the $99,990 all-wheel drive version as the lowest-priced option. Analysts suggest demand issues are leading to increased inventory.

MNDY — Monday.com reported its first profitable quarter, exceeding analysts’ expectations. The company raised its full-year revenue growth forecast to 31% to 32%, up from 29% to 30%. Shares surged nearly 12% as revenue increased 34% year over year, reaching $236.1 million.

HD — Shares of Home Depot are slightly lower this morning despite beating on earnings and revenue expectations. That’s as management lowered its outlook for full-year comparable store sales growth, a key metric for the retailer.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.