The Daily Breakdown examines the last two trading days of the week, as well as the potential breakout in AMD stock.

Thursday’s TLDR

- Stocks try to shake off Tuesday’s dip.

- AMD could be setting up for more upside.

- Bitcoin’s market cap tops $1 trillion.

What’s happening?

Stocks bounced back from Tuesday’s decline, with the S&P 500 rallying almost 1% and closing at 5,000. Small caps have been volatile lately but led the way yesterday with the Russell 2000 climbing more than 2.4%.

Despite the bounce, most US indices are still down for the week after Tuesday’s inflation-inspired pullback following a hotter-than-expected CPI report.

Investors aren’t necessarily in the clear this week when it comes to big economic reports, either.

The retail sales report will be released on Thursday morning, giving investors an update on the health of the consumer. Friday morning features the PPI report, which can help shed more light on inflation.

There are a few other things to keep in mind as we approach the end of the week.

First, Friday is the February monthly options expiration. Otherwise known as “OpEx week,” these weeks can evolve into difficult trading days filled with choppy price action.

Second, we’re also going into a long weekend. So as attention shifts to next week’s events — like Nvidia’s earnings report on February 21 — keep in mind that US stock markets will be closed on Monday.

Want to receive these insights straight to your inbox?

The setup — AMD

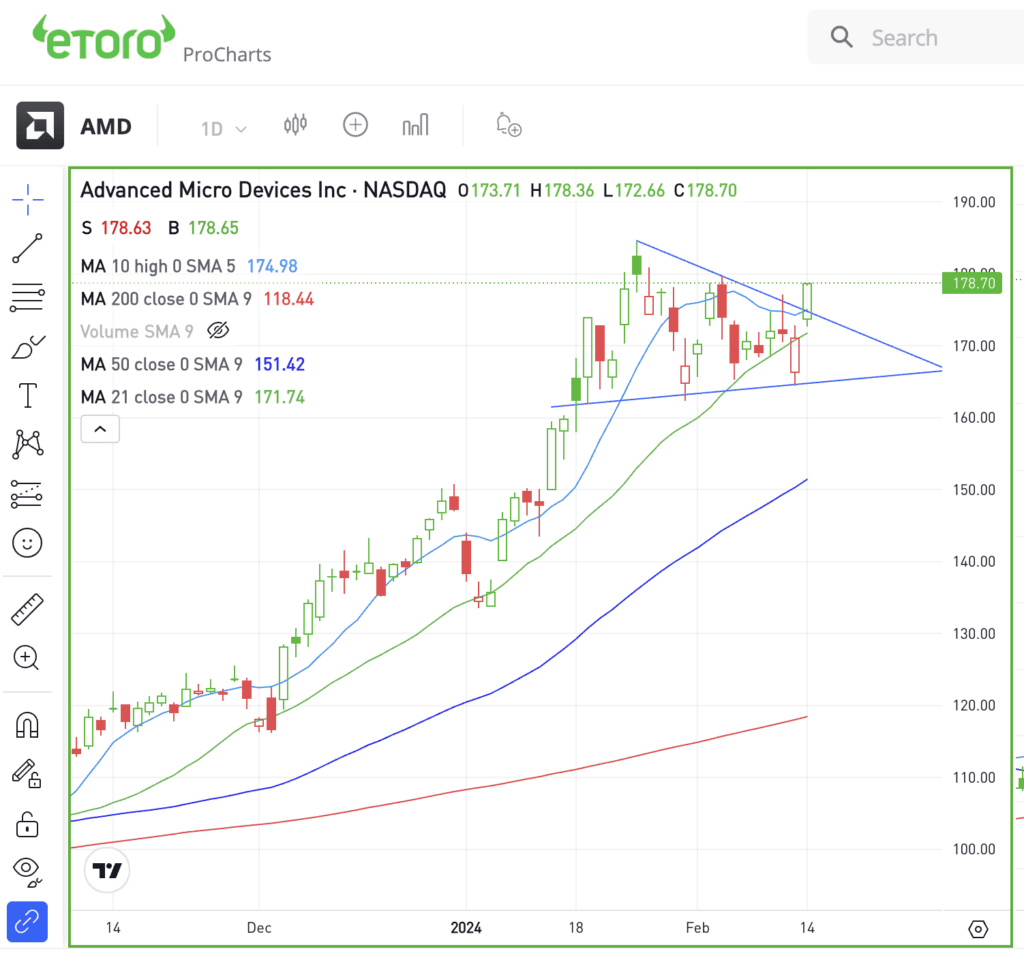

At one point on Tuesday, AMD stock was down 4.4% before closing the day down just 0.2%. Then on Wednesday, shares rallied 4.2% and cleared a notable downtrend resistance line.

AMD rode a huge wave of bullish momentum into 2024, but shares have been consolidating for almost a month now. That consolidation has come with higher lows and lower highs, as the price formed a wedge pattern (shown above).

Now trying to break out of the top side of this wedge, bulls want to see if AMD can keep its recent momentum. If it can, the focus may quickly shift to the January high (and all-time high) near $185.

Above that, investors may start to look for a potentially larger rally, perhaps toward the $198 to $200 zone.

There are risks to keep in mind, though.

Remember, OpEx week can be bumpy, and some chip stocks have rallied pretty hard already. It wouldn’t be too surprising if these stocks eventually experienced some profit-taking. That could include AMD, too.

For now, AMD’s trend remains strong, but keep these risks in mind going forward.

What Wall Street is watching

NVDA: Nvidia surpassed Alphabet in market cap, reaching $1.83 trillion. It’s now the third-largest US company by market cap, trailing just Microsoft and Apple. Fueled by strong AI chip demand, shares are up about 225% over the past year.

BTC: Bitcoin’s market cap hit $1 trillion again amid crypto’s recovery from two rocky years. The top cryptocurrency by market cap, Bitcoin has been boosted by new ETF approvals and anticipation of April’s halving event, as it hits new 52-week highs.

CSCO: Cisco shares fell about 5% in after-hours trading on Wednesday. Despite beating earnings and revenue expectations for its fiscal Q2, the firm delivered disappointing Q3 and full-year guidance.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.