The Daily Breakdown takes a look at Amazon stock, as shares finally break out over the 2021 highs and make new all-time highs.

Wednesday’s TLDR

- US stock markets will close at 1 p.m. ET.

- The VIX just hit its lowest level since May.

- Amazon makes a multi-year breakout.

What’s happening?

Wednesday’s session is a unique one, as the US stock market will close for trading at 1 p.m. ET today. There are only a few other trading sessions a year where that happens, which is Black Friday (the day after Thanksgiving) and, if applicable, December 24th.

What does that mean for investors?

Well for starters, they can expect a low-volume trading day. With three less hours in the trading session, that only makes sense. However, the reality is that many investors — particularly active traders — will cut back on their trading today and many will likely take off Friday’s full session as well, stretching their time off into a long weekend.

Welcome to summer trading.

Another sign we’re there? How about the VIX — also known as Wall Street’s “fear gauge.”

Right now, there’s not much fear out there, as the VIX closed at 12.02 yesterday and hit its lowest level since May. That’s not to say volatility can’t increase at some point this summer — it can and likely will — but clearly there are very few concerns out there right now.

Want to receive these insights straight to your inbox?

The setup — AMZN

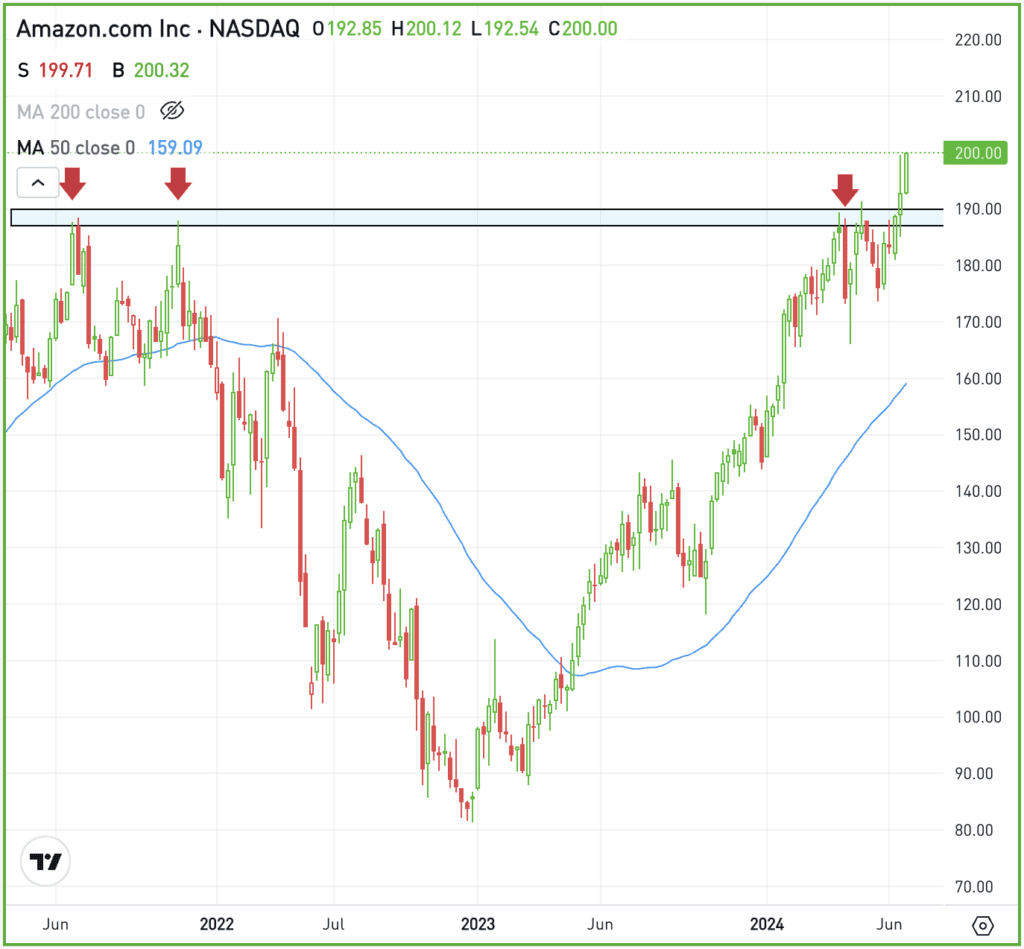

A few weeks ago, we talked about the potential for an Amazon breakout over the $190 area.

Not only had this area been resistance for the past few months, but it actually goes all the way back to Amazon’s prior bull-market high from 2021.

With that in mind, this area is a major focus for investors — and not just for a breakout that might last for a few days and send shares to $200. It already did that.

Amazon hit $200 on Tuesday on its way to a record high. With a market cap of just over $2 trillion, it joins an exclusive club with Microsoft, Apple, Nvidia and Alphabet.

Bulls are hopeful that this is just the start and that AMZN stock has more momentum into its Prime Day event (on July 16 and 17), earnings later this month, and beyond.

For that to be the case, shares need to stay above the $185 to $190 breakout area. So long as that’s the case, bulls can maintain momentum. If the stock breaks below this zone, it may need more time before setting back up on the long side.

Options

For some investors, options could be one alternative to speculate on Amazon. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and AMZN rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

SPX500 — The S&P 500 closed above 5,500 for the first time — extending a 2024 rally with 32 record highs — while the Nasdaq 100 closed above 20,000 for the first time. This came as Fed Chair Powell announced progress on inflation and amid continued momentum in mega cap tech stocks.

LLY — The FDA approved Eli Lilly’s Alzheimer’s drug, donanemab, expanding treatment options in the US. Meanwhile, both Eli Lilly and Novo Nordisk fell after President Biden urged them to lower prices on popular anti-obesity medications.

PARA — Paramount Global shares rose after merger talks for its Paramount+ streaming service. Warner Bros. Discovery is among the interested parties to potentially combine Paramount+ with Max, sources say.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.