The Daily Breakdown looks at the week ahead with earnings set to pick up pace and with the recent breakout in Amazon stock.

Monday’s TLDR

- Earnings from banks, Netflix, and J&J are in focus.

- Google reportedly eyeing $23 billion deal for Wiz.

- Retail sales on watch tomorrow.

Weekly Outlook

It was a bumpy end to the week for stocks, with the S&P 500 grinding out a near-1% gain for the week but the Nasdaq 100 falling 0.3%. Notably, small caps stole the show, up 6%, as we’re clearly seeing some rotation into the the Russell 2000.

Coming into this week, nerves are high for many investors — and not because of earnings.

The events over the weekend involving an assassination attempt on former President Trump have emotions high across the nation. While those emotions could play a role in the markets this week, stocks appear steady going into Monday’s open. As of 8:00 a.m. ET, the major US indices are higher in pre-market trading.

When it comes to this week, earnings really pick up the pace.

We’ll hear from Goldman Sachs this morning, Bank of America tomorrow, then Johnson & Johnson and United Airlines on Wednesday. On Thursday, Taiwan Semiconductor and Netflix will report, followed by American Express on Friday. While many other firms will report too, those are some of the big names on our radar this week.

One report stands out this week on the economic front, which is the retail sales report on Tuesday morning. This will give investors the latest update on the consumer.

Want to receive these insights straight to your inbox?

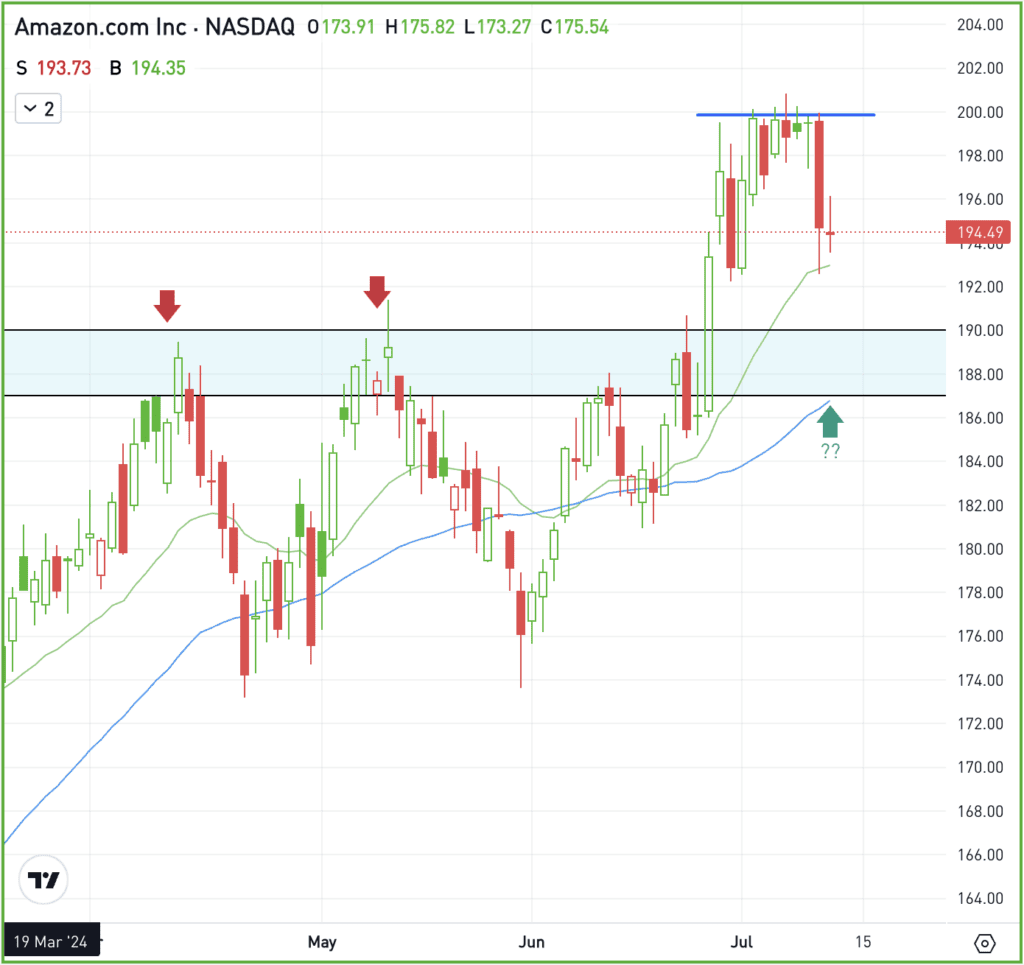

The setup — AMZN

The breakout in Amazon is something we’ve been tracking for a while now. While the breakout is still intact, the stock has not been gaining steam.

One reason could be that Jeff Bezos continues to unload large quantities of stock, keeping a short-term lid on the price.

Regardless of the reason though, investors can try to take advantage as Amazon drifts back down toward the breakout zone in the low-$190s.

Remember, that breakout level in the low-$190s isn’t just a resistance level from the past few months. It dates all the way back to Amazon’s prior bull-market high in 2021.

Bulls can look for potential support between $187.50 and $192.50, with more aggressive investors likely buying near the upper end of that range and more conservative bulls nibbling at the lower end.

If support fails, investors can use a stop-loss to bail on their position with minimal losses. On the upside, $200 is the ceiling that the stock needs to clear.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

GOOG — According to reports, Alphabet is nearing an acquisition of Wiz for roughly $23 billion. Wiz is a cybersecurity firm headquartered in New York City that provides cloud security services. If the deal goes through, it will mark Alphabet’s largest acquisition.

DJ30 — The Dow Jones Industrial Average hit a record high on Friday, climbing as high as 40,257. Up 6.3% this year, the index has lagged the S&P 500 and Nasdaq 100, which are up roughly 18% and 21%, respectively.

T — On Friday, AT&T revealed a massive cybersecurity breach, disclosing that hackers stole six months’ worth of mobile-phone customer data. The breach included call and text information for nearly all cellular customers from May to October 2022.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.