The Daily Breakdown looks at the recent interest rate comments from the Fed, as well as a potential setup in Alphabet after its earnings dip.

Thursday’s TLDR

- The Fed tamped down hopes for a March rate cut.

- Alphabet falls 7.5% on earnings.

- Apple, Amazon, and Meta earnings are up next.

What’s happening?

It’s shaping up to be a pretty intense week for stocks. Less than a day after AMD, Microsoft, and Alphabet reported earnings, we heard from the Fed.

As expected, the Fed left rates unchanged in its latest meeting, but it was the March meeting that investors were focused on. Specifically, the bond market was pricing in about a 50-50 chance that the Fed would cut rates at its March meeting.

He left it slightly ajar, but Chair Powell mostly closed the door on a March rate cut, saying it’s unlikely that the Fed will reach a level of confidence to cut by then.

For what it’s worth, the market is rather confident rate cuts are coming, it’s just a matter of when — and more specifically, a debate of March vs. May.

If you think it’s been a busy week so far, buckle up.

After today’s close, we’ll get earnings from Apple, Amazon, and Meta. Then on Friday morning, we get the monthly jobs report. While that’s an important report to begin with, it’s even more critical now after hearing from the Fed this week.

Want to receive these insights straight to your inbox?

The setup

Of the three big tech reports yesterday, Alphabet had the largest post-earnings stumble, falling 7.5%.

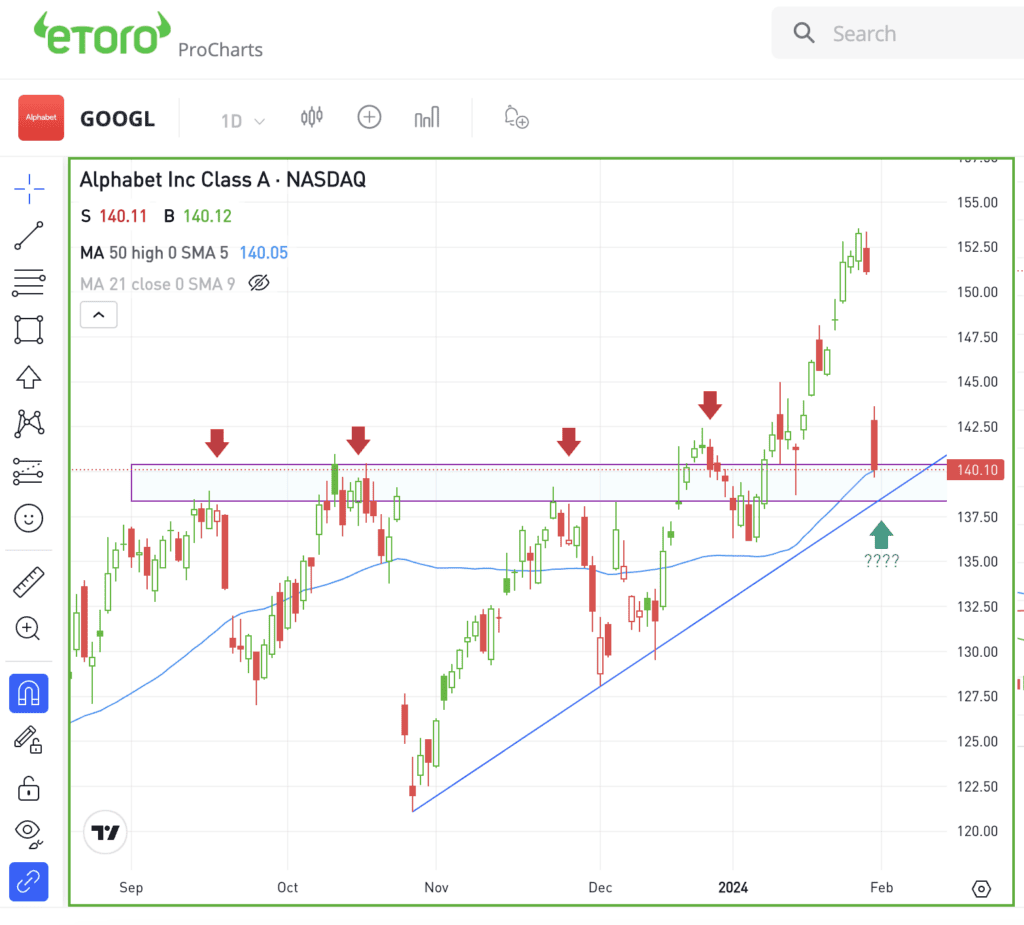

However, the decline landed the stock in an interesting area on the charts.

Alphabet stock declined into the $140 area, which had been key resistance in the third and fourth quarters. The 50-day moving average also comes into play near this level.

For those looking for an opportunity in Alphabet, this could be a reasonable dip to consider accumulating a position.

For 2024, consensus expectations call for 16.5% earnings growth and 10.7% revenue growth. Free cash flow is forecast to jump 16.5% too, while shares trade at 20.7 times this year’s earnings forecast — the lowest forward price-to-earnings ratio in the Magnificent Seven.

On the flip side, Alphabet is just the fifth best-performing component to the group over the last 12 months, up 39.5%. And clearly, investors weren’t impressed with its quarterly update.

Keep an eye on the $140 zone and let’s see if the stock can hold this area as support.

What Wall Street is watching

SBUX: Starbucks stock opened higher by 4.5% despite missing on fiscal Q1 earnings and revenue expectations. Bulls initially clung to management’s reaffirmed full-year earnings outlook, the 13% growth in active Starbucks Rewards members, and the company’s plan to dominate China’s premium market. However, the stock ultimately ended lower on the day.

PLUG: Plug Power surged after Roth MKM upgraded the stock to “buy” and doubled its price target to $9 — implying about 100% upside from yesterday’s close. The analysts are confident given the progress at the company’s Georgia plant, while they expect significant margin improvements to come.

PARA: Paramount Global jumped following Byron Allen’s $14.3 billion bid for the company. The offer is for $28.58 per share for voting shares and $21.53 for non-voting shares. Allen Media Group urged Paramount to seriously consider the deal, which climbs to $30 billion in value when including debt.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.